The Income Tax Appellate Tribunal in Ahmedabad has confirmed a decision to add ₹45.5 lakh to a person’s income due to claims of fake agricultural income. This means that the tribunal found that the individual was improperly reporting income from farming that wasn’t real.

It was discovered that the taxpayer’s explanation that there has been a hike in agricultural income by 3 times in the current year, and expenses have gone down from 76% to 43% cannot be held to be reasonable, logical, and acceptable.

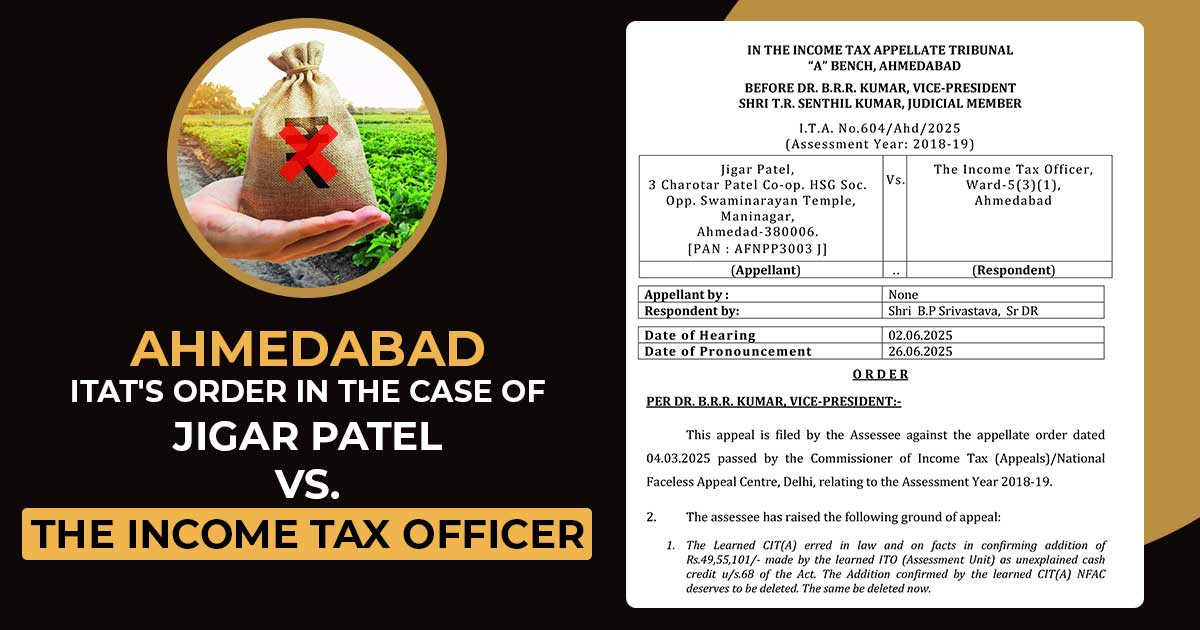

The appellate order contested by taxpayer Jigar Patel, on 04.03.2025, was passed by the Commissioner of Income Tax (Appeals)/National Faceless Appeal Centre, Delhi, for Assessment Year 2018-19.

In law, CIT(A) has made a mistake on facts in validating the addition of Rs 49,55,101 made via the ITO (Assessment Unit) as unexplained cash credit under section 68 of the Act. The CIT(A) NFAC validated that the addition should be removed. The same should be removed now.

A mistake has been made by CIT(A) in appropriately appreciating the facts, distinct submissions, explanations, and information submitted by the appellant during the assessment proceedings, which must be considered in an appropriate perspective before passing the impugned order.

The appellant desires to add, amend, alter, delete, change, or modify any or all grounds of appeal before or in the hearing.

On 31.07.2018 taxpayer has e-filed his income return for the assessment year 2018-19, specifying the total income at Rs 5,48,790 and agriculture income of Rs 75,54,376. Under CASS, under the selection criteria “Agricultural Income,” the matter was chosen for scrutiny.

The representative of the taxpayer, Shri Shailesh C Parikh & Co. CAs, in response to several statutory notices issued to the assessee to furnish details about the agricultural activities, has furnished a reply.

The AO, while analysing the case, concluded that for the year under consideration, which saw widespread calamity, i.e. Gujarat 2017 floods, the agricultural income cannot be more, and the response furnished via the taxpayer was nothing but a concocted story.

The assessment under section 143 (3) r.w.s 143(3A) & 143(3B) of the Act dated 18.03.2021 has been completed by the AO considering Rs. 25,99,275 as the agriculture income was held as income from the unexplained sources shown as agricultural income and Rs.49,55,101/- (i.e. Rs.75,54,376 – Rs.25,99,275) was ministered as unexplained cash credit u/s 68 of the Act.

The taxpayer’s appeal has been dismissed by the CIT(A) as it marks that the taxpayer’s explanation that there has been a rise in the income of agriculture by 3 times in the existing year and expenses have gone down to 43% from 73% cannot be held to be reasonable, logical and acceptable.

The appeal has been dismissed by the two-member bench of Dr. B.R.R. Kumar, Vice-President, and T.R. Senthil Kumar, Judicial Member, after considering the same.

| Case Title | Jigar Patel vs. The Income Tax Officer |

| Case No. | I.T.A. No.604/Ahd/2025 (Assessment Year: 2018-19) |

| Appellant by | None |

| Respondent by | Shri B.P Srivastava |

| Ahmedabad ITAT | Read Order |