Now, you shall not be paying taxes in the way you used to pay in FY 2021-2022. Noteworthy changes in the Income-tax regime that shall be operative from 1st April 2021 include the following: No requirement of tax filing for senior citizens above 75, Pre-filled IT forms, Tax on interest on PF, Income tax return (ITR) non-filers, Penalty imposition for non-linking of Aadhar & PAN, and High TDS/TCS Rate for submission of bills under LTC Cash Voucher Scheme.

Senior-Citizens Above 75 Years Exempted from Tax Filing

- Senior citizen shall be exempted from filing income tax

- If he is above the age of 75 years

- Who has a pension scheme

- Who earns interest on fixed deposit in the same bank

Pre-filled ITFT Forms

This time in the Financial Year 2021-22, Pre-filled IT Forms shall be put in place.

What items shall be included in pre-filled IT forms?

The details related to Capital Gains from Listed Securities, Interest from Banks/Post Office, Dividend Income and so on shall be included in the Prefilled ITft Forms. Gone are the days when salaried employees only used to fill Pre-filed ITft form. Others used to fill Form-16. Now the domain of Prefilled ITft Forms has been widened.

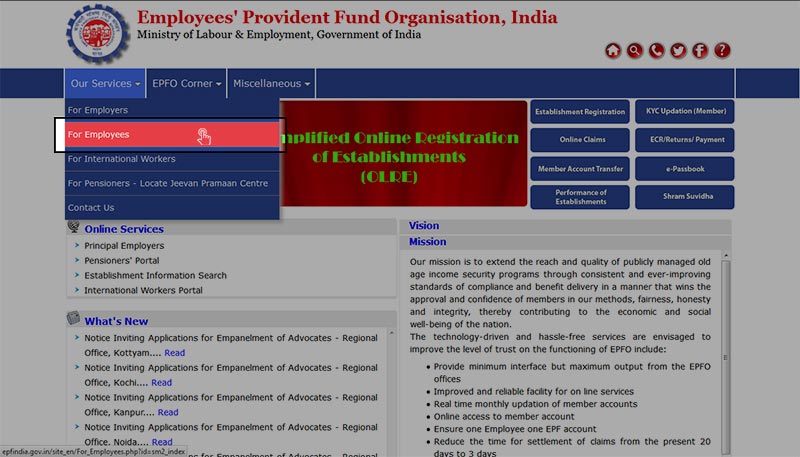

No Tax for Interest Earned on PF

Now the Interest that is earned on the Provident fund

However, interest on employee contribution to provident fund over 2.5 lakhs shall be taxable.

Raising TDS for Non Filers

In case an individual does not file Income Tax Return (ITR) wef 01.07.2021, high TDS/TCS shall be imposed

As per section 206AB that has been inserted this year, rate proposed for non-filers shall be higher of the following:

- 5%

- Two times the rate specified in the relevant provision of the Act

- Two times the rate or rates in force

Imposition of Penalty for not Linking on Aadhar & PAN

It is hereby informed that the last date for linking Aadhar

Bills Submitted under LTC Cash Voucher Scheme

As per the recent Cash Voucher Scheme, for availing the benefits as per the aforesaid scheme, an employee should spend thrice the amount that is deemed as LTA fare on goods and services having GST of 12% or more. However, For availing tax benefit under the umbrella of Leave Travel Concession, bills in the correct format and vendor number should be submitted.