It was said by the Kerala High Court that consolidated Show cause notice engaging diverse assessment years could be furnished when the common period of adjudication is there.

“Issuing a consolidated show cause notice covering various financial/assessment years would cause prejudice to an assessee who would not get the full period envisaged for adjudication under the Statute if that period is circumscribed by the limitation period prescribed in relation to an earlier financial/assessment year” the Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S cited.

For the same case, a Show cause notice was furnished before the taxpayer/respondent. The department/appellant has furnished a single consolidated notice for 6 distinct fiscal years. The taxpayer/respondent has contested the SCN via a writ petition.

It was noticed by the Single Judge that force in the contention of the taxpayer is there that issuing a composite order that wraps all the financial years from 2017-18 to 2023-24 shall prejudice the taxpayer concerning its claim for those assessment years which the time limit cited u/s 74(10) of the CGST Act would not expire by 07.02.2025, which was the due date for passing orders concerning assessment year 2017-18.

The order has been contested by the department and passed via the Single Judge.

The regulatory period available for the taxpayer to put forth its claim against the SCN in a perfect way could not be curtailed via an unnecessary act on the end of the department in issuing an SCN that comprises therein a financial/assessment year concerning which the period for passing a final order expires earlier, the bench observed.

It was viewed by the bench that “where, in a situation such as the present, the proximate expiry of the limitation period under Section 74(10) is only in relation to one of the six financial/assessment years, the contentions of the assessee and the opportunity available to an assessee for adducing evidence in relation to the other years cannot be rendered illusory by forcing upon the assessee the period of limitation prescribed under Section 74(1) for passing the final order in relation to the earliest financial/assessment year [2017-18]”.

Read Also: Kerala HC Rejects Tax Reassessment Order After Assessee Was Given Only 3 Days to Respond to SCN

Also, the bench viewed that a consolidated notice shall result in a consolidated adjudication order that covers the financial/ assessment years and in the event of it being adverse to the taxpayer, the fee/pre-deposit mandated to be filed via the taxpayer for choosing the regulatory plea shall indeed be higher.

The bench in the above-mentioned view has dismissed the plea.

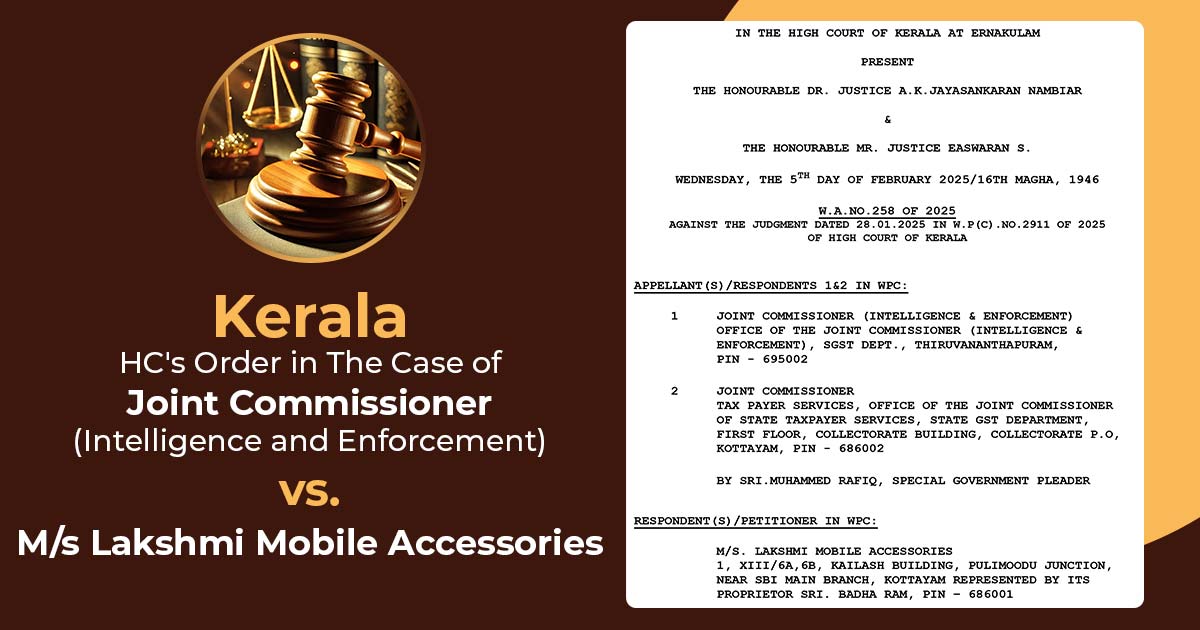

| Case Title | Joint Commissioner (Intelligence and Enforcement) vs. M/s Lakshmi Mobile Accessories |

| Citation | W.A.NO.258 OF 2025 |

| Date | 05.02.2025 |

| For the Petitioner | SRI. K.S. Hariharan Nair |

| For the Respondents | SMT. Divya Ravindran |

| Kerala High Court | Read Order |