What is GSTR 9A (GST Composition Annual Return Form)?

The GSTR 9A is an annual GST composition return form that has to be mandatorily filed by composition scheme taxpayers. The GSTR 9A form constitutes consolidated details of SGST, CGST and IGST paid during a given financial year. In this article, SAG Infotech highlights the detailed rules and regulations as well as the step-by-step compliance procedure which composition dealers must adhere to during online filing of GSTR 9A.

In this article, you get to know about the format, eligibility, rules, and filing procedure of the annual GST composition return 9A form. Filing Procedures for each and every section as well as the subsection of the GSTR 9A composition annual return form are explained with relevant screenshots and filing guidance. The user also views and free download the GSTR 9A in PDF format.

In case of any query or doubt, readers are always welcome to seek help from our experts and professional chartered accountants. Our team of experts and CAs strives to respond and solve user doubts at the earliest. In this article, we discuss the complete GSTR 9A form which is an important composition annual return form under GST.

Latest Update

29th June 2022

- In FY 2021-22, AATO up to Rs. 2 crores will be exempt from filing the GSTR 9A form. Read More

29th June 2022

- “47th GST Council Meeting: Exemption from filing annual return in FORM GSTR-9/9A for FY 2021-22 to be provided to taxpayers having AATO upto Rs. 2 crores.”

39th GST Council Meeting Updates for Annual Return

- “Reconciliation Statement and annual return for financial year 2018-19 due date extended till 30th June 2020”

- “Annual return and the Reconciliation Statement for financial year 2017-18 and 2018-19 late filing penalty waived off for the taxpayers having turnover lower than Rs. 2 crores. Read Official Press Release“

- Meaning GSTR 9A

- Who Required GSTR 9A?

- GSTR 9A Due Date

- GSTR 9A Penalty Norms

- GSTR 9A Council Meeting Updates

- Simple File Format GSTR 9A

- General Queries on GSTR 9A Form

- File GSTR 9A By Gen GST Software

Meaning of GST Composition Annual Return Filing Form 9A?

GSTR 9A is a simplified annual return filed once a year by business owners and dealers who are under the composition scheme of GST. It constitutes all quarterly returns filed by the composition scheme holders (dealers/vendors) during a particular financial year. Each quarterly return must further reflect all sub-tax categories i.e CGST, SGST and IGST.

The GSTR 9A form makes composition scheme owners file detailed information of supplies made and received in a consolidated manner (monthly/quarterly returns) for a particular year.

Who is Required to File GST Return 9A?

Composition Scheme dealers under GST must file GSTR 9A before 31st December. Other prerequisites for GSTR 9A return filing include:

- The business must have an annual turnover of less than Rs. 1 crore. (For North Eastern states the Annual Turnover must be less than Rs. 75 lakh)

- Note – “GST Council increased the limit of annual turnover for composition scheme taxpayers to 1.50 Crores, effectively from 1 April 2019 under which the composition taxpayers allowed to file returns annually and pay tax on a quarterly basis.”

- Composition dealers must keep details of all quarterly transactions (including imports and purchases) for the current Financial Year.

What are the Different Aspects of Annual GST Returns?

- GSTR 9: GSTR 9 is mandatory annual return for the regular taxpayer who files GSTR 1, GSTR 2, and GSTR 3.

- GSTR 9A: This annual return must be filed by a composition scheme holder under GST.

- GSTR 9B: This is a mandatory return form for e-commerce operators who filed GSTR 8

during the Financial Year. - GSTR 9C: Taxpayers with an annual turnover greater than Rs 2 crores during the financial year must file GSTR 9C audit form under GST. Further, the return form mandates copies of account audits to be filed along with the form. The taxpayer must also provide a reconciliation statement of paid as well as payable tax as per audit along with GSTR 9C.

Due Date Extension for Filing GST Composition Annual Return GSTR 9A

For a given Financial Year bracket, Taxpayers under the GST Composition Scheme must submit GSTR-9A on or before 31st December of the current year.

CBIC department has extended the due date of GSTR 9A for FY 2018-19.

- FY 2018-19 – Due Date 31st December 2020

- FY 2017-18 – Due Date 31st January 2020 (Date Showing After Login on GST Portal)

Note: Check order number 8/2019-Central Tax

GSTR 9A Penalty Norms When You Miss the Due Date

- As per the penalty provisions of GSTR 9A composition annual return form, the composite taxpayer has to pay Rs. 200 per day as a penalty in which Rs. 100 consist of SGST and Rs. 100 for CGST. Also, it is to be noted that the total penalty cannot exceed 0.25% of the total turnover on which the said penalty is being levied.

