The Hyderabad Bench of the Income Tax Appellate Tribunal (ITAT) has exempted late fees imposed under Section 234E of the Income Tax Act, 1961, for the delayed filing of quarterly TDS (Tax Deducted at Source) returns.

As per the Tribunal, when the taxpayer has deposited TDS with applicable interest, submitted all the pending quarterly returns before the deadline of the fourth quarter, and specified the genuine medical causes for the delay, no prejudice has been caused to the revenue or deductees.

Supujita Advisory and Consultancy (OPC) Pvt. Ltd., a corporate advisory firm, diligently deducted TDS on multiple payments throughout the Financial Year 2022-23. Demonstrating timely compliance, the company submitted its Form 26Q TDS statements for the first three quarters on 29 April 2023.

Although the submissions were made after the statutory due dates under Section 200(3), they were filed before the fourth quarter deadline of 31 May 2023. Despite this, the CPC (TDS) imposed late filing fees under Section 234E, a decision upheld by the Commissioner of Income Tax (Appeals).

The taxpayer before the tribunal has claimed that the delay was attributable to the ill health of its sole director, who was undergoing spinal surgery, supported by medical records. The company has submitted the TDS amounts, including interest, and ensured that all the returns were being submitted to the final quarterly due date, which prevents any revenue loss or inconvenience to deductees.

As per the revenue, a late filing fee for delays in quarterly TDS returns has been levied u/s 234E, and the law does not provide for condonation on grounds of reasonable cause.

The Tribunal noted that although Section 234E imposes a fee for late filing, the unique circumstances of this case warranted relief. It recognised that the taxpayer had provided valid medical reasons for the delay and had fully met its obligations by paying the TDS along with interest.

As the returns were submitted before the due date for the fourth quarter, the Department did not face any inconvenience, and the deductees were not deprived of their credit.

As per the Bench, a mistake has been made by the Assessing Officer and CIT(A) in mechanically imposing and sustaining the late fee without acknowledging such mitigating situations.

While setting aside the orders of lower authorities, the Bench of Vijay Pal Rao (Judicial member) and Manjunatha G (Accountant member) cited that “No prejudice is caused to the Department or deductees when compliance is ultimately achieved in time for the last quarter,” and directed the deletion of the late fee levied for all three quarters.

Therefore, the appeal was permitted.

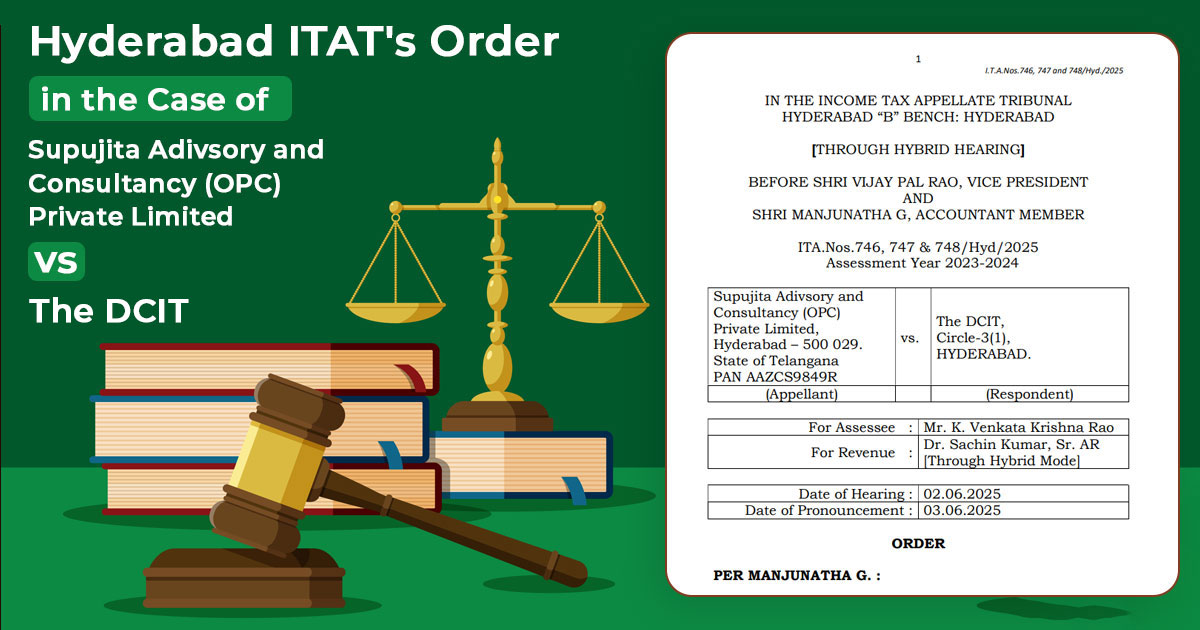

| Case Title | Supujita Advisory and Consultancy (OPC) Private Limited vs. The DCIT |

| Case No. | ITA.Nos.746, 747 & 748/Hyd/2025 |

| For Assessee | Mr. K. Venkata Krishna Rao |

| For Revenue | Dr. Sachin Kumar |

| Hyderabad ITAT | Read Order |