The Karnataka Authority for Advance Rulings (AAR) held that “Pushti,” a powdered mixture of cereals, pulses, and sugar, is waived from GST (Goods and Services Tax).

The petitioner, Raibag Taluka MSPC is registered as a “Society” under the Karnataka Societies Registration Act of 1960. They are in supplying supplementary products to Anganwadi centres via the Child Development Project Office (CDPO). CDPO of the respective Taluks supervises the activities and operations of the Applicant.

From the open market, the Applicant purchased raw materials and ingredients, which were then cleaned, roasted, and powdered as per specified proportions. These ingredients are packaged as ‘Pushti’ products and supplied to the CDPO. The packaging of the Pushti product shows the “Free supply and not for sale,” although it is pre-packaged and unlabeled.

According to Advance Ruling No. KAR ADRG 56 dated 29.10.2021, the product ‘Pushti’, a powdered mixture containing ragi, rice, wheat, green gram, fried gram, moong dal, and soya, has been categorized under HSN code 1106. The Applicant explained that ‘Pushti’ does not bear a registered brand name and is supplied in packages weighing either 0.5 kg or 1 kg. It also states that it is “Free Supply and not for Sale,” following government guidelines.

Along with ‘Pushti’, the Applicant supplies other goods, including jaggery powder, oil, moong dal, groundnut, green gram, HDP plastic bags, parched gram, and salt to the CDPO. These items were also distributed to Anganwadi centres to benefit children, pregnant women, and lactating mothers.

Read Also:- Karnataka AAR Rules Rapido Has to Pay GST on Cab Service

The Court noted that the product ‘Pushti’ is a powdered mixture of cereals, pulses, and sugar. The Applicant asked for clarification on whether their product can be classified as “pre-packaged and labelled,” thereby subject to taxation under entry No. 59 of Notification No. 01/2017 Central Tax (Rate) on 28.06.2017, further amended by Notification No. 06/2022 Central Tax (Rate) dated 13.07.2022.

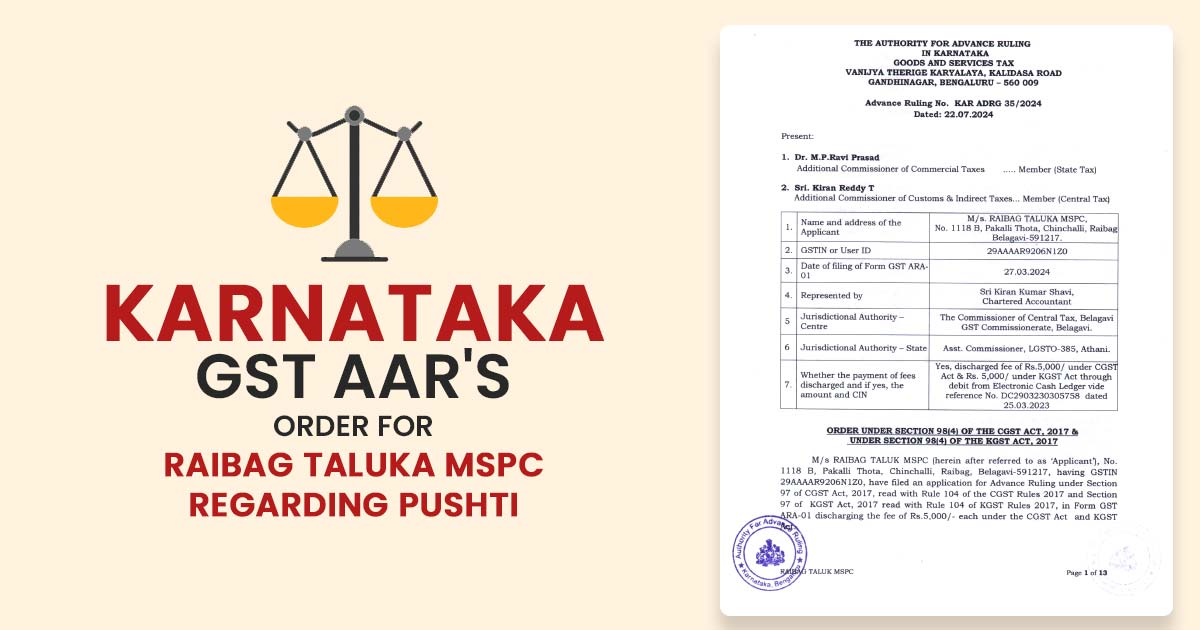

The AAR’s two-member bench Dr. M.P. Ravi Prasad and Kiran Reddy ruled that ‘pushti,’ a powdered mixture of cereals, pulses, and sugar, is waived from GST.

| Applicant Name | M/S. Raibag Taluka MSPC |

| GSTIN of the applicant | 29AAAAR9206N1ZO |

| Date | 27.03.2024 |

| Applicant | Shri Kiran Kumar Shavi, Chartered Accountant |

| Karnataka GST AAR | Read Order |