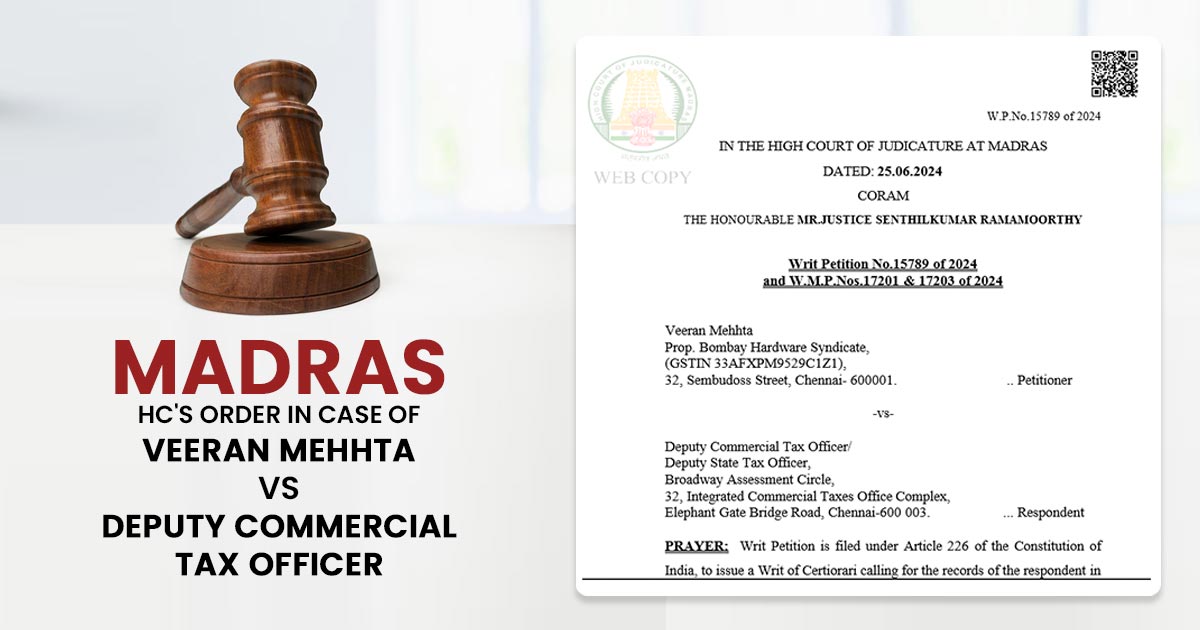

The Hon’ble Madras High Court in Veeran Mehhta v. Deputy Commercial Tax Officer and Deputy State Tax Officer [Writ Petition No. 15789 of 2024 dated June 25, 2024], asked the disposal of the Order on January 22, 2024, which was established on a belatedly filed Form GSTR-1, for the incorrect assessment period.

The Court said that no recovery or coercive actions could be formed until the taxpayer’s rectification petition was fixed.

Attributes:

Form GSTR-3B has been correctly filed by Veeran Mehhta (“the Petitioner”) for January 2018-19 by declaring the correct outward taxable supplies and, certainly, the IGST value thereof as Rs.4,17,577. The Petitioner, during filing the belated Form GSTR-1 for January 2019, accidentally furnished the return for July for the AY 2019-2020 assessment period, rather than the return for January of the 2018-2019 assessment period.

The Deputy Commercial Tax Officer and Deputy State Tax Officer (“the Respondent”) passed an order on January 22, 2024 (“the Impugned Order”), based on Form GSTR-1. Subsequently, the Petitioner filed a rectification petition dated June 01, 2024. With recovery action based on the Impugned Order, the Petitioner was then threatened.

The Petitioner aggrieved by the Impugned Order, filed the present writ petition.

Had:

The Hon’ble Madras High Court in W.P. No. 15789 of 2024 held as under:

- Remarked that the applicant has placed on record the Form GSTR-3B for January in the assessment duration 2018-19. The Form GSTR-1 was also on record, purportedly for July in the assessment duration 2019-20. The outward taxable value of IGST in the two documents is tallied. Also, the applicant has placed on record the tax liability comparison report from the GST portal.

- This document exhibited an excess in liability when Form GSTR-3B and Form GSTR-1 were compared. Such excess was Rs. 4,17,577. In these cases, a prima facie case was made out for consideration of the rectification petition.

- It was ruled that the writ petition was disposed of without any order. Also, the respondent was restrained from starting the recovery or coercive actions till the rectification petition was disposed of and therefore asked the respondent to regard and dispose of the rectification application within 3 months from the order date.

| Case Title | Veeran Mehhta Vs Deputy Commercial Tax Officer |

| Citation | Writ Petition No.15789 of 2024 |

| Date | 25.06.2024 |

| Counsel For Petitioner | Ms.Hema Muralikrishnan |

| Counsel For Respondent | Mr V Prashanth Kiran, Govt. Adv. (T) |

| Madras High Court | Read Order |