The Income Tax Appellate Tribunal (ITAT) Mumbai Bench has recently ruled that the Assessing Officer (AO) must provide the assessee with the full Tax Deducted at Source (TDS) credit amounting to ₹14,78,140 for the Assessment Year (AY) 2011–12. This decision highlights the importance of correctly applying TDS credits in tax assessments.

According to the Tribunal, a mere technical discrepancy or non-reflection of TDS in Form 26AS cannot be a sufficient cause to refuse the credit, where the deduction and deposit of tax are duly validated through Form 16 and other evidence.

In the case of Tan Boon Hoe, who was employed by M/s Urban Transit Private Limited during the relevant financial year, the individual earned a total salary of ₹52,70,290. The employer properly deducted and deposited the TDS amounting to ₹14,78,140. However, during the return processing under Section 143(1) of the Income Tax Act, 1961, the Centralised Processing Centre (CPC) did not acknowledge the claimed TDS credit.

The dissatisfied taxpayer then approached the Commissioner of Income Tax (Appeals) [CIT(A)] – National Faceless Appeal Centre (NFAC), and filed copies of the employment contract, Form 16, pay slips, and bank statements.

Also Read: New Digital Form 16: Next-Gen ITR Filing with Advantages

The CIT(A) considered that TDS was deducted accurately via the employer and asked AO to verify Form 26AS and permit credit accordingly, permitting the appeal for statistical purposes.

When the AO gave effect to the appellate order, only a partial credit of Rs 5,31,197 was permitted. The taxpayer submitted a rectification petition u/s 154, asking for the complete credit of Rs 14,78,140. The rectification application has been disposed of by the CIT(A), repeating that it was the duty of the AO to validate records and grant the credit of prepaid taxes.

After that taxpayer has submitted a second appeal to the ITAT claiming that CIT(A) has been unable to issue particular directions, which results in continued refusal of legitimate TDS credit.

Read Also: ITR Filing: Solution for TDS Mismatch Between Form 26AS & 16

The Bench, Vikram Singh Yadav (Accountant Member) and Kavitha Rajagopal (Judicial Member) said that the salary income of ₹52,70,290 had been offered to tax earlier, and the TDS of ₹14,78,140 was duly shown in Form 16 issued via the employer.

As per the tribunal, the employer had deducted and deposited the tax with the government treasury, and hence, no justification was there for refusing credit only because of the non-appearance of the information in Form 26AS.

“The same cannot be a basis to deny the TDS credit in respect of which the assessee is lawfully eligible,” the Bench stated, asking the AO to validate Form 16 and pertinent proof and permit the complete TDS credit of Rs 14,78,140 post-furnishing a reasonable chance to the taxpayer.

Thereafter, the appeal was permitted for statistical objectives.

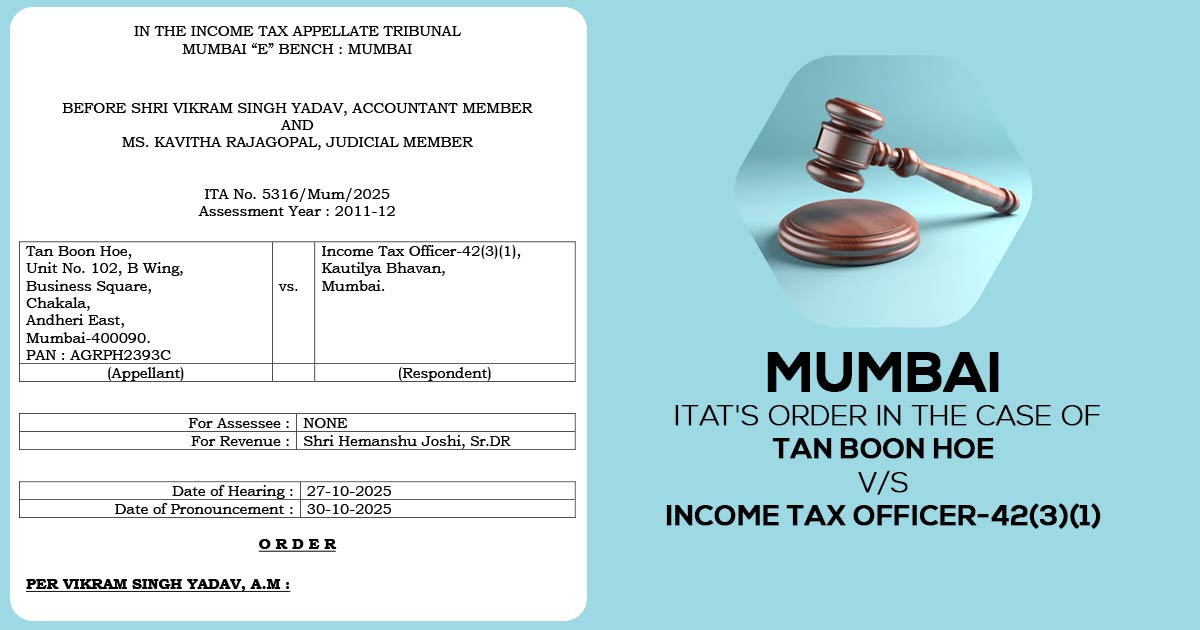

| Case Title | Tan Boon Hoe vs. Income Tax Officer-42(3)(1) |

| Case No. | ITA No. 5316/Mum/2025 |

| Assessee by | None |

| Revenue by | Shri Hemanshu Joshi |

| Mumbai ITAT | Read Order |