31st GST Council Meeting Updates in GSTR 9A Form

- Change of headings in the forms to specify that the return in FORM GSTR-9 FORM GSTR-9A would be in regard to supplies etc. ‘made during the year’ and not ‘as declared in returns filed during the year’

- FORM GSTR-9A would be filed after the filing of all returns in FORM GSTR-4

Where to Download GSTR 9A Offline Utility in Excel?

- The government has released GSTR 9A offline utility on its gst.gov.in portal to help taxpayers in filing the annual form.

- The GSTR 9A offline utility is available on the portal when clicking on the downloads tab on the main menu

- Then you have to select the returns options and click on the downloads on the GSTR 9A offline utility for downloading the zip files

- The zip files have the excel sheet which will be helpful in filing the details of the return, download here

System Requirement for GSTR-9A Offline Filing

For the easy and uninterrupted functioning of the GSTR-9A Offline tool, ensure to have Operating system – Windows 7 or above and Microsoft Excel 2007 & above, installed in your system.

Process of Filing GSTR 9A Online for Composition Taxpayers

The GSTR-9 is divided into five parts and subdivided into total 17-row heads. As there is no revise facility provided by CBIC on the GST Portal so please be cautious before filing the GSTR 9A form.

Here’s a detailed closer look at each of them:

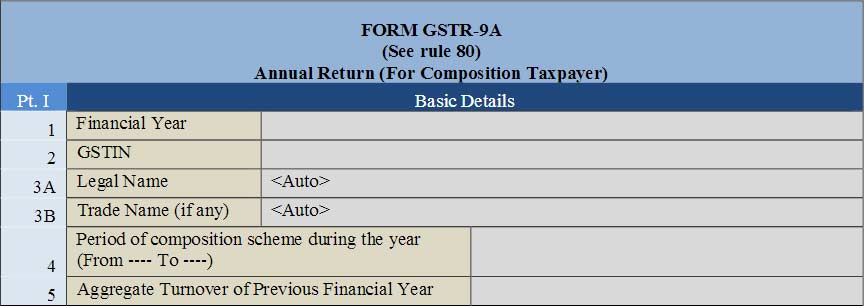

Part I Basic Details: This part is subdivided into 5 sections and 6 rows. These details are at most auto-populated.

- 1 Financial Year: The year for which the return has to be filed

- 2 GSTIN: PAN-based 15 digit GST Identification Number of the Taxpayer

- 3A Legal Name: Auto Populated on log-in

- 3B Trade Name (if any): Auto Populated on log-in

- 4 Period of composition scheme during the year (From —- To —-): Tax duration period

- 5 Aggregate Turnover of Previous Financial Year: Compounded turnover of the previous year

