We are living in the Digital Era. Given the aforesaid fact, The Government of India has recently launched a mobile app through which you can file your Income Tax Returns.

So, all the features of the web portal of Income Tax that are available on the desktop are also available on the income tax return filing mobile app. Further, all the pertinent features that are available on the income tax portal via desktop and Laptop can be accessed through a mobile app also.

And you can access the aforesaid information from any place and at any time. The government ITR mobile app shall assist taxpayers to access information like

- ITR form,

- Saral Income Tax facility,

- Pre-filled income tax details,

- Refund claim

- and so on.

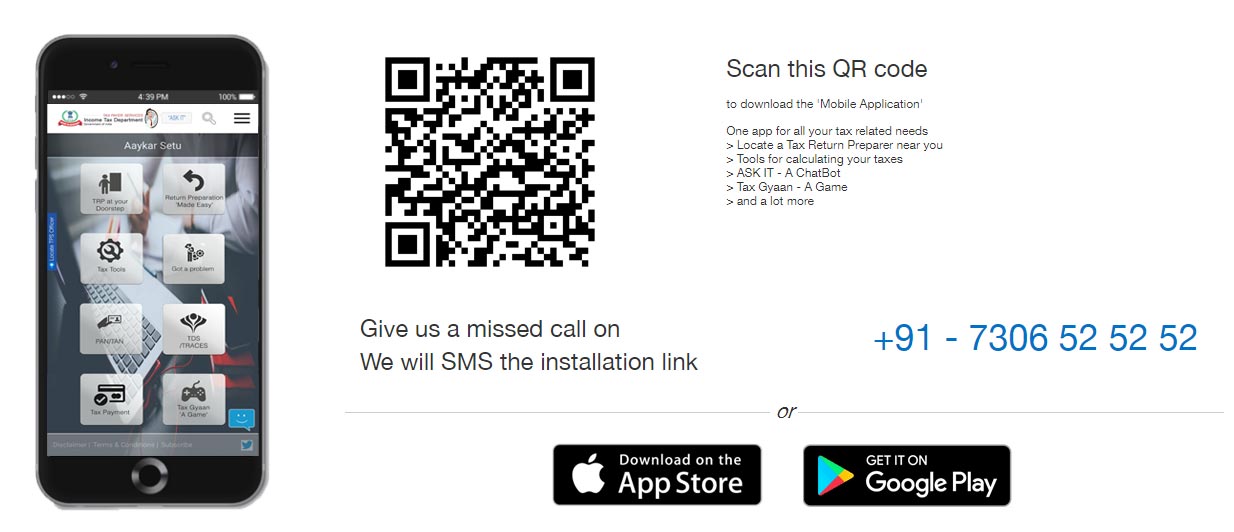

The aforesaid new income tax filing mobile app can be freely downloaded from the Apple app store and the Play Store.

How to Install Income Tax e-Filing Mobile App?

Give a missed call to the number +91 – 7306 52 52 52 and the I-T department shall SMS the installation link.

New ITR Mobile App Installation from the Portal

Access the new mobile application for Income tax returns filing: https://www.incometaxindia.gov.in/pages/tps/default.aspx

It’s important to note that the Indian government has not extended the deadline for filing income tax returns (ITRs) for the last two financial years. Therefore, you should file your ITR using the Gen Income Tax Software before the deadline to avoid any penalties.