It was ruled by the Kerala High Court that the income tax authorities through not taking into account a request for a personal hearing have breached the norms of natural justice. It was marked by Justice K. Babu that as of the same breach, the orders have been passed without considering the request of the taxpayer restricted to be set aside.

“The adherence to principles of natural justice as recognized by all civilized States is of supreme importance when a competent statutory authority embarks on an action involving civil consequences. The fundamental principle is that no one should be condemned unheard.”

The income tax authority has passed a draft assessment and furnished a Show Cause Notice (SCN) against the Federal Bank questioning why the assessment must not be finished under the draft assessment order.

In the SCN it was furnished that the bank could ask for a personal hearing post submitting a written answer. Answering that the bank asked for a personal hearing via video conference. Without furnishing the chance the income tax authority has passed an assessment order making an additional demand of Rs 321.26 crore. The bank approaches the HC against the same.

Read Also: Penalty for TDS Violations and SCN Issues from Previous Name Company Can Be Rectified u/s 292-B

It was furnished via the tax authority to the court that the bank must have applied for the hearing via the e-filing module and not via their answer before the SCN.

It was marked by the court that the central government has introduced a scheme for the faceless assessment. The scheme does not obligate personal appearance in the Assessment Centres or Units. The taxpayer could ask for a personal hearing via video conference. The same scheme was started in the Income Tax Act and section 144B was inserted into the Act.

Under section 144B of the Income Tax Act, an individual can ask for a personal hearing in which a variation is offered in the draft assessment order. Additionally, the section cites that standards, procedures, and processes for the proper operation of the National Faceless Assessment Centres will be relied on. The court mentioned that nothing has been placed to specify that these norms have been formulated.

It was mentioned by the court that the taxpayer could not be refused a chance to be heard merely because he does not apply for the same via the e-filing module. As per the court, it mentioned that this refusal is against the legal provisions particularly considering that no standards, procedures, and processes for approving the request for a personal hearing have been approved by the competent authority.

It was claimed by the income tax authority that the taxpayer must have chosen the other remedy and must have opted for a plea u/s 246A of the Income Tax Act. it was carried by the court that there was a breach of natural justice, and the taxpayer could proceed to the HC even after having another remedy.

It was asked by the court the authorities to provide a fresh assessment order post providing a chance to be heard by the applicant.

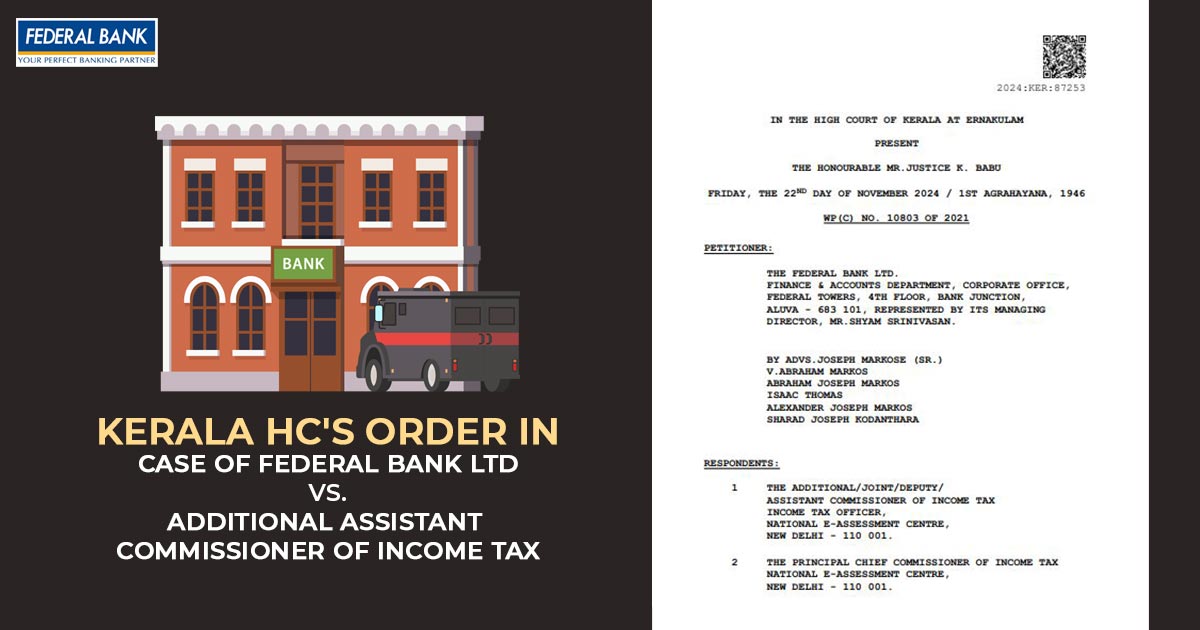

| Case Title | Federal Bank Ltd vs. Additional Assistant Commissioner of Income Tax |

| Citation | Wp(c) No. 10803 of 2021 |

| Date | 22.11.2024 |

| Kerala High Court | Read Order |