Here, we will guide every outline with the steps to file the GSTR-1A form using Gen GST online software. This is a new and important form for taxpayers.

Understanding GSTR-1A

A registered assessee has been permitted under GSTR-1A to update the information of sales towards GSTR-1 which has been furnished before. Since 2007 the form was not under utlisation though it was again introduced in July 2024 vide CBIC Notification 12/2024 dated 10th July 2024.

A proviso to Rule 59(1) was inserted, introducing a new Form GSTR-1A permitting amendments in the GSTR-1 before filing the GSTR-3B. CGST Rule 59(4A) enrolls the details needed in the GSTR-1A.

When Would GSTR 1A be Available to File?

For monthly filers, GSTR-1A will be open from the subsequent following two dates, till the actual filing of GSTR-3B of the identical tax duration-

- The due date for filing GSTR 1 is the 11th of the following month.

- Date of actual filing of GSTR-1 Form

Quarterly filers will be able to access GSTR-1A starting from the later of the following two dates, and they will be able to use it until they file GSTR-3B for the same tax period (Quarter).

- Return filing due date of the GSTR-1 form i.e., 13th of the month following the end of the quarter.

- Due date of actual filing of GSTR-1 Return Form (Quarterly).

What is The Difference Between GSTR-1A & GSTR-1?

GSTR-1 is a return that poses all the information of sales. It is filled up and filed via the seller taxpayer. The data from one’s GSTR-1 will appear in his buyer’s GSTR-2B where he may modify some information. GSTR-1A comprises merely the changes to GSTR-1 information of the provided month.

When is GSTR 1A Generated?

GSTR-1A is generated when the recipient takes any of the subsequent measures in their GSTR-2, GSTR-4, or GSTR-6 return:

- Rejects the details added by the supplier and submits the return.

- Changes the details added by the supplier and submits the return.

- Adds new details missed by the supplier and submits the return.

For this information to be auto-populated in GSTR-1A for the supplier, the following conditions should be fulfilled:

- The recipient submits GSTR-2, GSTR-4, or GSTR-6 on or before the 17th of the month.

- The supplier has not filed or generated GSTR-3.

- The supplier has not submitted GSTR-1A.

What is the Deadline to File Form GSTR-1A?

GSTR-1A filing has no deadline. It can be filed till the filing of GSTR-3B of the identical tax duration.