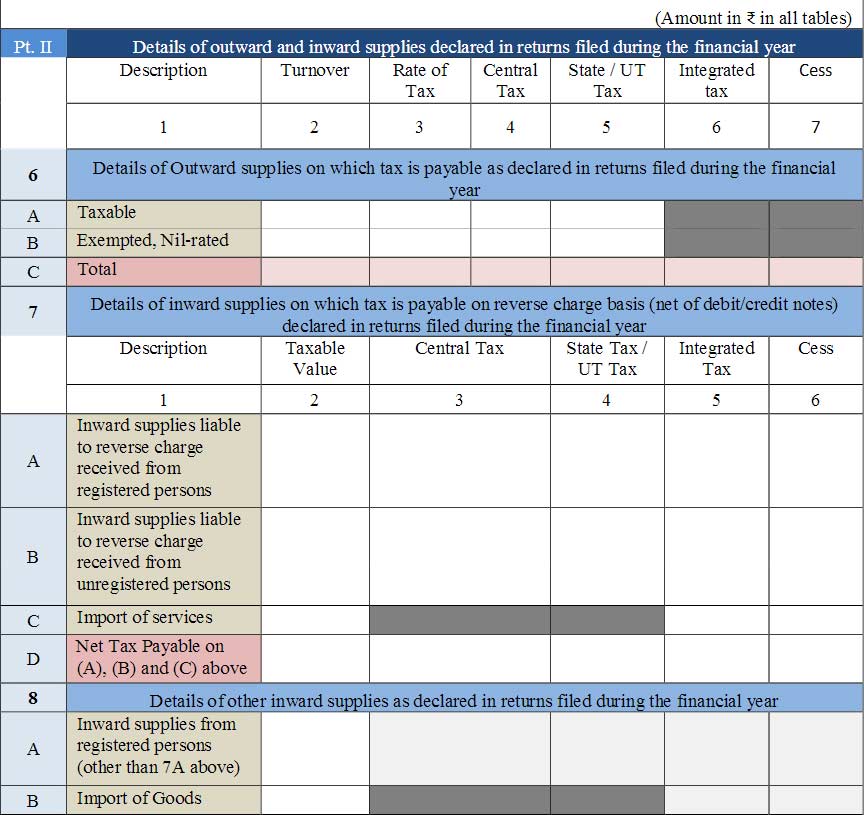

Part II Details of outward and inward supplies declared in returns filed during the financial year: This part has 3 Sections and 9 subsections. It is a consolidated summary of all returns filed during the previous Financial Year.

- 6A Taxable outward supplies details like Turnover, Rate of Tax Central Tax State / UT Tax

- 6B Exempted, Nil-rated outward supplies details like Turnover, Rate of Tax Central Tax State / UT Tax

- 6C Total Summation of 6A and 6B details

- 7A Inward supplies liable to reverse charge received from registered persons: Details include Taxable Value, Central Tax, State Tax / UT Tax, Integrated Tax Cess

- 7B Inward supplies liable to reverse charge received from unregistered persons: Details include Taxable Value, Central Tax, State Tax / UT Tax, Integrated Tax Cess

- 7C Import of services: Details of total import values, the applicable IGST and Cess

- 7D Net Tax Payable on (A), (B) and (C) above: Subtotal of the values in the above three sections

- 8A Inward supplies from registered persons (other than 7A above): Details of Inward supplies nonliable for RCM

8B Import of Goods: Taxable Value, Integrated Tax, and Cess details of imported goods

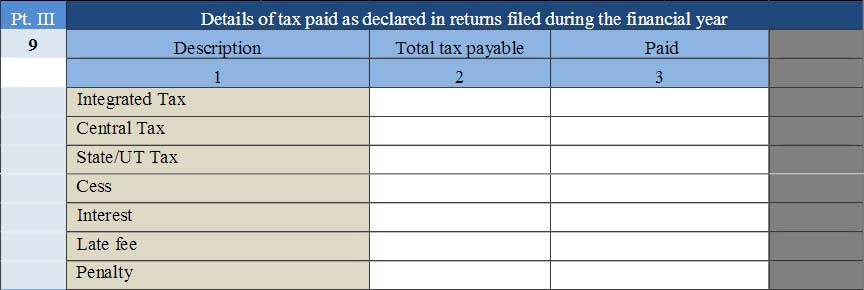

Part III

- 9 Details of tax paid as declared in returns filed during the financial year: This section will include the Total tax payable as well as paid under various GST tax heads during the current FY. These will include payable and already paid details of Integrated Tax, Central Tax State/UT Tax, Cess Interest, and Late fee Penalty

- This section subsumes information of total tax payable and paid for all tax components in the current Financial Year. Enter payable and paid amount of GST components i.e Integrated Tax Central Tax State/UT Tax 19 Cess Interest as well as Late fee and Penalty

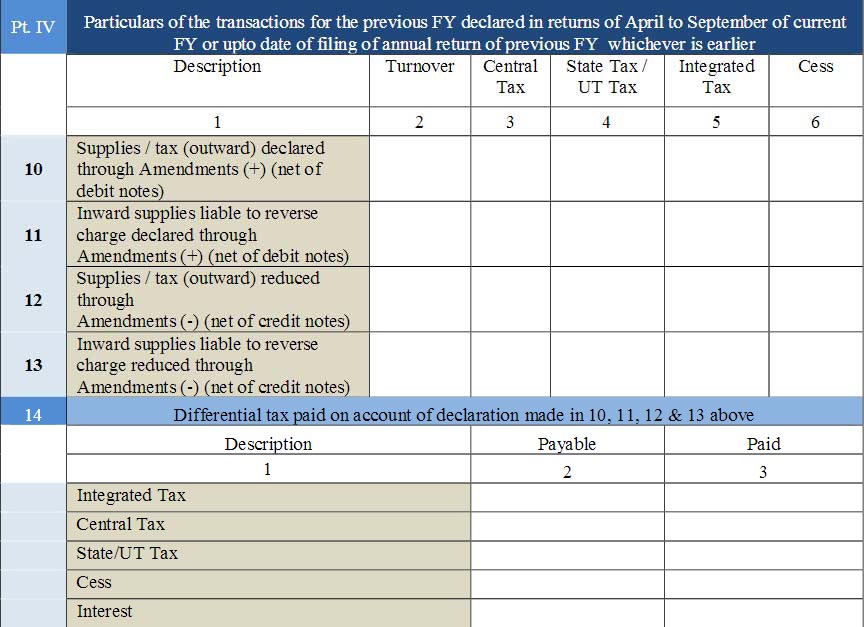

Part IV: Particulars of the transactions for the previous FY declared in returns of April to September of current FY or up to the date of filing of annual return of previous FY whichever is earlier:

