Easy to Understand ITR Filing Status

When you file and validate your ITR then the income tax department shall execute functioning your tax return. At the time of processing the tax department shall verify if there would be any differences between the shown income in the Income-tax return via the person with the available data they have. Once the process of ITR undertakes the tax department shall provide you with the notice of intimation under section 143 (1) of the Income-tax Act, 1961.

The notice of intimation to the individual describes if the tax council would accept the information of the income furnished in the income tax return or when there would be any tax refund due or when there is any other tax demand.

For any person, the same shall make it essential to verify the income tax return status. Post verification the ITR status prompts a message of successfully verified. The status will show as ITR processed the Income tax return after processing the ITR.

Why Do Tax Professionals Need Gen Income Tax Software in India?

For the calculation requirements of Income Tax, Self Assessment Tax, Advance Tax, and Interest calculation under sections 234A, 234B, and 234C Gen income tax software would be the effective software solution.

The software is been made to fulfil the success mantra “For those who can’t afford to make errors” which explains Gen IT. Our Income Tax return e-filing software is meticulously designed to prepare returns and includes the ability to e-file returns straight from the ITR filing software. SAG’s income tax software has been praised for more than a decade, and as a result, several major corporations choose our software as their primary filing option. It is a subsidiary of the well-known taxation firm Genius.

Steps to Check ITR Filing Status Using Gen IT Software

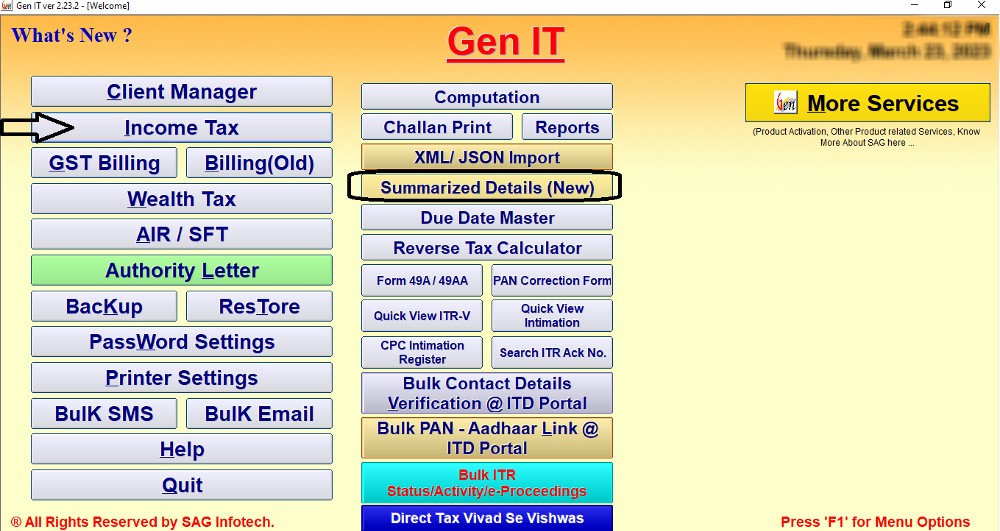

Step 1:- Open the Gen-IT Software. Go to Income Tax and then click on Summarized details (New).