Steps to File GSTR-1A Via Gen GST Online Software

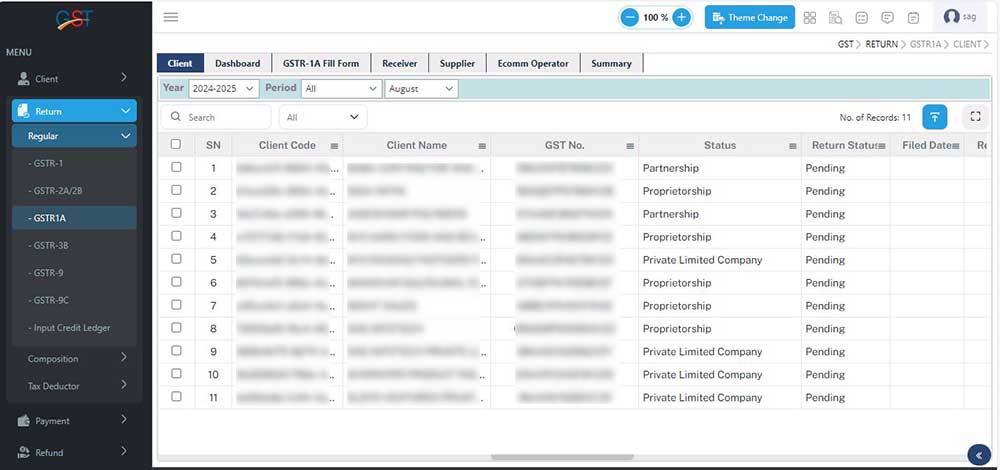

Step 1: Log in to Gen GST Online Software on your PC and Laptop

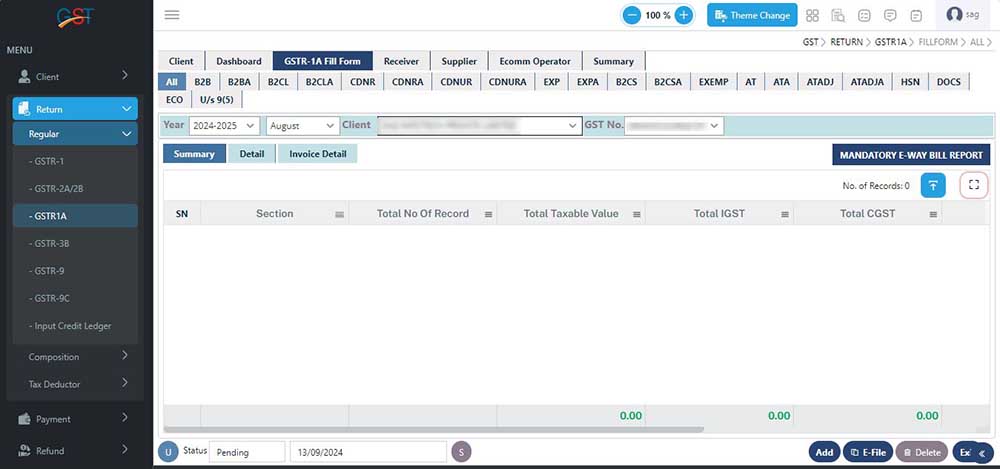

Step 2: After Login then move the cursor on ‘Return’ > ‘GSTR-1A’ for filing

Sept 3: Select the client and then click Fill the form GSTR-1A

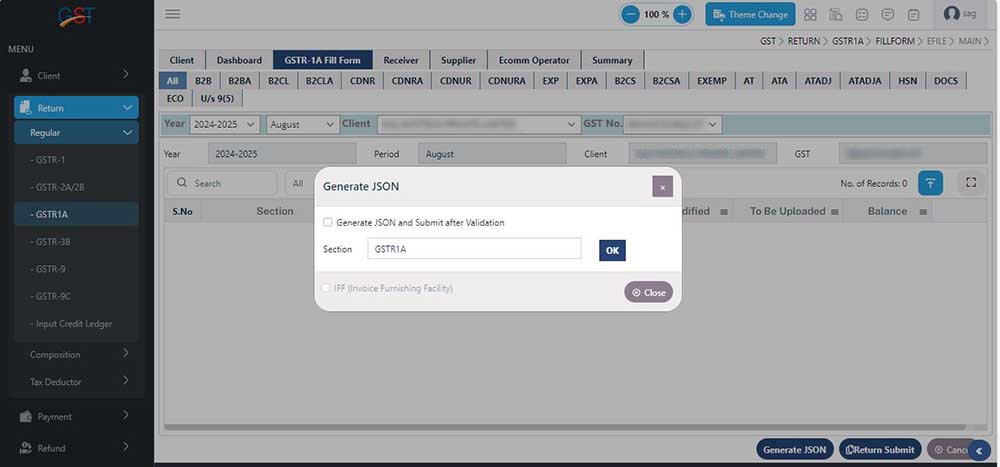

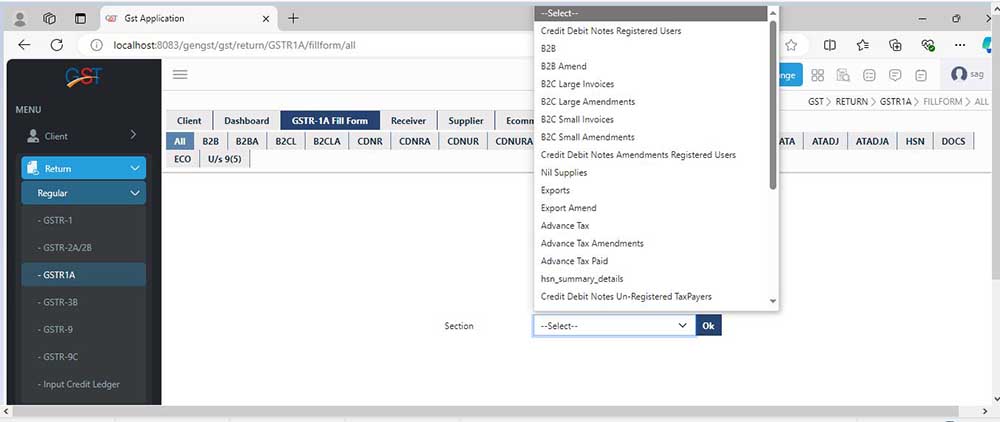

Step 4: After that click on the add button to enter manually entry for the respective section