- 10 Supplies/tax (outward) declared through Amendments (+) (net of debit notes)

- 11 Inward supplies liable to reverse charge declared through Amendments (+) (net of debit notes)

- 12 Supplies/tax (outward) reduced through Amendments (-) (net of credit notes)

- 13 Inward supplies liable to reverse charge reduced through Amendments (-) (net of credit notes)

- 14 Differential tax paid on account of declaration made in 10, 11, 12 & 13 above:

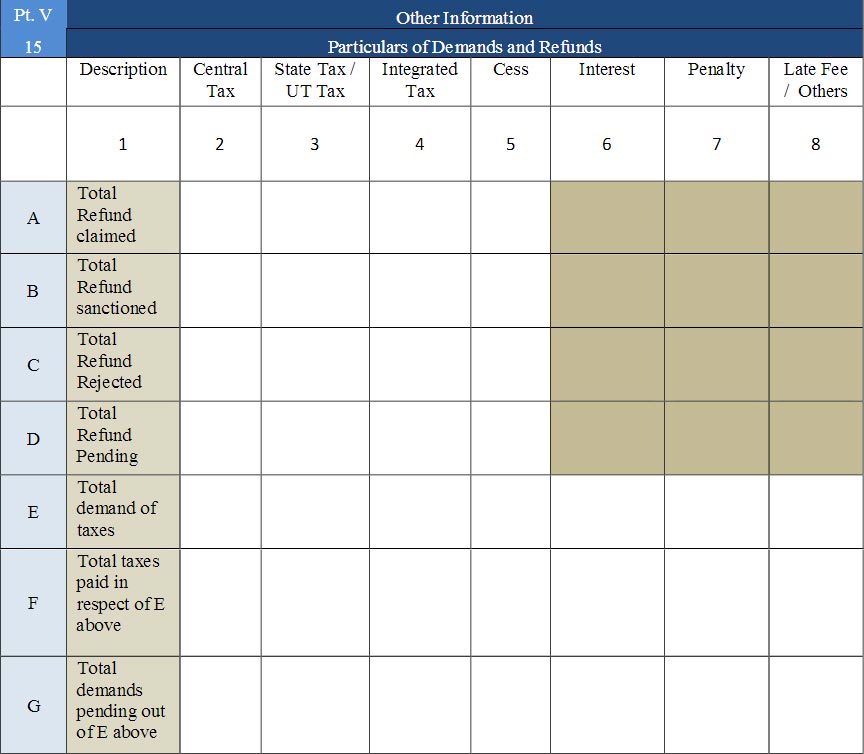

Part V Other Information:

- 15 Particulars of Demands and Refunds: Furnish additional information related to Demands and Refunds in this section. Detail all claims made, refunds credited, refunds pending. This part includes the following tables:

- 15A Total Refund claimed: Furnish bifurcated details of claims refunded including all tax components i.e Central Tax, State Tax / UT Tax, Integrated Tax and Cess

- 15B Total Refund sanctioned: Total tax components of refunds sanctioned i.e Central Tax, State Tax / UT Tax, Integrated Tax and Cess

- 15C Total Refund Rejected: Total tax components (same as above) of refunds rejected

- 15D Total Refund Pending: Total tax components (same as above) of refunds pending

- 15E Total demand of taxes: Liable tax components (same as above) at first place

- 15F Total taxes paid in respect of E above: Enter the detail of total tax components paid with respect to point E above

- 15G Total demands pending out of E above: Enter the detail of total uncleared tax components with respect to point E above

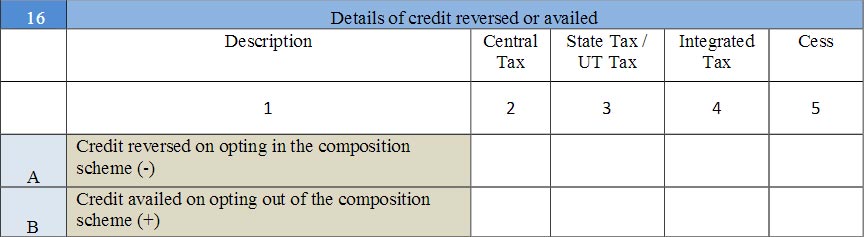

16 Details of credit reversed or availed :

- 16A Enter detail of Credit reversed when opting for composition scheme (-)

