GST is a new taxation structure which is almost ready to apply all over the nation but not only a professional but as well as businessmen and small traders are also confused regarding the calculation of GST tax. There are lots of issues that are related to GST so before the discussion related to tax calculation on GST, We must understand the term and how the GST calculator works in the calculation of Tax.

Opting for manual GST calculations in your business operations can be prone to errors. To circumvent such pitfalls, leveraging a GST calculator emerges as a prudent choice, streamlining the calculation process.

This blog post will delve into common pitfalls encountered during GST return submissions and elucidate the role of the GST Calculator in assisting businesses in sidestepping these routine mistakes.

What the Term GST Calculator Signifies?

The GST Calculator presents a user-friendly interface, simplifying the process of determining the GST amount due for a specific month or quarter based on the transaction total. This tool finds widespread utility among various professionals, including wholesalers and manufacturers. Here are its primary features:

- The GST Calculator is a valuable tool for businesses and individuals, enabling them to compute the GST for their transactions.

- Utilizing the GST calculator requires inputting transaction particulars, including the value of goods or services, the relevant GST rate, and any additional costs such as freight or insurance.

- Once all the data is provided, the GST calculator will swiftly and accurately determine the GST amount and the total transaction value.

- This tool serves as a reliable means for precise and expeditious GST computation while minimizing the likelihood of calculation errors. Consequently, it plays a crucial role in preventing penalties and legal complications.

What is the Method to Compute the Tax Via A GST Calculator?

For those seeking simplified GST calculations, numerous online websites offer a convenient solution. These websites provide access to GST calculators that can be utilized on any computer. These calculators are equipped with intelligent formulas designed to compute various aspects of GST, including the GST amount, net price, CGST, SGST/UTGST, and more.

Process for Using the GST Calculator to Compute the GST Online

- Through the GST calculator search for a website.

- As per your requirements, choose either the GST-contained or GST-exclusive option.

- The quantity of the purchased item should be added.

- After that, determine which GST rate is suitable for the products you sell.

- Once you tap calculate, you’ll see the total.

Advantages of Using the GST Calculator

- GST calculator diminishes the possibility of calculation errors.

- It keeps time and resources.

- Computing gross or net product pricing is helpful based on percentage GST rates.

- A GST calculator simplifies the computation of Integrated Goods and Services Tax (IGST).

- Businesses can prevent any tax penalty with a GST calculator.

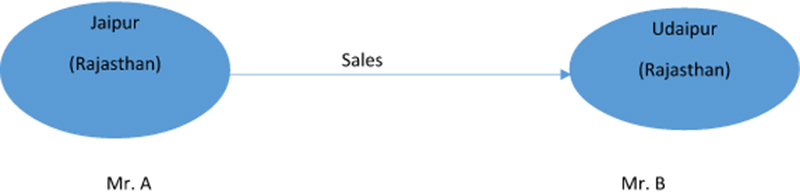

Central Goods and Service Tax (CGST): In the case of intra-state transactions, a portion of the tax rate or tax amount will go to the central government directly.

States Goods and Service Tax (SGST): In the case of intra-state transactions, a portion of the tax rate and tax amount will go to the state government directly.

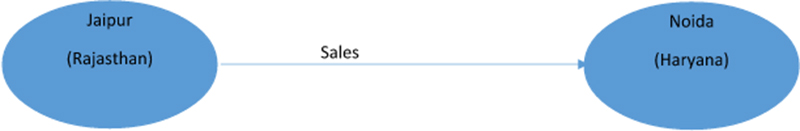

Integrated Goods and Services Tax (IGST): In the case of interstate transactions, the tax amount will go to the Central government and after that, the appropriate tax amount will be transferred by the Central Government to the State government.

Now, Let’s See How to Calculate Tax in the Preview of GST:

In Case of Intrastate Transaction:

- Taxable Sales Value 1000/-

- Tax Rate@ 5% 50/-

- Total Sales 1050/-

Bifurcation of Tax Amount is:

- SGST 25/-

- CGST 25/-

In the Case of Interstate Transactions:

- Taxable Sales Value 1000/-

- Tax Rate@5% 50/-

- Total Sales 1050/-

Bifurcation of Tax amount is:

- IGST 50/-

Now a new question is generated how to make a set-off after the payment of the tax?

The news is spread all over GST India that it will decrease the tax liability and inflation will be decreased once the GST becomes applicable. But the question is, how this will be possible? So here is the answer to this question:

Following taxes will be set off with the same or with different tax input credits:

| CGST | CGST and IGST |

| SGST | SGST and IGST |

| IGST | IGST , CGST and SGST |

Common Errors at the Time of GST Return Filing

- Inaccurate reporting of sales and purchases may result in tax calculation errors.

- Precision is imperative when claiming input tax credits, as incorrect claims can lead to severe repercussions.

- Failure to uphold proper tax invoices and documentation can trigger compliance complications.

- Overlooking GST return deadlines can incur penalties and interest charges.

- Neglecting data reconciliation and discrepancy resolution may invite penalties.

- Choosing an incorrect GST category can complicate the return filing process.

- Mixing up zero-rated and nil-rated supplies can introduce errors in export-related transactions.

What Are the Key Points to Prevent the Common Mistakes?

- Maintain proper records for rectifying the sales and purchases.

- Verify if the ITC claims match with the data of the supplier for the precise filing.

- File the GST returns within time and file the taxes so as to prevent penalties.

- Validate the preciseness of the tax invoices and the needed documents.

- Cross-verify the GSTR-2A against the purchase records so as to settle any issues.

- Consult with experts or professionals to ensure GST compliance.

- Conduct routine audits to find and correct problems prior to submitting returns

- Utilise technology to streamline the filing of GST returns and minimize errors.

- For complicated GST provisions, approach the GST helpdesk