The Madras High Court has ruled that the interest on delayed GST payments shall be calculated based on the date the tax amount is deposited, even if the actual debit occurs later during the filing of the GSTR-3B form. The interest amount shall not be credited to the electronic cash ledger.

The imposition of interest and penalty for the late return filing has been contested by Tamil Nadu State Transport Corporation (Villupuram) Ltd for the late return filing, even after having paid the tax dues in time.

As per the applicant, it was not able to file GSTR-3B returns on time for the period July 2017 to July 2019 due to technical glitches and issues with the digital signature registration of its Managing Directors.

But without ITC claiming the whole tax obligation was paid in full and via the electronic cash ledger.

Even after the same, the department imposes the interest on the foundation that the tax was not acknowledged as paid till the same was debited from the ledger via GSTR-3B filing, which appeared only in August 2019.

Justice Krishnan Ramasamy, as per Rule 88B(1) of the CGST Rules, cited that the interest obligation ends on the day the tax amount gets deposited in the electronic cash ledger, quoting its earlier ruling in M/s. Eicher Motors Ltd.

As per the rule, no interest would be computed on the tax amount lying in the cash ledger on the due date, debited later during return filing for the intervening period.

The provision is clarificatory in nature, the court mentioned, cited concerns for prospective application, and outlined that no interest is subject to be paid if the funds were available in the ledger of the taxpayer within the deadline.

Read Also: Late GSTR 3B Filing: No Interest Liability If ECL Balance

Thereafter, the impugned order was quashed to the scope of the interest obligation, but the department was allotted liberty to pursue penalty or other demands, if any, concerning non-payment after the deadline.

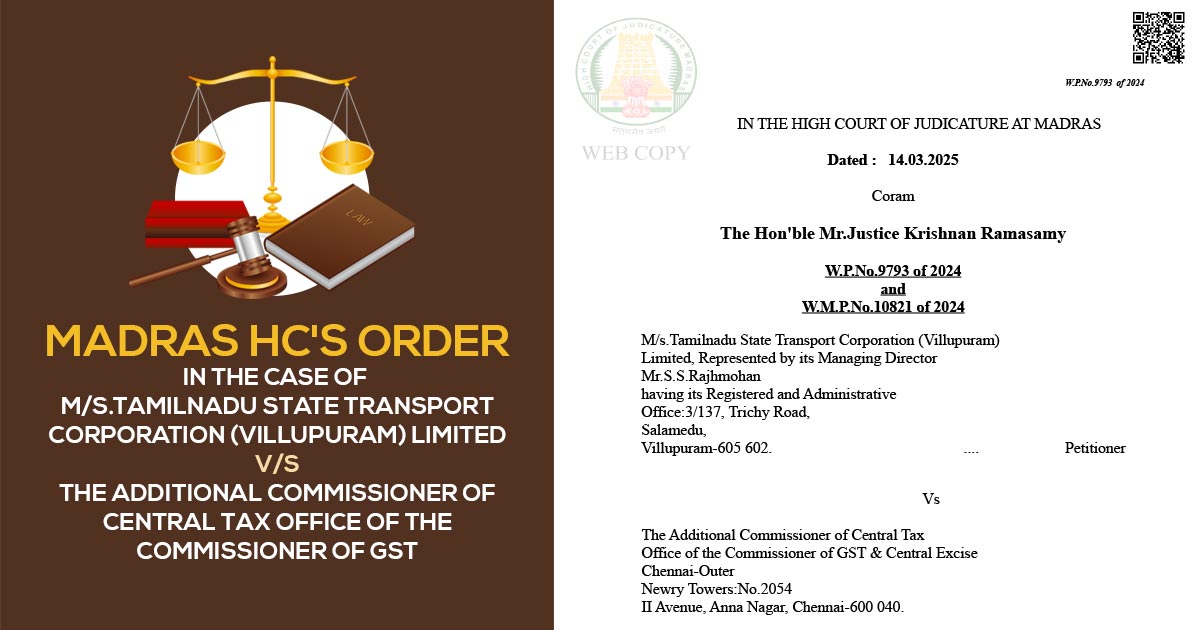

| Case Title | M/s.Tamilnadu State Transport Corporation (Villupuram) Limited vs The Additional Commissioner of Central Tax Office of the Commissioner of GST |

| Case No. | W.P.No.9793 of 2024 and W.M.P.No.10821 of 2024 |

| For Petitioner | Mr.P.Rajkumar |

| For Respondent | Mr.S.Gurumoorthy |

| Madras High Court | Read Order | Read Order |