The Hyderabad Bench of the Income Tax Appellate Tribunal recently cancelled certain tax reassessment actions that had been started for several past years, specifically from 2014 to 2019. These actions were based on specific sections of the Income Tax Act, which deals with how taxes are assessed and reassessed by the government. In simple terms, the tribunal decided that the tax authority’s attempts to review and adjust previously filed tax returns for those years should not proceed.

The case of the taxpayer company, ACE Tyres Private Limited, has emerged from a search and seizure operation in 2023 on the Exel Group of Companies, including the taxpayer, and a simultaneous, separate search conducted at the residential premises of Shri Ramesh Kumar Sanaka, the Senior Accounts Manager of the group cited.

For starting the reassessment proceedings after the 3-year limitation period, the assessing officer used seized material. U/s 149(1)(b) of the Act, to open an assessment after 3 years, the escaped income should amount to Rs 50 lakhs or more and be represented in the form of an asset, an expenditure, or an entry in the books of account.

Similar: Delhi HC Clarifies Section 149 of Income Tax Act: Reassessment Barred Beyond Limitation Period

The validity of the notice has been contested by the taxpayer on a distinct legal basis. The taxpayer, the cash receipts along with the payments discovered in the laptop, which were consolidated transactions for the whole group, do not comprise an asset as specified under the act, nor did the loose, selective transaction details in the software constitute “books of account.”

The two-member Bench, Vijay Pal Rao (Vice President) and Manjunatha, G. (Accountant Member), stated that the receipts and payments, being business transactions, did not define a specific “asset” in existence during the search.

The tribunal said that the selective information of cash transactions in a software file, not being a complete record, does not constitute books of account.

The Tribunal specified that the Assessing Officer (AO) had mechanically recorded satisfaction without applying his mind as specified via the difference in the income computed in the assessment compared with the reasons recorded for the reopening.

As per the bench, the satisfaction along with the approval granted via the superior authority (DGIT) u/s 151 was mechanical and inadequate since it skipped the fundamental jurisdictional need that income needs to be exhibited as an asset or entry in the books of account.

Read Also: ITAT Indore: Unexplained Cash Credit Addition Invalid After Rejection of Books of Accounts

The tribunal specified the procedural issue that the material was seized from a third party (the Accounts Manager) under a separate search warrant; however, the AO erroneously moved as if the material was seized from the taxpayer.

Tribunal held that under Section 148, the notices issued did not comply with the law by concluding that the obligatory norms of Section 149(1)(b) were not fulfilled and the needed sanction u/s 151 was invalid.

The consequential reassessment orders were quashed by the tribunal. Therefore, the taxpayer’s appeal was permitted.

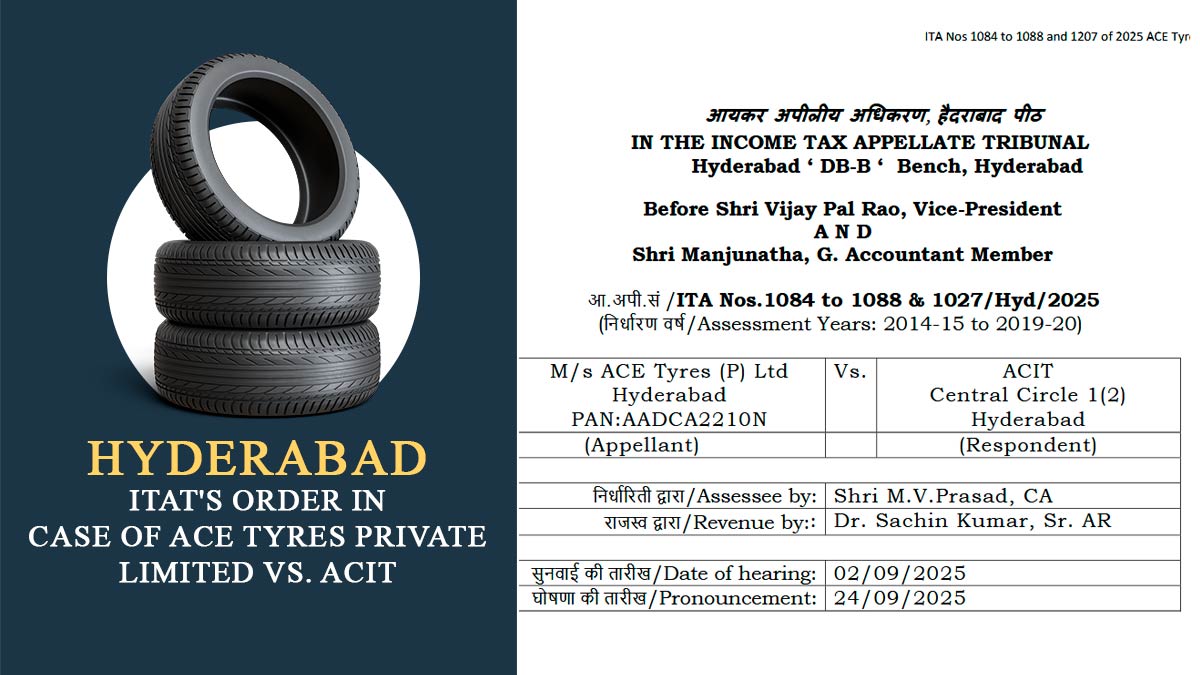

| Case Title | ACE Tyres Private Limited vs. ACIT |

| Case No. | ITA Nos.1084 to 1088 & 1027/Hyd/2025 |

| For Petitioner | Shri M.V.Prasad, CA |

| For Respondent | Dr. Sachin Kumar, Sr. AR |

| Hyderabad ITAT | Read Order |