The decision of the Single Bench has been carried out by the bench of Justice A.K. Jayasankaran Nambiar and Justice Syam Kumar V.M. where it was ruled that the applicant had downloaded the assessment order from the identical portal, and hence the delay occasioned in retrieving the assessment order from the portal was a predicament that the appellant revealed himself as of his latches.

Under the Central Goods and Services Tax Act/Kerala State Goods and Services Tax Act, 2017 and Rules, the petitioner/taxpayer was a dealer. The taxpayer has approached the writ court contesting the assessment order.

It was argued by the appellant that the assessment order was communicated before the appellant via the portal that the government reported for the objective as per Section 146 of the CGST Act. therefore he was unaware of the order as he had accessed the portal belatedly. The government does not report the portal for the objective of uploading orders, notices, etc. Hence, for the specific purposes cited in Section 146 of the Income Tax Act, the portal can be used.

The single judge who acknowledged the case revealed that belatedly the applicant had downloaded the assessment order via the same portal and hence the delay occasioned in recovering the assessment order via the portal was a predicament that the appellant revealed himself in as of his latches. Hence the single judge relegated the appellant to his other remedy of the appeal filing as per Section 107 of the GST Act. Accordingly, the writ petition was dismissed.

It was argued by the taxpayer that the notification of the portal as per section 146 was just for the objective of streamlining the registration, payment of tax, furnishing of returns, computation, and settlement of integrated tax, electronic waybill, and for carrying out such other operations as may be specified. In section 146 the orders uploading has not been cited, and the common portal could not be utilised for the objective such as communication of notices, orders, etc.

According to Section 169 of the Income Tax Act, any decision, order, summons, notice, or other communication under the Act or Rules may be served on the taxpayer, inter alia, by making it available on the common portal.

Read Also: An Informative Guide to GST Portal for Taxpayers and Cos

It was ruled by the court that the legal provision is required to be read including the provisions of Section 146 and when so read the same is directed that once a common portal is notified for the act then any of the measures like registration, tax payment, filing of returns, etc., and the communication of notices, orders, etc., as provided for under the regulation, can come into effect via the same portal.

It was remarked by the court that the notification revises the former notification that has been issued u/s 146 of the CGST Act to make it clear that the notification of the common portal could be for all the operations given under the CGST rules 2017. The change has indeed been furnished retrospective effect as of June 22, 2017.

While dismissing the writ appeal the Kerala High Court has carried the decision of the single bench.

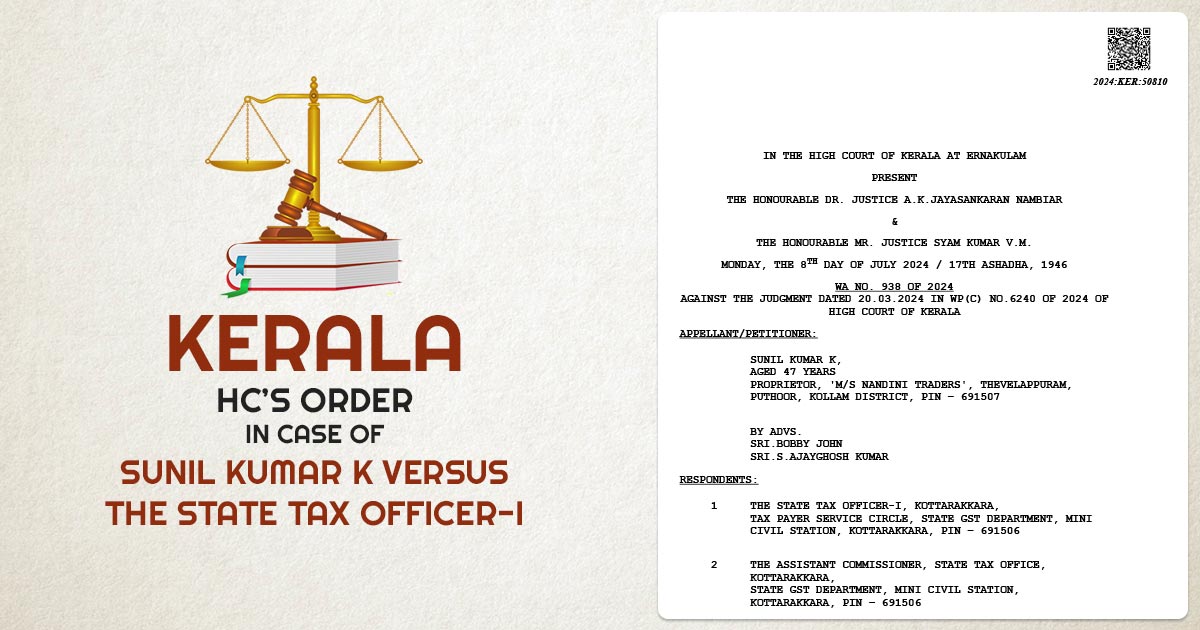

| Case Title | Sunil Kumar K Versus The State Tax Officer-I |

| Citation | WA NO. 938 OF 2024 |

| Date | 08.07.2024 |

| Counsel For Petitioner | Bobby John, SRI. S.AjayGhosh Kumar |

| For R1 | Mr. C.Harsha Raj, AGP (T) |

| Counsel For Respondent | Thomas Mathew Nellimoottil, SMT. Reshmitha Rama Chadran |

| Kerala High Court | Read Order |