The Kerala High Court has issued a ruling stating that a Goods and Services Tax (GST) registration that has been cancelled cannot be reinstated solely for the intention of claiming Input Tax Credit (ITC) as per Section 16(6) of the CGST Act, 2017.

Under Section 16(6) of the Central Goods and Services Tax Act, 2017, taxpayers have the right to claim the input tax credit recorded in their ledger if their GST registration cancellation is revoked. This revocation can occur through an order issued under Section 30 or as a result of decisions made by the appellate authority, appellate tribunal, or the High Court.

Justice Ziyad Rahman A.A. cited that Section 16(6) does not envisage a fresh cause of measure concerning the taxpayers, whose registration is cancelled, for getting the restoration of the registration, only for taking the advantage of Section 16(6).

The taxpayer/applicant was involved in distributing SIM cards and recharge coupons. Business had been closed by the taxpayer and the registration was cancelled, grounded on the application submitted by him w.e.f 30.11.2018.

No obligation was there for tax on the taxpayer during the cancellation of the registration. After that, an intimation under Section 73(5) was issued to the taxpayer dated 24.12.2022, asking for Rs. 1,52,060, including interest.

An order was passed validating the demand. The taxpayer does not contest the order by filing a plea.

After that, a new provision, namely, Section 16(6), w.e.f 1.10.2024, was rolled out in the CGST Act under the Finance Act 2024.

A petition has been submitted by the taxpayer to restore the registration to allow him to submit the returns and to take the eligible ITC as per section 16(6).

Read Also: Kerala HC Upholds GST Registration Cancellation Citing Delay in Seeking Remedy

Post reviewing section 16(6), the bench said that the specified benefit is applicable merely for the taxpayers whose registration was cancelled and thereafter this cancellation was revoked by the order passed via the authorities or via this court.

The bench clarified that at the time the order was issued, Section 16(6) was not in effect. As a result, the benefit that was unavailable to the taxpayer at that time cannot be claimed by the assessee, simply because a provision was introduced at a later date.

The bench cited that the reliefs asked via the taxpayer to restore the registration are for the availing of the benefit of Section 16(6) of the CGST Act, and not under any circumstances referred to in the Act.

The bench in the aforesaid view had dismissed the petition.

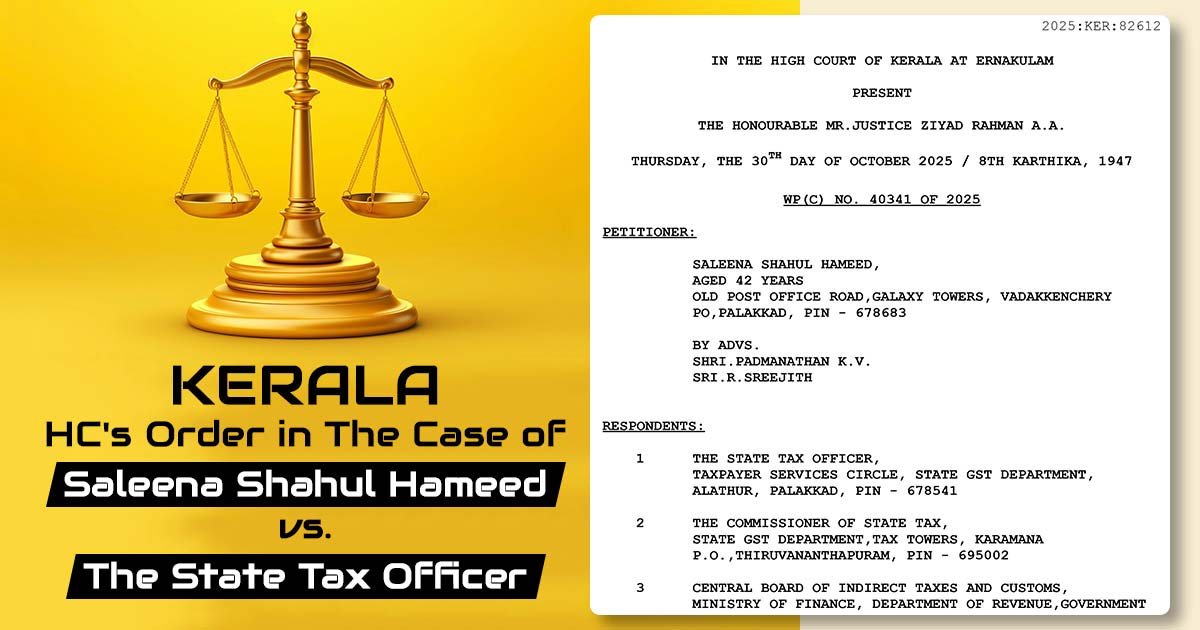

| Case Title | Saleena Shahul Hameed vs. The State Tax Officer |

| Case No. | WP(C) NO. 40341 OF 2025 |

| For Petitioner | Shri.P.R.Sreejith, SMT.Reshmitha R Chandran, SR. G.P., Shri. P.R. Sreejith |

| For Respondents | Shri.P.R.Sreejith, SMT.Reshmitha R Chandran, SR. G.P, Shri. P.R. Sreejith |

| Kerala High Court | Read Order |