It was mentioned by the Gujarat High Court that there cannot be any income escapement from the taxpayer if there is no unexplained amount in the bank statement on record.

The Bench of Justice Bhargav D. Karia and Mauna M. Bhatt noted that “the reason given by the Assessing Officer for alleged escapement of Rs.3,25,00,000/- is not sustainable since there is no unexplained amount in the bank statement on record since the assessee did not retain the amount of Rs.3,25,00,000/- and as such the ingredients of Section 68 are not attracted”

Section 148 of the Income Tax Act, 1961 furnishes the assessing officer the authority to reassess tax returns if the income is notified inaccurately. Under Section 148 or 148A for reassessment, a notice has been sent.

Section 68 of the Income Tax Act, 1961 demands the assessees to furnish explanations for any cash credits that can raise concerns for their authenticity or source. The petitioner is the legal heir of the late Mahasukhlal Navnidhlal Parekh, who submitted an income tax return for the year 2015-16 on August 31, 2015. Mahasukhlal passed away on September 30, 2019.

Under Section 148 of the Income Tax Act, a reassessment notice was issued for the 2015-16 tax year. An order has been furnished and notice in July 2022, asserting that Rs 3.25 crore was unaccounted for from a loan his late father furnished in 2015, which directed to the reassessment. Under Section 148 of the Income Tax Act, 1961 the taxpayer has contested the notice before the High Court.

It was argued by the taxpayer that the loan was provided dated 04.09.2014 and it was repaid dated 21.09.2015 hence there could not be any income escapement for the year under consideration. It was marked by the bench that no income escapement is there as the amount was obtained to the late taxpayer’s father dated 04.09.2014 from Mr Hardik Parekh and was paid by NEFT to Ms Darshana Doshi on an identical day.

Read Also: All About Section 68 of IT Act with Applicability & Laws Case

The amount was obtained on 19.09.2015 from Ms Darshana Doshi and returned to Mr Hardik Parekh. Under these conditions, there is no escapement of income related to the deceased father of the assessee.

“The reason given by the Assessing Officer for alleged escapement of Rs.3,25,00,000/- is therefore not sustainable since there is no unexplained amount in the bank statement on record since the assessee did not retain the amount of Rs.3,25,00,000/- and as such the ingredients of Section 68 are not attracted,” the bench said.

The bench in the aforesaid view permitted the petition.

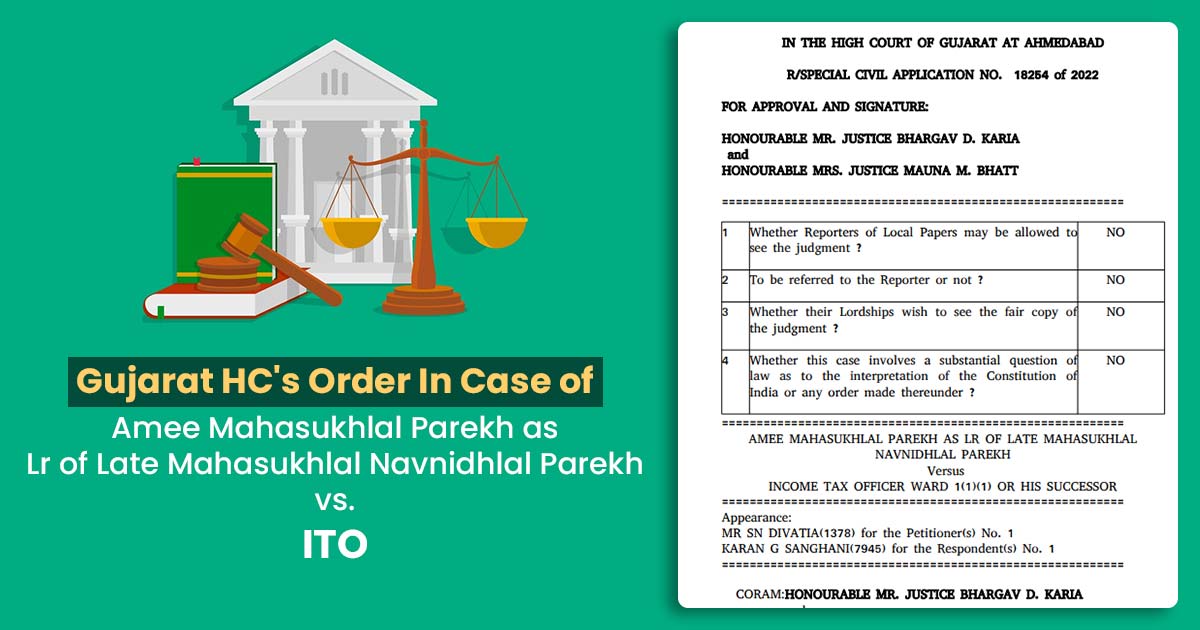

| Case Title | Amee Mahasukhlal Parekh as Lr of Late Mahasukhlal Navnidhlal Parekh vs. Income Tax Officer |

| Citation | R/Special Civil Application No. 18254 of 2024 |

| Date | 23.09.2024 |

| Counsel For Petitioner | SN Divatia |

| Counsel For Respondent | Karan G Sanghani |

| Gujarat High Court | Read Order |