Taking a step towards the ease of the taxpayers, the Income Tax Department has launched E-filing lite services. This favourable approach by the tax government will prove to be of great help for taxpayers in e-filing of returns. The feature is initiated on the link www.incometaxindiaefiling.gov.in. Tax Authority says, “the department is glad to inaugurate e-lite filing which is the easy version of online ITR filing and will attract more taxpayers on the portal”.

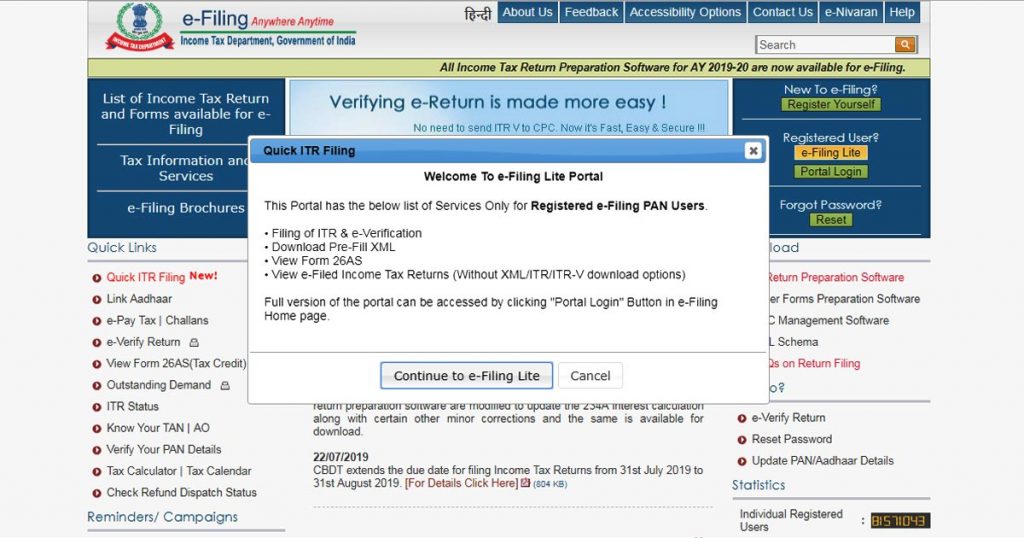

To access the e-lite feature one may click on the ‘e-lite button‘ flashing on the homepage of the website. E-filing portal has a login button on the homepage to facilitate all the services. The tax official says “the new tab for lite is provided on the e-filing website which will direct the registered taxpayer to only the valid links of ITR and Form 26AS after login. The taxpayer can also file his/her previous returns and easily download XML format files.”

He further stated that e-lite edition is exclusive to make ITR Filing easy and is immune from other settings such as e-proceedings, e-exemptions, compliance, schedule and profile settings. However, these options are available in the standard edition.

The last date of filing ITR for FY 2018-19 has been extended by the government from earlier 23rd July 2019 to current 31st August 2019. Taxpayers who have not filed the ITR yet can still file the return by 31st August from the respective e-filing portal or by using lite services.

To be noted: The lite version of e-filing has fewer features than the standard version.