The Karnataka High Court in a judgment quashed the criminal proceedings alleging a fake ITR with a bogus Chartered Accountant (CA) seal, mentioning jurisdictional problems.

The petition was being filed contesting the enrollment of a First Information Report which has culminated in the filing of a charge sheet.

Taxpayer No.1 Vidya Sachitanand Suvarna was a partner of the firm before along with the complainant. Indeed the subject was not in dispute that the petitioner had filed a private complaint being aggrieved by the alleged concoction of a retirement deed, under which taxpayer No.1 came out of the firm and the wife of respondent No.2 Syed Toufiq Ahmed was inducted into the firm.

After the start of criminal proceedings by the assessees a complaint was presented u/s 200 of Criminal Procedure Code, 1973 (“Cr.P.C.”) against the applicants (wife and husband) alleging that specific wrong income tax returns had been submitted via the applicants in the complaint that they had lodged against respondent No.2 and this included offenses under Sections 193, 195, 196, 209, 417, 419, 420, 465, 468, 471, 504, 506(B) of the Indian Penal Code, 1860 (“IPC”).

After investigation, the police laid a charge sheet against the applicants for the offence under Sections 417, 419, 420, 465, 468, 471, 504, and 506 read with Section 34 of IPC.

It may be related to state here that respondent No. 2 alleged that the income tax returns furnished via the applicants with their complaint were falsified documents, and the charge sheet only cited that, in the course of the investigation, the applicants allegedly provided falsified income tax returns with bogus seals of a Chartered Accountant and signatures, intending to deceive.

Because petitioner No.1 was a partner of the firm, the providing of alleged falsified income tax returns by taxpayers in their complaint cannot be construed as cheating respondent No.2 in any case. The income tax returns of certain other persons had been falsified, it was for that person to start the measure, and respondent No.2 herein cannot complain that he has been cheated under this particular forgery.

It might indeed be related to the state that when as a case of fact the applicants had produced the wrong documents then the same is for the pertinent court to which the wrong documents are been produced to execute the measure against the applicants, Respondent No.2 cannot argue that the documents produced to a court of law are a forgery and thus initiate proceedings u/s 200 of Cr.P.C.

Read Also: Solved! How to Check Income Tax Notices Fake or Genuine?

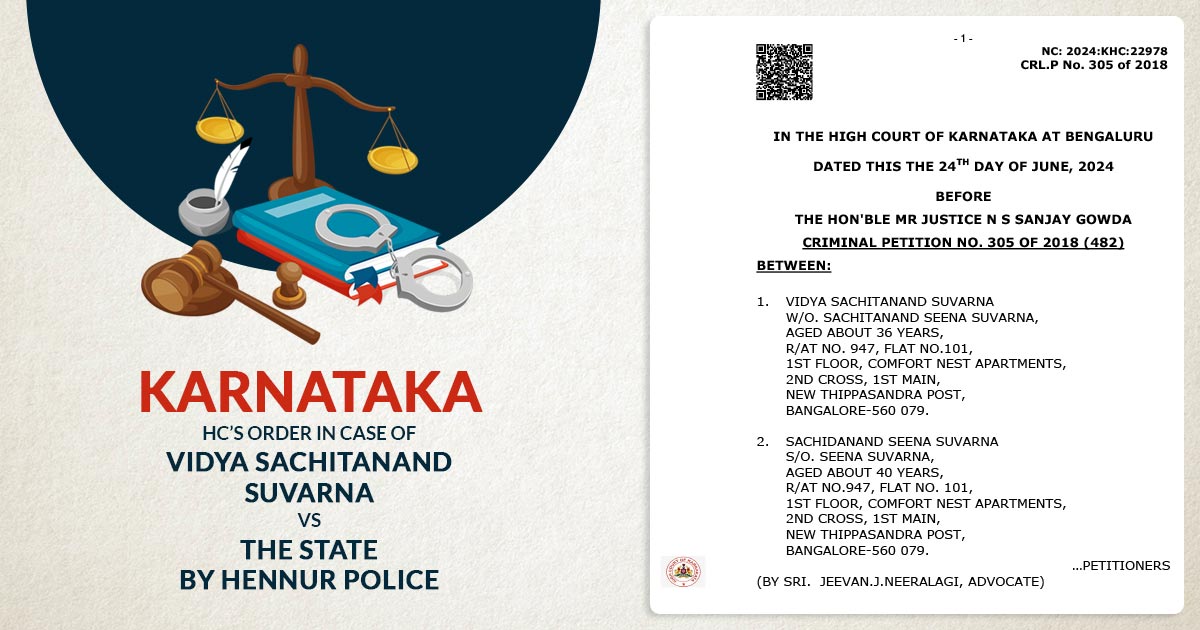

The single bench, led by Justice N.S. Sanjay Gowda carried the view that the impugned proceedings started against the taxpayer were without jurisdiction, and they were accordingly, quashed. The petition was permitted.

| Case Title | Vidya Sachitanand Suvarna Vs. The State By Hennur Police |

| Case Number | NO. 305 OF 2018 (482) |

| Date | 03.07.2024 |

| Petitioners | Sri. Jeevan.J.Neeralagi |

| Respondents | SMT. Rashmi Patel, Sri. P.B.Ajit |

| Karnataka High Court | Read Order |