The Kerala High Court ordered the administration to allow the applicant to upload the returns for the earlier period to claim the qualified Input Tax Credit (ITC).

Section 139 (1) of the GST Act the applicant is the owner of Madhav motors who is a dealer in automobiles and was recorded under the GST Act, he is authorized with provisional registration.

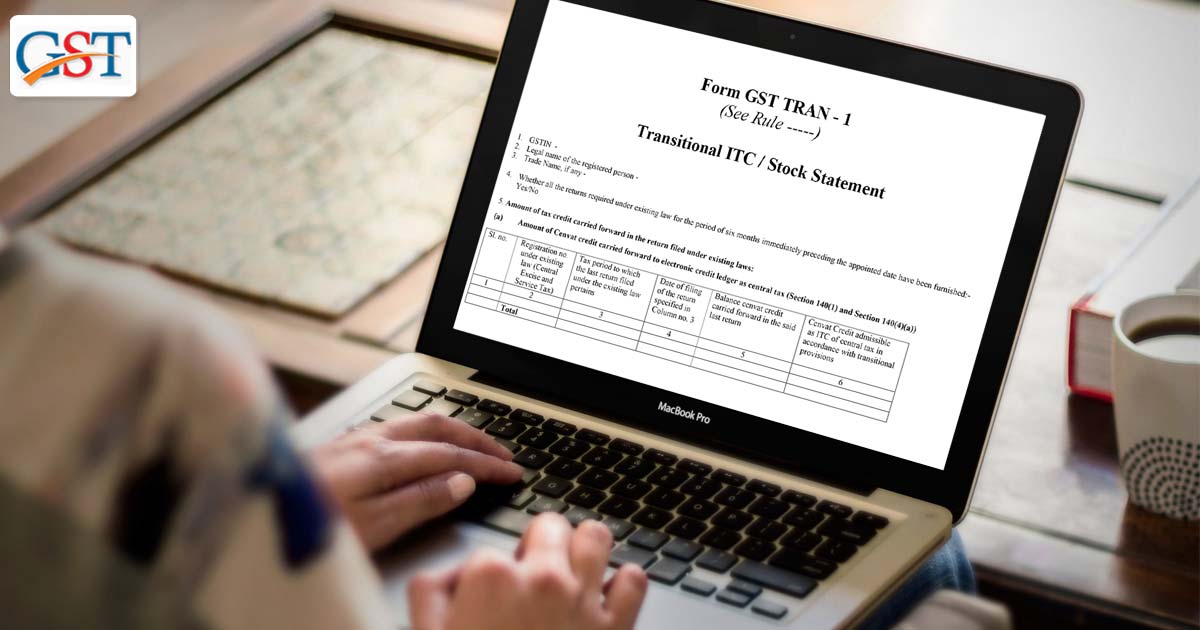

In context to view the permanent enrolment, the applicant had practiced uploading form GST TRAN-1

He has not succeeded in logging into the system and uploading the TRAN-1 Form said the applicant and even with various attempts composed for the purpose.

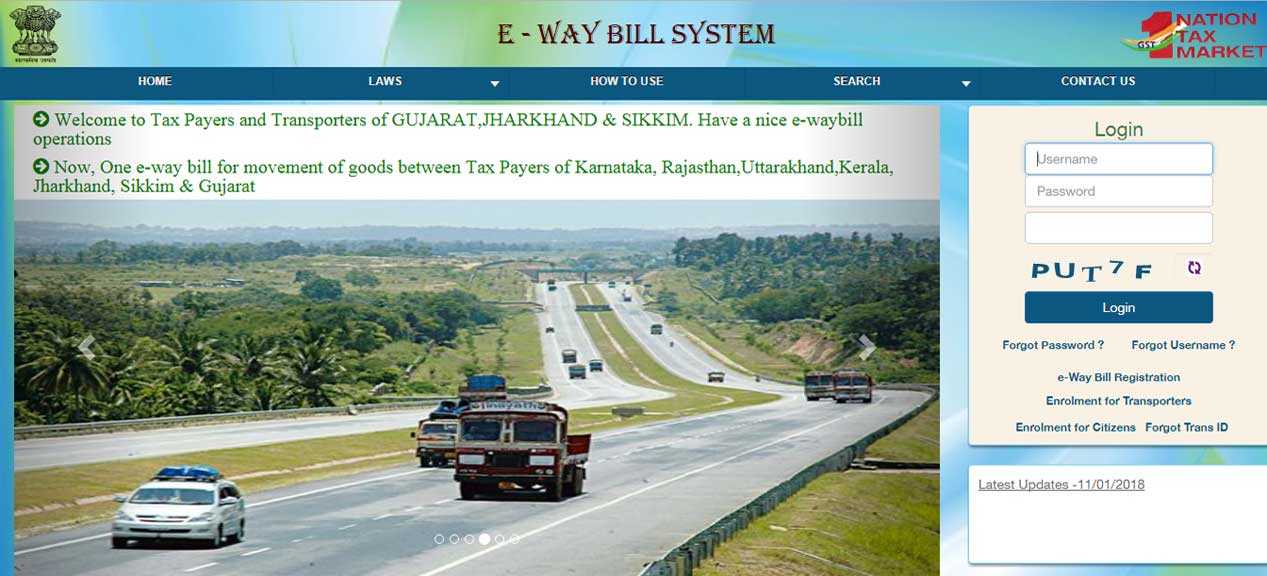

The applicant is not able to generate the e-way bills

The applicant shows the difference and reveals that it is the cause of not giving the advantage to him on the input tax credit, also he was unable to upload the returns for the duration before January 4, 2020, on the web portal or the maintained system through the respondent authority.

Justice Jayasankaran Nambiar ruled that under the section when the provisional enrollment has not permitted to the applicant was not canceled throughout the process and the respondent has allowed a regular enrollment on January 4, 2020, the permanent enrollment should relevant to the previous date of the provisional enrollment and the applicant is asked to upload the returns for the previous period and to claim the eligible input tax credit under GST

Thus the judge stated to the respondent authority to change the enrollment certificate given to the applicant so as to build it valid from July 1, 2017, and allow the applicant to upload the returns along with paying and availing the input tax credit concerned on the returns therefore uploaded.