An important functionality on the website of the IT department has been introduced by the officials which permits the assessees to discard their previously filed however unverified ITR. The assessee previously was permitted to amend the ITR merely in the matter of the error or omission.

The latest addition to the income tax portal allows users to ‘Discard Return‘ for unverified original, belated, or revised ITRs beginning from the assessment year 2023-24. This step taken by the income tax department is commendable as it broadens the opportunities for taxpayers to revise their income tax returns beyond the previous limitations confined to omission and error.

Nevertheless, the absence of a legal provision for discarding the ITR raises concerns about its future legal validity, potentially opening it to questioning down the line.

The discard feature can be utilized multiple times, as long as the ITR status remains unverified or pending verification. This functionality is exclusively applicable for AY24 onward for the respective ITR until the specified time limit for filing Income tax returns under sections 139(1)/139(4)/139(5). Once an ITR is discarded, restoration isn’t possible. This action is permanent and effectively asserts that the ITR was never filed in the first place.

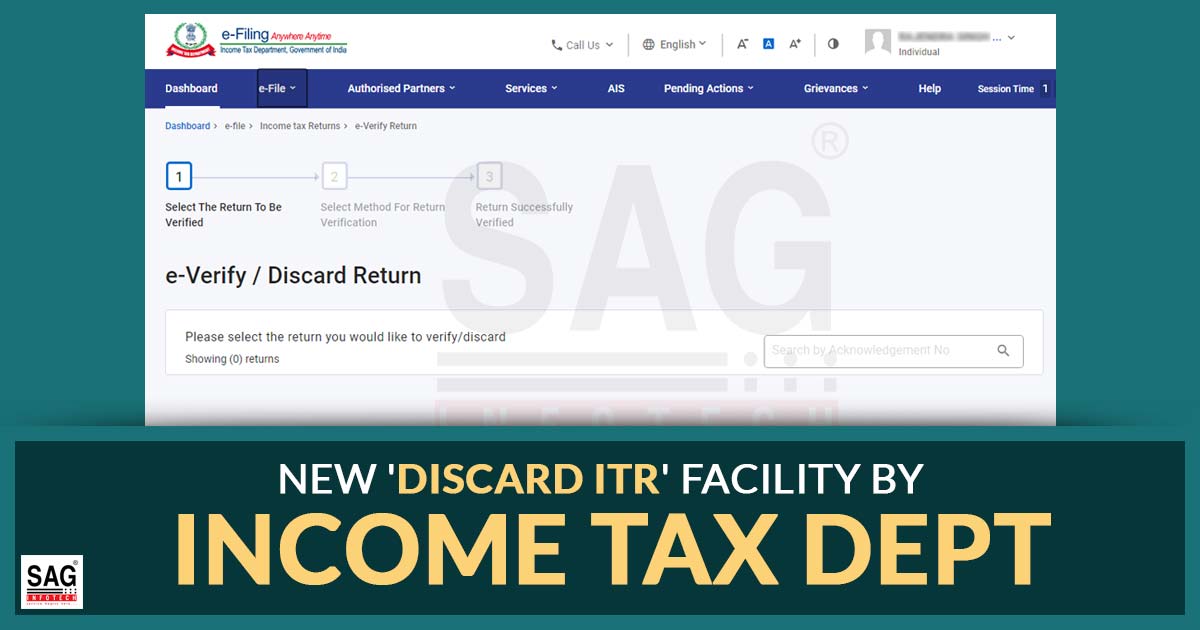

To locate the ‘Discard’ option, follow the website pathway: www.incometax.gov.in → Login → e-File → Income Tax Return → e-Verify ITR → “Discard Return.”

The income tax department’s FAQs clarify that users can utilize the “Discard” option for ITRs filed under sections 139(1)/139(4)/139(5) if they choose not to verify it. This allows users to file a fresh ITR after discarding the previous unverified one.

However, discarding an “ITR filed u/s 139(1)” and subsequently filing a return after the due date under the same section may lead to consequences like the imposition of belated return penalties such as 234F, etc. Therefore, it’s advisable to verify if the due date for filing the return under section 139(1) is available before discarding any previously filed return.

While discarding a previously unverified ITR doesn’t mandate filing a subsequent ITR, considering that the taxpayer has previously uploaded return data, it’s generally expected that they would file another ITR later. Additionally, if you’ve sent your Income Tax Return V to CPC and it’s in transit, and you later realize that the details weren’t reported accurately, it’s explicitly advised against discarding such returns.

The newly introduced ‘Discard’ feature empowers taxpayers to handle their ITR filings more effectively and addresses any inaccuracies or omissions within specific time frames. However, exercising caution is crucial because once an ITR is discarded, restoration becomes impossible.