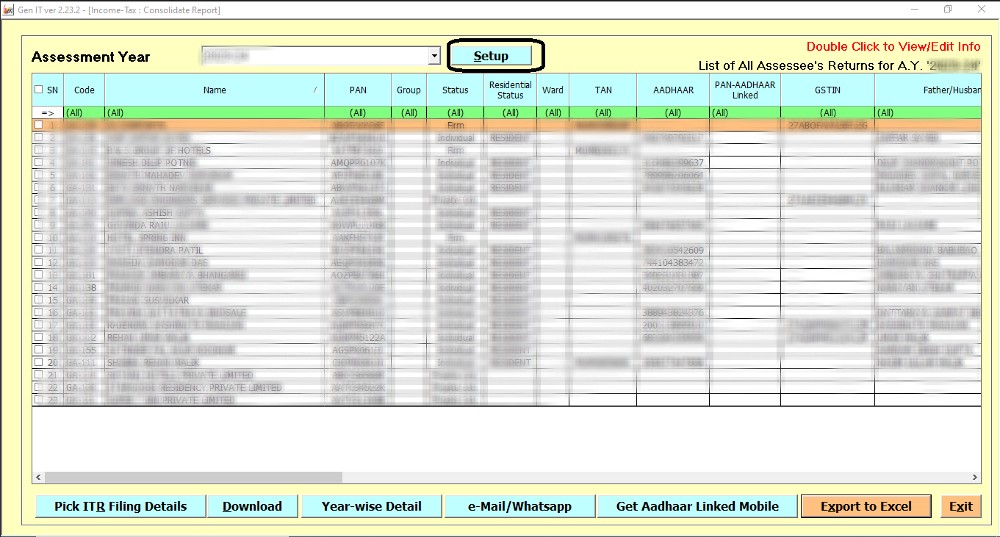

Step 2:- Window will appear with the list of names of all the clients. Click on the Set Up tab there to select the Set up required.

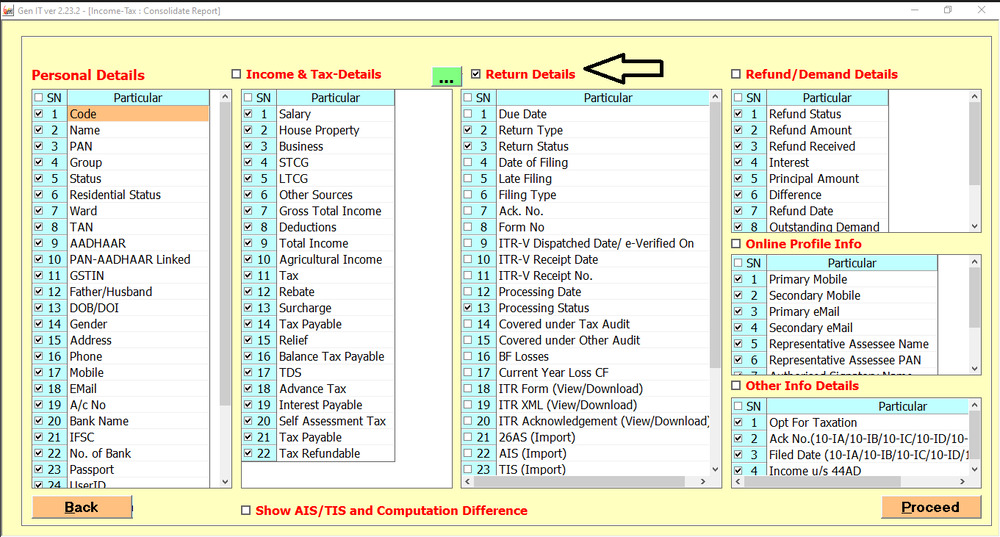

Step 3:- Click on Return Details and then select the Return Type, Return Status, Processing status and then click on proceed tab.

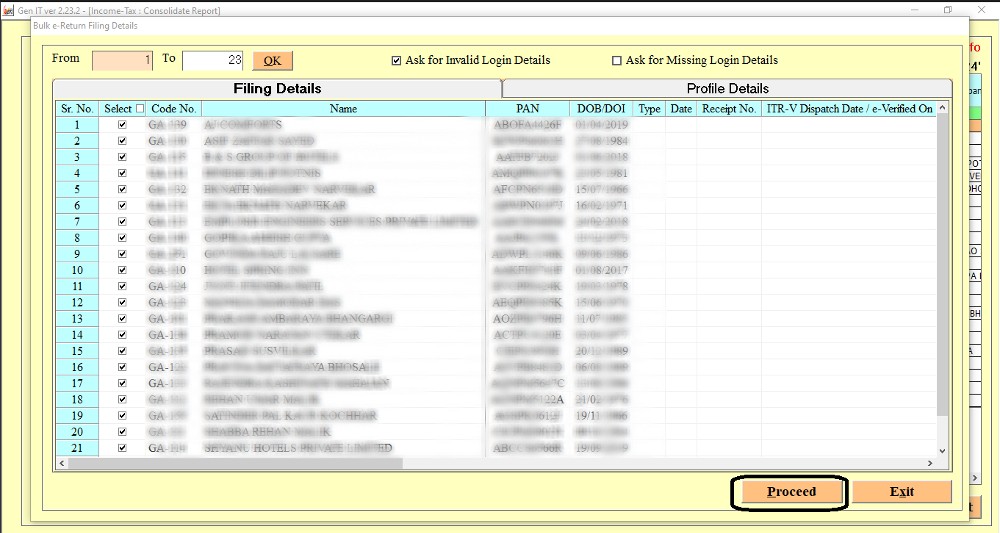

Step 4:- Click on proceed tab.

