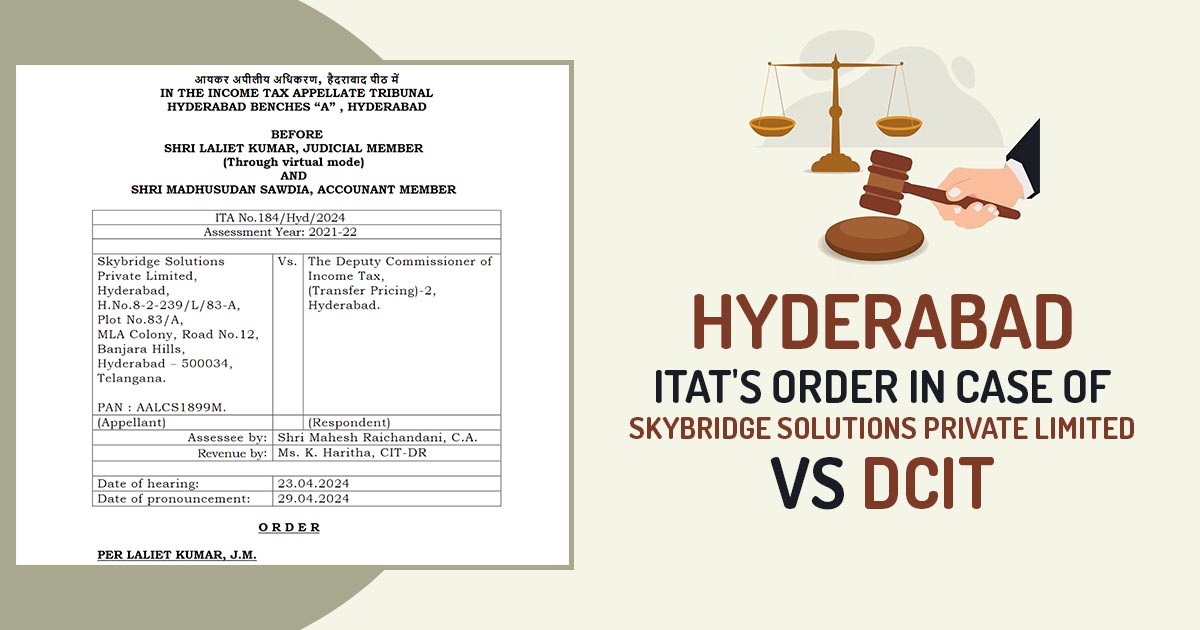

Final Assessment order Passed U/S 144C not appealable when the Assessee has not filed an objection against the draft assessment order: ITAT Hyderabad ITA No.184/Hyd/2024

All Case Summary:

The taxpayer Skybridge Solutions Private Limited is a software development and services company. The taxpayer has furnished the ITR (Income Tax Return) for the financial year 2020-21 declaring its total income of Rs. 1.06 Crore.

U/s 143(1)(a) of the Income Tax Act (“Act”), the return was processed. Subsequently, the case was chosen for scrutiny and a notice was served U/s 143(2) of the Act. The reference was made through the related Assessing Officer (“Ld. AO”) to the Learned Transfer Pricing Officer (“Ld. TPO”) U/S 92CA(1) of the Act to find the Arm’s Length Price (“ALP”) of the international transactions entered into by the taxpayer.

The transfer pricing order has been passed by the Ld. TPO directing the Ld. AO an upward adjustment of Rs. 1.83 Crore. Ld. AO passed the draft assessment order (after giving ample opportunities to respond to the show cause notice issued concerning the adjustment proposed by the Ld. TPO and some other adjustments).

Related New:- Full Process of Income Tax Return Filing without Software

A period of 30 days was provided to the taxpayer to act as per the provision of section 144 i.e. either accept the offered adjustment or furnish the objection before the Dispute Resolution Panel.

The taxpayer does not take any action in the above said 30 days. Hence Ld. AO passes the final assessment order assuming that the offered adjustment has been accepted by the Indian Taxpayer.

Post consideration of the argument of both the parties and material available on record, Hon’ble ITAT, quoted that the final assessment order is passed under section 144C(3) of the Act and it does not result from any direction of DRP.

As the impugned order is passed under section 144C(3) and no provision is there for filing of a petition against these orders before the tribunal, hence, the present appeal is not maintainable.

On the taxpayer’s appeal, Hon’ble Hyderabad ITAT granted the taxpayer the privilege to approach any alternative forum or authority or High Court.

| Case Title | Skybridge Solutions Private Limited Vs DCIT |

| Case No.: | ITA No.184/Hyd/2024 |

| Date | 29.04.2024 |

| Counsel For Appellant | Shri Mahesh Raichandani, C.A. |

| Counsel For Respondent | Ms. K. Haritha, CIT-DR |

| Hyderabad ITAT | Read Order |