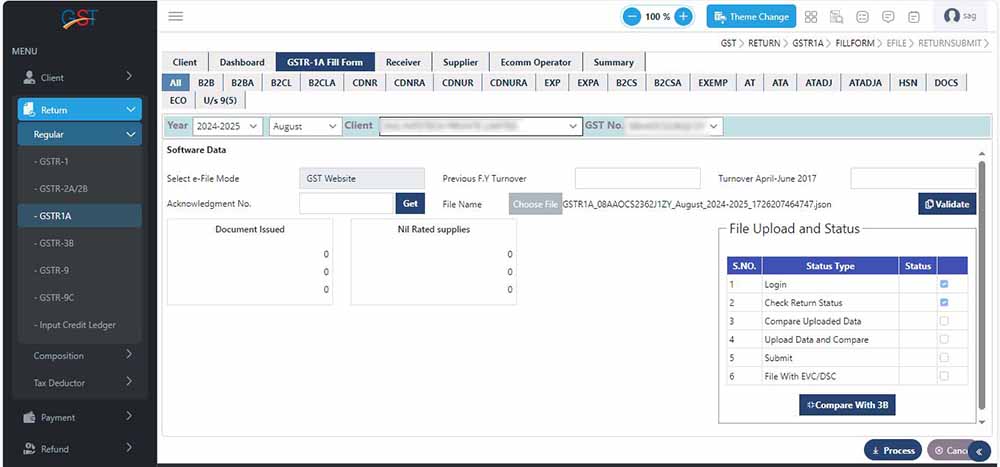

Step 5: After entering the required data in the respective section click on the JSON button to create of JSON file

Step 6: File GSTR-1A By Gen GST Online Software After creating a JSON file click on the validate button JSON file and then click on the proceed button on the GST portal

Get a demo today: https://saginfotech.com/gst-software.aspx

Main FAQs for GSTR-1A

Q.1 What is the working of GSTR-1A?

For instance- Karan buys 200 Mobile Phones worth Rs. 60,000 from Vinay and company. Vinay and company have shown it as Rs. 40,000 sales in his GSTR-1 by mistake. The data from Vinay and company GSTR-1 will flow into GSTR-2A of Karan. Karan discovers it wrong and edits it to Rs. 60,000. This correction is automatically shown in Vinay and the company’s GSTR-1A. Now Vinay and the company ought to accept the correction and his GSTR-1 will automatically be updated.

Q.2 Is it compulsory to submit GSTR-1A before the generation of GSTR-3?

No, it is not compulsory to submit GSTR-1A for the generation of GSTR-3.

Q.3 In GSTR-1A the submit button is disabled, what must I do?

You are mandated to select the acknowledgment checkbox to enable the submit button

Q.4 What are the measures that are not allowed in GSTR-1A?

The supplier in GSTR-1A is not allowed to make any amendments to any of the invoices.

Q.5 Can I revise the invoices post-furnishing GSTR-1A?

No, you cannot do any revisions once the GSTR-1A is submitted.

Q.6 What is the method to check GSTR-1 status?

Login to your GST portal, select File returns, enter the relevant F.Y. and month and tap on search, you will be able to check the status.

Q.7 Can GSTR-1A be filed before GSTR-2?

GSTR-1A could be submitted post GSTR-2 though it could be submitted before GSTR-2 if GSTR-1 has been submitted within time and the deadline of GSTR-2 is over.

Q.8 What is the difference between GSTR-1A and GSTR-1?

Both are documents filled in via the registered taxpayer. The major differences are as follows:

- GSTR 1 is the return including the sales details while GSTR 1A includes the modification made in the sales details

- GSTR 1 is filed by the taxpayer and GSTR 1A is auto-populated with the data of another person.

- Seller files GSTR 1 while GSTR 1A is filed by the modifications accomplished by the buyer.

- GSTR 1 illustrates the details that are filled while details of GSTR 1A ought to be accepted or rejected by the seller.

Q.9 – Can I amend the records reported in earlier GSTR 1 in the current GSTR-1A?

GSTR-1A merely permits amendments to records filed in the current tax period’s GSTR-1. For records reported in earlier GSTR-1 filings, amendments should be made in the following GSTR-1, within the time limits prescribed by law.