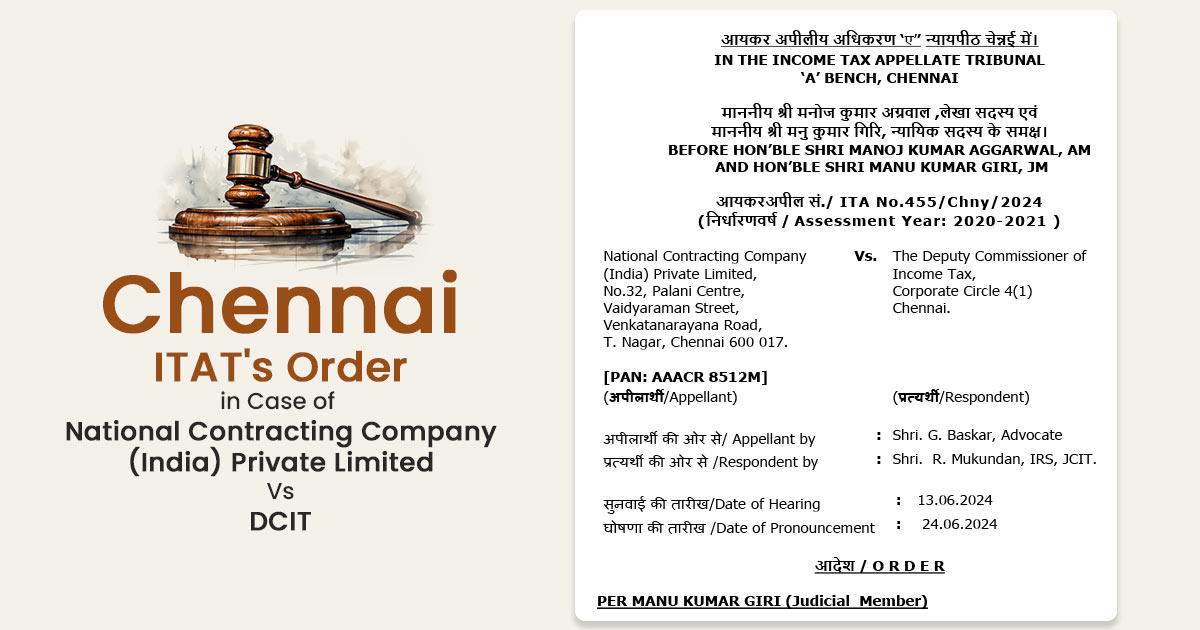

In the case of National Contracting Company (India) Private Limited vs. Deputy Commissioner of Income Tax (DCIT), the Chennai Income Tax Appellate Tribunal (ITAT) delivered a ruling. On June 24, 2024, the decision, pronounced, addresses the problem of whether a wrong classification in an Income Tax Return (ITR) can result in the refusal of a legitimate deduction.

- Case Overview: National Contracting Company (India) Private Limited, the appellant, filed its income return for the AY 2020-21 on December 18, 2020, declaring a total income of Rs 38,10,910. The Centralized Processing Center (CPC) processed the return in Bengaluru, which decided the total income at Rs 1,18,30,990 after making several disallowances. Among these disallowances was an amount of Rs 79,25,442 for gratuity, which was claimed u/s 43B of the Income Tax Act but wrongly classified in the ITR.

- Key Issues: The major problem in the same petition was whether the wrong classification of gratuity u/s 43B rather than the precise allowance schedule in the income tax return could explain the disallowance of a genuine deduction. It was argued by the appellant that the mistake was accidental and must not result in the refusal of a legal claim. The appellant has furnished an amended tax audit report and the ITR however it was still refused relief via the Commissioner of Income Tax (Appeals) [CIT(A)].

- Arguments and Conclusions: It was claimed by the appellant that the disallowance was because of a technical error and that all the pertinent information was available on record. The appellant’s counsel quoted precedents and circulars from the Central Board of Direct Taxes (CBDT) that stress the duty of the tax council to support assessees in availing the effective deductions and not to exploit their ignorance or errors. Chennai ITAT analyzed the contentions of the appellant and the reply of the tax authorities.

It stressed the distinction between an amended return and the correction of an existing return, directing the Allahabad High Court judgment in CIT v. Dhampur Sugar Ltd, which highlighted that a correction does not correlate to filing a new return. The tribunal directed to the Gujarat High Court’s decision in S.R. Koshti vs. CIT, which carried that tax authorities are required to update over-assessment resulting from taxpayer mistakes, ensuring only fair taxes are collected.

Closure

The ITAT Chennai ruled in favour of the appellant, stating that a legitimate claim should not be rejected due to a mistake in the ITR classification. The tribunal underscored that all essential details were available in the records and that the taxpayer’s blunder was genuine.

As a result, the ITAT directed the Assessing Officer to authorize the deduction and remove the previously made addition. This ruling emphasizes the idea that tax authorities should prioritize the essence of a claim over formalities and help taxpayers obtain their rightful claims, even when there is a case of technical errors.

| Case Title | National Contracting Company (India) Private Limited |

| Case No. | ITA No.455/Chny/2024 |

| Date | 24.06.2024 |

| Appellant by | Shri. G. Baskar |

| Respondent by | Shri. R. Mukundan |

| Chennai ITAT | Read Order |