The Delhi ITAT has removed the AO addition in the absence of any related proof, which was only based on the assumption and not on any material recovered in the investigation.

ITAT mentioned that the taxpayer/employee undertaking overtime after the finish of working hours may be counted as a breach of banking rules, however, it cannot create grounds for the addition, assuming that the taxpayer has obtained the commission from his manager for it.

The Bench of S. Rifaur Rahman (Accountant Member) and Sudhir Kumar (Judicial Member) kept that “the Assessing Officer (AO) has made the addition on the basis that the assessee had helped Rajeev Singh Kushwaha in cash deposits by flouted the banking norms”. (Para 10)

Facts of the Case

An investigation was performed at the premise of one Mohit Garg and Bother, which consequence in the seizure of specific documents that belonged to the taxpayer. Furthermore, the taxpayer has filed its returns showing a total income of Rs 6.5 lacs. It was discovered by AO that the cash of Rs 5 lacs was furnished before the taxpayer via Rajeev Singh Kushwaha through Raj Kumar Sharma and cash of Rs.12 lacs was furnished before the taxpayer by Rajeev Singh Kushwaha.

The allegation was refused by the taxpayer and mentioned that addition was made on the grounds of assumption and no incriminating material was encountered from the taxpayer in the investigation. In the assessment the AO made an addition of Rs 17 lacs based on the unexplained income under section 69 r/w/s 115-BBE and Rs.60 lacs on account of the commission made via the Rajeev Singh Kushwaha u/s 69A r/w/s 115-BBE.

ITAT’s Statement

The Bench from the perusal of the CIT(A) order discovered that there is no cash or gold was recovered from the taxpayer’s house.

The ITAT marked that the addition was incurred on the grounds of the assumption that the taxpayer who was working in the bank as a bank employee completed their work after working hours.

The bench mentioned that “If the assessee has done the work beyond the working hours this may be the violation of the banking rules but on that basis, the addition cannot be made assuming that the assessee has received the commission from the Rajeev Singh Kushwaha.”

It was accepted under Bench that the statement recorded under section 132(4) has an effective proof value however it is indeed designated of law that addition could not get sustained only on the grounds of the statement.

The bench in the case marked that the addition was made only based on the statement and no additional corroborating material was discovered at the time of investigation.

As per the AO “1 kg gold bar was seized by the Enforcement Directorate from the premise of the accomplice of the assessee Shobhit Sinha sister’s residence at Lucknow”, the Bench added.

It was marked by the Bench that the AO has cited additions because the taxpayer has assisted Rajeev Singh Kushwaha in cash deposits by flouting the banking norms.

Subsequently, ITAT has permitted the appeal of the taxpayer as the AO has made the addition merely on the mere assumption instead of any material encountered during the investigation.

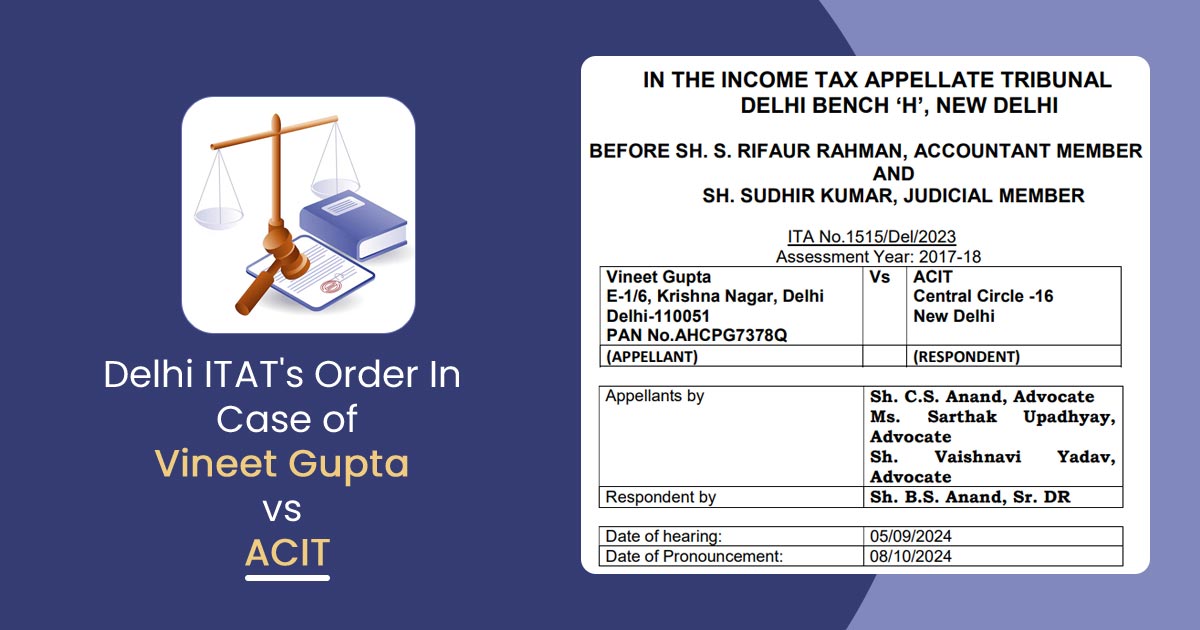

| Case Title | Vineet Gupta vs ACIT |

| Citation | ITA No.1515/Del/2023 |

| Date | 05.09.2024 |

| Appellants by | Sh. C.S. Anand, Advocate Ms. Sarthak Upadhyay, Advocate Sh. Vaishnavi Yadav, Advocate |

| Counsel For Respondent | Sh. B.S. Anand, Sr. DR |

| Delhi ITAT | Read Order |