An appeal was dismissed by the Delhi Bench of the Income Tax Appellate Tribunal (ITAT) after the taxpayer had chosen to settle the pending dispute under the VSVS, 2024.

While dismissing the appeal as withdrawn, the tribunal has provided the liberty to the taxpayer to take the restoration if the scheme application does not reach closure.

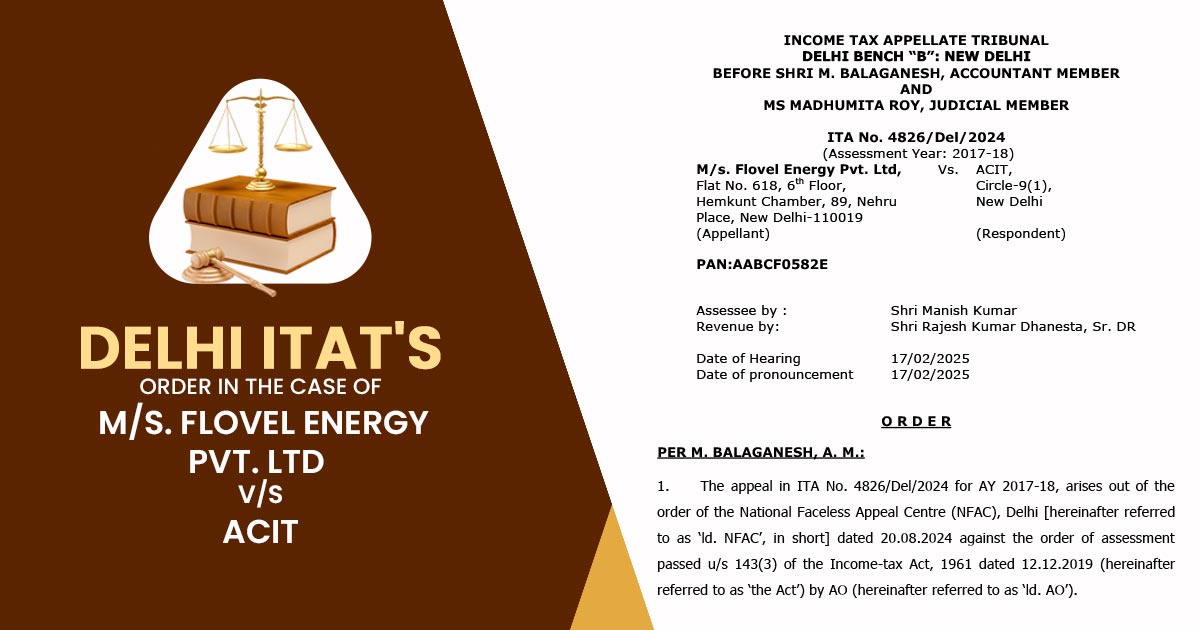

The case is related to the AY 2017-18 and has emerged from an assessment order issued u/s 143(3) of the Income Tax Act, 1961. Before the Tribunal, the taxpayers, Flovel Energy Pvt. Ltd, contest the assessment formulated by the assessing officer, which is thereafter kept via the National Faceless Appeal Centre (NFAC).

At the time of the case hearing, the taxpayer’s counsel furnished a letter on 12th February 2025, notifying the tribunal of the taxpayer’s decision to take advantage of the Vivad Se Vishwas Scheme, 2024. A declaration was submitted earlier under Form No.1 dated 11th December 2024 via the process mentioned under the scheme.

Taxpayer mentioned to settle the dispute via the direct tax dispute resolution scheme of the government, as per which the appeal comes within the purview of the scheme, the Tribunal cited.

Concerning the dispute resolution, the tribunal acknowledged the move via the regulatory procedure like VSVS. Bench, the appeal can be dismissed as withdrawn, as the taxpayer had submitted the requisite declaration earlier.

A significant safeguard for the taxpayer by the tribunal’s allowing the restoration of the appeal if the declaration made under the scheme does not come to an end.

The tribunal mentioned that the taxpayer had chosen to settle the dispute of the same appeal via claiming Vivad se vishwas Scheme (VSVS), 2024, the taxpayers appeal is considered as withdrawn with the obligation to be provided to the taxpayer to get the same appeal restored on an application made via it in the case of the declaration made under under VSVS Scheme, 2024 not reaching to conclusion for any reason.

The Tribunal, M. Balaganesh, Accountant Member, and Ms. Madhumita Roy, Judicial Member, asked that these restorations, if required, shall be entertained on a formal application via the taxpayer.

The same strategy aligns with the principles of natural justice, ensuring that the rights of the taxpayer are safeguarded even after procedural withdrawal. Consequently, the appeal was dismissed as withdrawn.

| Case Title | M/s. Flovel Energy Pvt. Ltd vs. ACIT |

| Citation | ITA No. 4826/Del/2024 |

| Assessee by | Shri Manish Kumar |

| Revenue by | Shri Rajesh Kumar Dhanesta |

| Delhi ITAT | Read Order |