The matter of Sunil Khaitan vs. DCIT (ITAT Kolkata) is concerned with the taxation of cash deposits incurred at the time of the demonetization period. Sunil Khaitan, the appellant, filed his ITR for the AY 2017-18, reporting a total income of Rs. 40,48,000/-.

However, his case was appointed for scrutiny under the Computer Aided Scrutiny Selection (CASS) for verification of cash deposits in the year, specifically those made during the demonetization period.

The Assessing Officer (AO) marked that Sunil Khaitan had deposited Rs. 34,18,000 in Specified Bank Notes (SBNs) at the time of demonetization. Khaitan illustrated that these cash deposits were sourced via cash withdrawals from banks and unsecured loans from different parties, and his salary income.

However, through the same explanation, the AO was not satisfied and added the alleged cash deposits to the income of Khaitan, assessing it at Rs. 74,66,000.

Before the Commissioner of Income-tax Appeals (CIT(A)) Khaitan pleaded this decision however his claims were not acknowledged. Aggrieved with the consequence, Khaitan pleaded to the Income Tax Appellate Tribunal (ITAT) Kolkata, raising numerous grounds of appeal, with the main grudge being against the addition of Rs. 34,18,000 u/s 68 of the Income Tax Act.

At the time of the hearing, the representative of Khaitan repeated that all the pertinent information for the source of funds was furnished to CIT(A). It was underscored that Khaitan had an adequate cash balance before and during demonetization, which his cash book and additional financial statements proved. It was represented that Khaitan had a cash balance of Rs. 38,81,508 available for deposit in the bank account, out of which only Rs. 31,68,000 was deposited during the demonetization.

The representative claimed that section 68 of the Income Tax Act. which permits the additions to income in which the taxpayer proposes no elaboration for the nature and the source of specific credits in their books was not applicable in the same matter.

They underscored that Khaitan had given a clear explanation and showed that the cash deposits were sourced from withdrawals incurred via his bank account. It was claimed that there was no proof to recommend that the cash came from undisclosed sources.

Income Tax Appellate Tribunal Kolkata acknowledges the submission via both parties. It has been learned that the cash deposits incurred via the Khaitan were preceded via withdrawals from the identical bank account and the same cash flow statement furnished via Khaitan had not been denied by the revenue authorities.

The ITAT quoted legal precedent, specifically the judgment of the Karnataka High Court in S.R. Ventakaratnam vs CIT, which highlighted that once the taxpayer shows the funds sources as having come from withdrawals made from a bank, it is not open to the revenue to doubt this explanation established on mere surmise.

Income Tax Appellate Tribunal (ITAT) lastly concluded that Khaitan had demonstrated the source of funds utilized for the cash deposits. It carried that the revenue authorities had laid on assumptions and surmises instead of concrete proof to the contention of Khaitan’s explanation. Hence, the addition made by the AO u/s 68 was deleted, and Khaitan’s appeal was permitted.

The matter specifies the need to furnish precise explanations and assist with the proof for the cash deposits, particularly at the time of the duration of the investigations like demonetization. It indeed specifies the requirement for the revenue council to base their decisions on factual proof instead of conjecture.

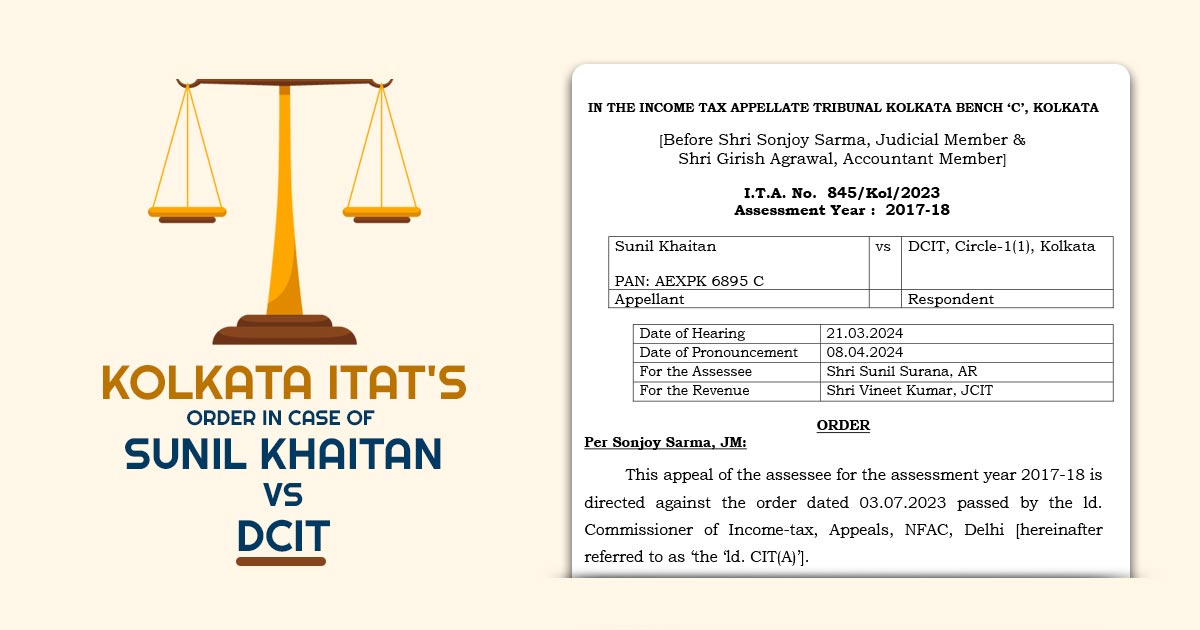

| Case Title | Sunil Khaitan V/S DCIT |

| Case No.: | I.T.A. No. 845/Kol/2023 |

| Date | 08.04.2024 |

| Counsel For Assessee | Shri Sunil Surana, AR |

| Counsel For Respondent | Shri Vineet Kumar, JCIT |

| Kolkata ITAT | Read Order |