What is the ITR A Form?

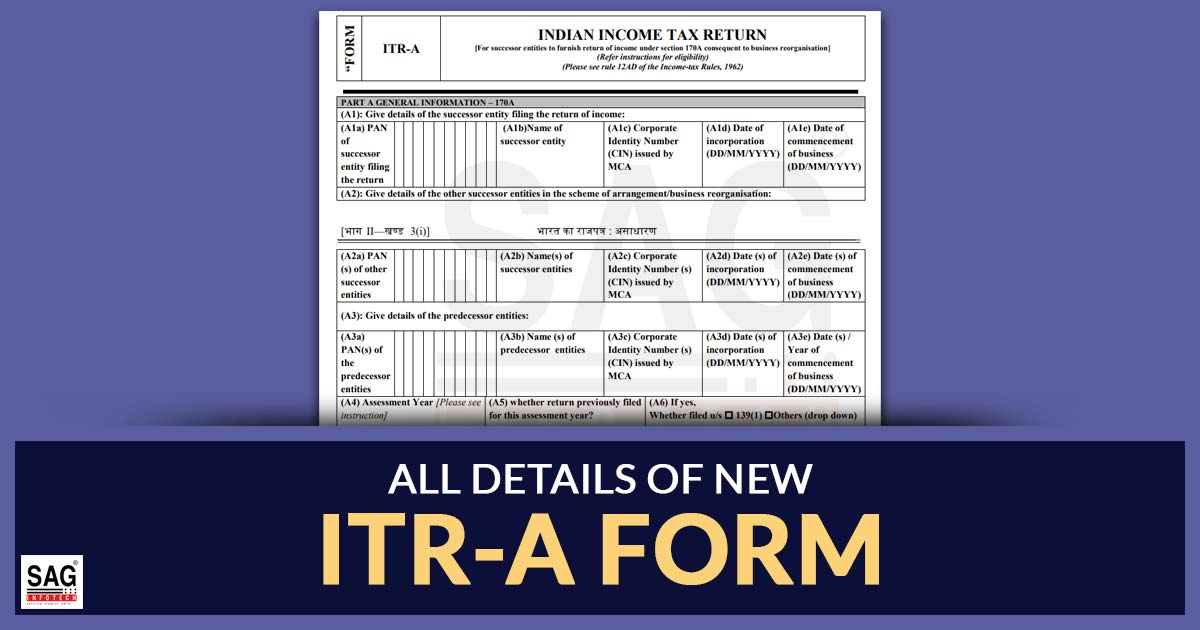

The Central Board of Direct Taxes (CBDT) has issued a notification for Form ITR-A, which is used for furnishing the revised return by the successor entity.

Through the same notification, CBDT specified Rule 12AD and Form ITR-A as the income return under Section 170A to be furnished via the successor entity pursuant to a business reorganisation.

These rules may be referred to as the Income-tax (31st Amendment) Rules, 2022, and will come into force with effect from November 1, 2022.

Under the compliance, if the assessment or reassessment proceedings for the AY related to the year where the order of the business reorganization applicable gets furnished or due on the filing date of the revised return as per the provisions of section 170A, AO will issues an order amending the total income of the related AY determined in the same assessment or reassessment or moved towards finishing the assessment or reassessment proceedings, under the case as per the order of the business reorganization and the amended return which has been filed.

It indeed amended ITR-6 for AY 2022-23 or previous Assessment years to contain a tick box for ITR filed under Section 170A.