The Gujarat High Court, in an order issued a notice on a petition contesting the constitutional validity of the second and third provisions of Section 16(2) of the GST Act, which require the reversal of GST ITC when payment to the supplier is not filed within 180 days.

The applicant, Priya Blue Industries Pvt Ltd, submitted a Special Civil Application questioning the legality of these provisos. The case is whether the 180-day payment condition for retaining ITC is consistent with constitutional protections and the structure of GST.

“Section 16(2) – Conditions for availing ITC

Second Proviso to Section 16(2):

“Provided further that where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be paid by him along with interest payable under section 50, in such manner as may be prescribed:”

GST Explained Directly from the Bare Act –

Section 16(2) Third Proviso:

“Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him to the supplier of the amount towards the value of supply of goods or services or both along with tax payable thereon.”

The counsel of the applicant in the hearing claimed that the challenge to the vires of the provision needs scrutiny from the court, and that the Additional Solicitor General was anticipated to appear, as previously recorded in the proceedings.

Also Read: Allahabad HC Upholds ITC Denial and Tax Penalty if Supplier Fails to Pay GST Dues

The counsel of the respondents appeared and exempted the service of notice. The court stated that as the vires of the provision is under challenge, the case should proceed as per the earlier order of 3 August 2022, which records the requirement of appearance by the Additional Solicitor General.

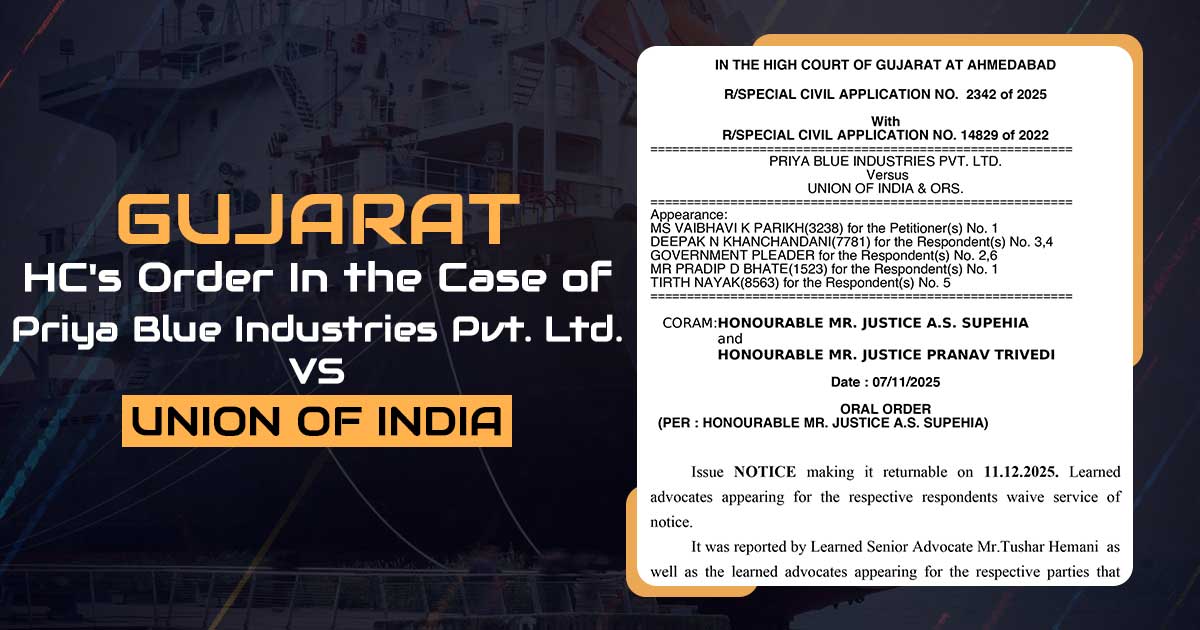

The Division Bench of Justices A. S. Supehia and Pranav Trivedi issued notice, making it returnable on 11 December 2025.

Now the petition shall be considered after obtaining the response of the government.

| Case Title | Priya Blue Industries Pvt. Ltd. vs Union of India |

| Case No. | R/SPECIAL CIVIL APPLICATION NO. 2342 of 2025 |

| For Petitioner | Ms Vaibhavi K Parikh |

| For Respondents | Deepak N Khanchandani, Mr Pradip D Bhate, Tirth Nayak |

| Gujarat High Court | Read Order |