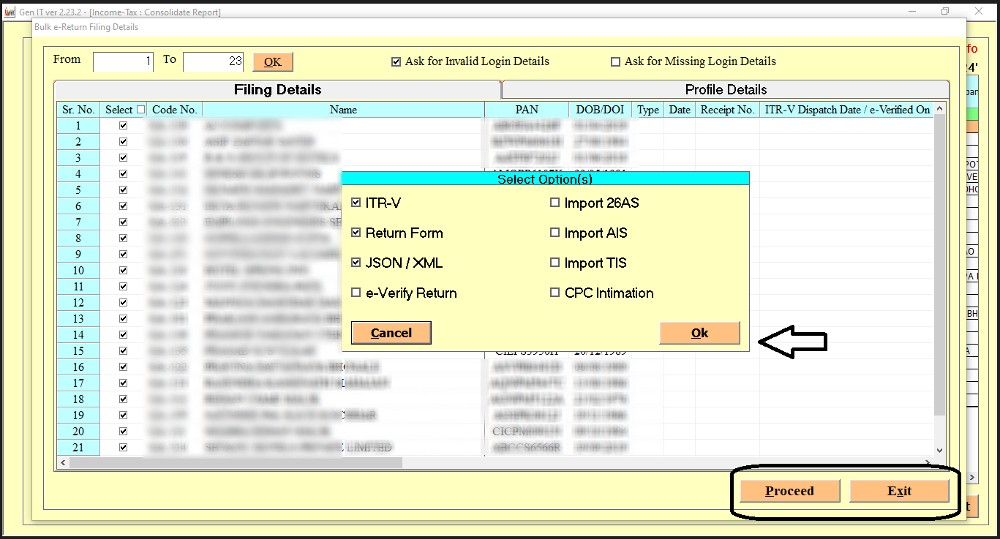

Step 5:- Click on the Ok tab and then click on proceed button.

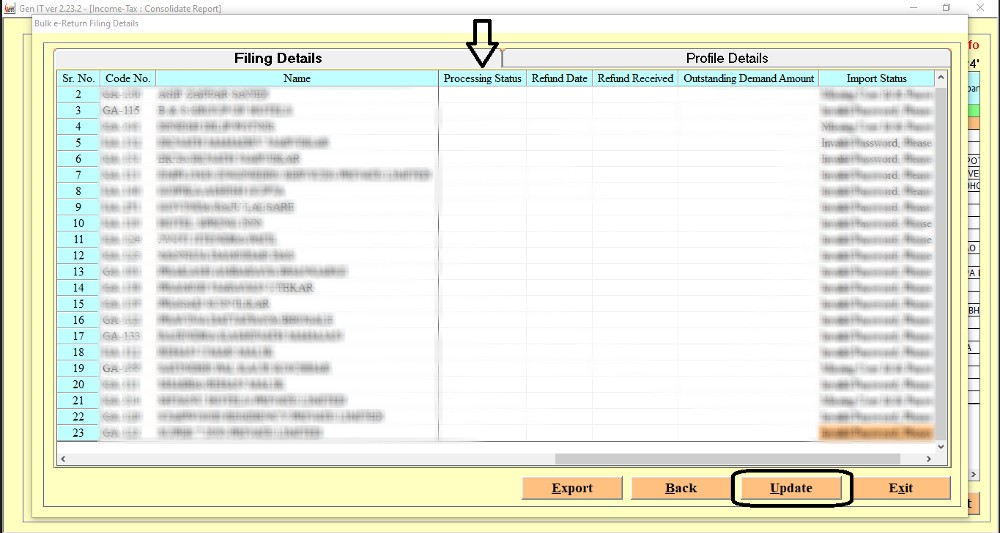

Step 6:- Filing Status will appear here and after that click on the Update button.