It was ruled by the Ahmedabad ITAT that the provision for leave encashment which was inherited by the taxpayer on the grounds of the restructuring practice of GEB, under which the majority of employers have been onboarded by the taxpayer company could not be added to the income of the taxpayer.

The Division Bench of Annapurna Gupta (Accountant Member) and T.R. Senthil Kumar (Judicial Member) marked that no disallowance of leave encashment liability was warranted if the taxpayer had not debited any amount on account of provision for leave encashment to the profit & loss account.

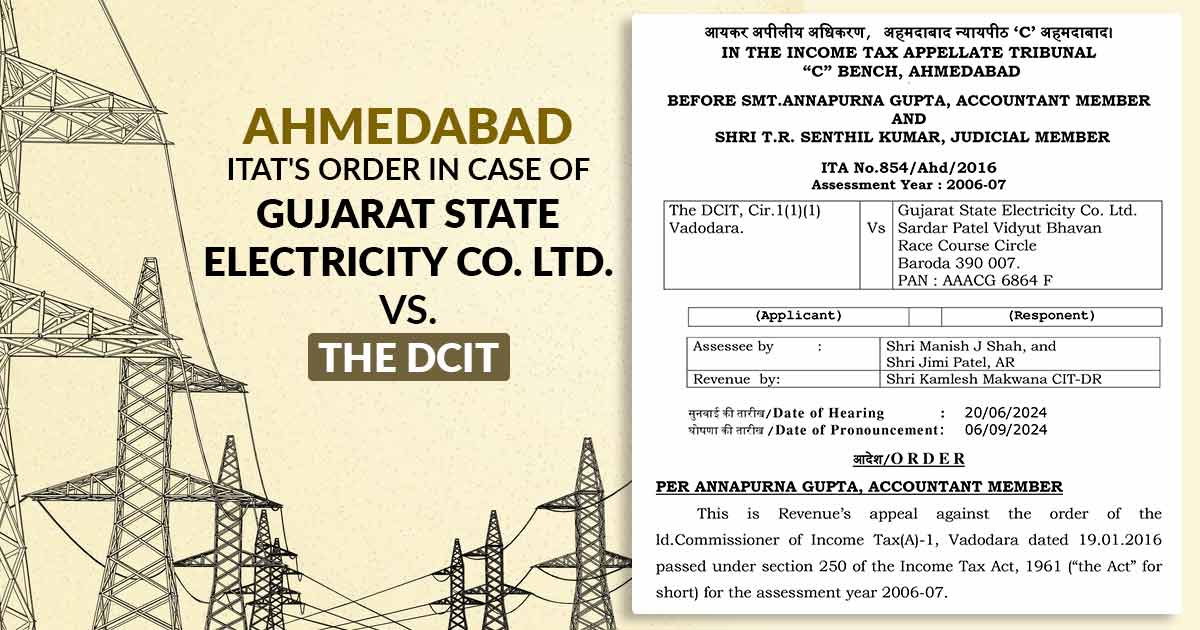

Case

AO in the assessment learned that the taxpayer companies’ provision for leave and encashment liability outstanding as of the end of the impugned year was Rs.6746.46 lakhs, which the obligation of it in the start of the year was remarked to be merely Rs 5.38 lakhs. From not holding the data that the provisions incurred in the year were not the same as the opening and closing balance being Rs 6741.08 lakhs and remarking it to be unpaid, he offered the disallowance/ addition of it to the taxpayer’s income. CIT(A) removed the disallowance on the plea.

Tribunal Observations

It was remarked by the bench that the taxpayer has proposed the explanation arguing that the disallowance was not warranted as it has not debited any amount on the grounds of provision for leave encashment to the profit and loss account.

It was elaborated that the obligation has been obtained via the taxpayer company under restructuring of GEB and related to employees onboarded by the taxpayer company as a consequence and related to former years, Bench stated.

On to that the Bench remarked that the Assessing Officer(AO) has not considered the AO contentions and does not even regard the same fit to validate the facts, however just move forward, in the non-consideration to the taxpayers’ explanation, to make disallowance/ addition of provision for leave encashment.

Hence, the Bench noted that the Commissioner of Income Tax (Appeals) (CIT(A)) has removed the disallowance/ addition incurred by the AO of provision for leave encashment of Rs 5874.34 lakhs, post validating the facts that the same provisions were not debited to the profit and loss account of the taxpayer and that it does not relate to the impugned year.

Subsequently, the appeal of the revenue has been dismissed by ITAT.

| Case Title | Gujarat State Electricity Co. Ltd. Vs. The DCIT |

| Citation | ITA No.854/Ahd/2016 |

| Date | 06.09.2024 |

| Assessee by | Shri Manish J Shah, Shri Jimi Patel |

| Revenue by | Shri Kamlesh Makwana |

| Bangalore ITAT | Read Order |