Nowadays, it is impossible for a common man to purchase a house in his own name and from his own Income due to inflation. So if a person wants a residential house, he can buy the same with easy EMI facilities. EMI facility is beneficial for buying a home with a starting limited down payment and the rest payment in equal monthly instalments. Buying a house with your own name and getting possession through EMI is like a dream come true, and getting tax benefits on EMI paid is like a “cherry on the cake”.

Real estate is witnessing a comeback and once again grabbing the attention of investors. Prices of real estate are reasonable and affordable. In addition, this is the right time to take home loans as various income tax incentives/sops are available for deduction. Here are the various benefits of investing in real estate.

Can’t Avail Income Tax Benefit on This Home Loan After 31st Mar

The central government has decided to stop the income tax advantage from 1st April 2022 under section 80EEA for those who are buying a home for the first time. In Budget 2019, the Union government has circulated an additional amount of Rs 1.50 lakh income tax advantage to the people who take a home loan, and buy their first property having a stamp duty valuation of up to Rs 45 lakh. Taxpayers should not be eligible to claim a tax benefit under Section 80EE.

When the new home loan borrower avails of the home loan sanction letter by the date 31st March 2022 and gets disbursal in FY23, he or she will be enabled to avail of the other income tax exemption advantage for the whole tenure of the home loan.

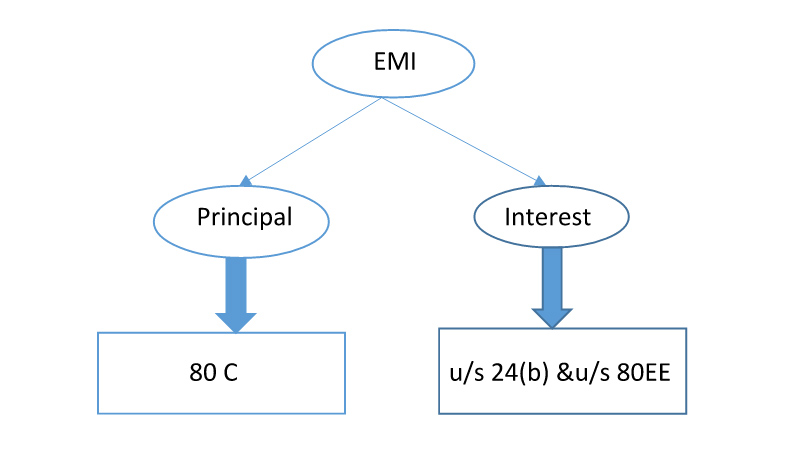

Tax Sops on Both Principal & Interest

Mainly, 3 types of deductions are available: Deductions under section 80C (repayment of the principal component of a home loan), under section 24 (Interest repayment) and under section 80EEA (Deductions for low-cost housing). Deductions under section 24 are capped at Rs 2 lakhs annually in case of self-occupied property. Additionally, if a house is purchased within the purview of the affordable segment, a deduction under section 80EEA of Rs 1.5 lakh is available. This deduction is available in addition to Rs 2 lakh on the interest component.

Deduction in the Case of Buying a Constructed Property

In case of purchasing an under-constructed property, you can claim “the total interest that has been paid before the pre-delivery period” as a deduction in 5 equal instalments. The financial year shall start in the year in which construction has been completed or the year in which you acquired your apartment (date of taking possession).

Self-Occupied Property

The maximum deduction you can claim per year continues to be Rs 2 lakh, although, in the case of self-occupied property, you can claim an extra interest deduction of Rs 1.5 lakh for the first house owned by you.

Deduction in Case of Joint Purchase

“Buying a house in a joint name” (for instance, spouse) makes both entitled to a deduction of Rs 2 lakh for the interest that is borne by each one. In case you have a working son/daughter and the bank is ready to split the loan between the three of you, all three of you can avail of the deduction of up to Rs 2 lakh on a self-occupied property.

Self-Occupied Home

In the case of two self-occupied houses, notional rent shall not be levied. In the case of three houses, tax on a third house equivalent to ‘deemed value’ or expected market rent shall be imposed.

The Following are the Tax Benefits

- Interest paid on EMI is available for exemption u/s 24(b) of the Income Tax

- Pre-construction Interest is also covered under this section.

- The principal amount of the loan is available as a deduction u/s 80C

- From Assessment Year 17-18, another Deduction will be available u/s 80EEA for interest paid other than Interest exemption u/s 24(b), but it depends on some conditions.

Here are details about tax benefits available to the assessee:

- Tax Benefits on Interest paid after the house is constructed

- Pre-Construction Interest:

Homeowners can claim a deduction of up to Rs 2 lakhs if the house property is Self-occupied (Rs. 1,50,000 up to FY 2013-14) on their home loan interest if the owner or his family reside in the house property. If you have a let-out house property, the “entire interest” on the home loan is allowed as a deduction.

Your deduction on interest for the self-occupied property is limited to Rs 30,000 if you fail to meet any of the conditions given below for the Rs 2 lakh rebate.

Conditions :

- The home loan must be for the purchase and construction of a new property.

- The loan must be taken on or after 1 April 1999.

- The purchase or construction must be completed within 3 years (5 Years from AY 17-18) from the end of the financial year in which the loan was taken.

Pre-Construction Interest and Deduction Limited to 30,000/-

If the construction of the property is not completed within 5 years, the deduction on home loan interest shall be limited to Rs 30,000. The period of 5 years is calculated from the end of the financial year in which the loan was taken.

Also, where the loan has been taken for reconstruction, repairs or renewal, only Rs 30,000 shall be allowed as a deduction.

Note: The deduction is to be claimed to start in the financial year in which the construction of the property is completed.

Deduction on home loan interest cannot be claimed when the house is under construction. It can be claimed only after the construction is finished. The period from borrowing money until the construction of the house is completed is called the Pre-construction period.

Interest paid during this time can be claimed as a tax deduction in five equal instalments starting from the year in which the construction of the property is completed.

The Benefit in Tax of Principal Repayment: Section 80C

The deduction to claim principal repayment is available for up to Rs. 1,50,000 within the overall limit of Section 80C.

Check the principal repayment amount in your early loan statement.

Tax Deduction for First-Time Homeowners: Section 80EE

- Section 80EE, recently added to the Income Tax Act, provides the first-time homeowners’ tax benefit of up to Rs 50,000 if the following conditions are satisfied

Conditions to Claim Deduction Under Section 80EE

To claim this deduction:

- Your home loan does not exceed Rs. 35 lakhs

- The value of residential house property must not exceed Rs. 50 lakhs

- The loan must have been sanctioned between 1 April 2016 to 31 March 2017

- No other residential house property is owned by the assessee on the date the loan is sanctioned

- This deduction is not available to AOP, HUF, Companies, Trust, etc

- This deduction benefit is not available for loans on commercial property

Both resident individuals and NRIs can claim this deduction. The Income Tax Department has not specified whether the house should be self-occupied to claim this deduction.