- 16B Enter the detail of Credit availed while opting out of the composition scheme (+)

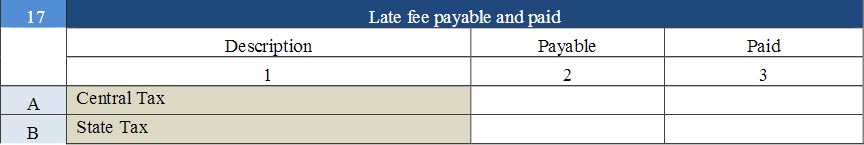

17 Late fee payable and paid: Enter details of impending late fees or those which have already been paid.

- 17A Central Tax: Enter the payable and paid CGST

- 17B State Tax: Enter the payable and paid SGST

Post furnishing all appropriate details, the assessee is must digitally sign the GSTR 9A composition GST annual return form either via a digital signature certificate (DSC) or Aadhaar based signature verification to authenticate and verify the return details.

General Queries on GSTR 9A Form

Q.1 Is it mandatory to file Form GSTR-9A even if someone opts out from the composition scheme in the fiscal year?

Yes, the taxpayers are compiled to file Form GSTR-9A even if he has opted out from the composition scheme for the time limit they were registered under the composition charge scheme.

Q.2 Can Form GSTR-9A be filed if the registration got cancelled in the fiscal year?

Yes, The Form GSTR-9A can be filed even in the case, the taxpayer has got his registration cancelled during the mentioned fiscal year.

Q.3 Can nil form GSTR-9A be filed?

Yes, nil form GSTR-9A can be filed for the FY, in the following conditions when: –

- Any outward supply (commonly known as a sale) is not made

- Any goods/services (commonly known as a purchase) is not received

- No liability is reported

- No credit is claimed

- No refund is claimed

- No order creating demand is received

- No late fee is there to be paid etc

Q.4 What are the prerequisites for filing Form GSTR-9A?

- The taxpayer must be registered in the relevant FY and have opted for composition scheme during the financial

- Year even for a single day. The taxpayer must file all applicable returns i.e. Form GSTR-4, the quarterly return of the relevant FY, prior to the filing of the Annual Return

Q.5 How can a taxpayer file Form GSTR-9A?

- The taxpayer can file FORM GSTR-9A through the following steps:

- Navigate to Services > Returns > Annual Return

Q.6 Is Form GSTR-9A return is needed to be filed at the entity level or GSTIN level?

Yes, Form GSTR-9A return is needed to be filed at GSTIN level i.e. for every single registration. In the case when the taxpayer has acquired more than one GST registrations, under the same PAN, irrespective of the same or different States, he/she is required to file annual return for each registrations individually, where the GSTIN was under composition scheme for the entire fiscal year or for a part of the year.

Q.7 Is the date of filing of Form GSTR-9A extendable?

Yes, date of filing of Form GSTR-9A is extendable through notification by Government.

Q.8 Does GST Portal calculate the GSTR-9A values present in different tables, based on Form GSTR-4 filed?

Values in different tables of Form GSTR-9A is auto-calculated based on Form GSTR-4. This is also downloadable in PDF format and auto-populates in different tables in Form GSTR -9A, in the format which can be edited.

Q.9 Can I file Annual return without the filing of those applicable return(s)/ statement(s) when I have not filed all my applicable return(s)/ statement(s) during the FY?

No, transactions for the period before July 2017 will not be included in GSTR-9 because the GST authority has said that only the details for the period between July 2017 to March 2018 will be considered while filing the GSTR-9.

Q.10 Are the auto-populated details in Form GSTR-9A editable?

Yes, the edit auto-populated data in form GSTR-9A editable except the tax paid column of Table no. 9. The outward supplies details can be modified to register the actual supplies made and not just the outward supplies reported in the Returns.

Q.11 Is the consolidated summary of Form GSTR-4 made for the returns filed during the F.Y. , available for download?

Yes. A consolidated summary of all filed Form GSTR-4 statement for the relevant F.Y. is available for download in PDF format. Navigate to Services > Returns > Annual Return > Form GSTR-9A (PREPARE ONLINE) > DOWNLOAD GSTR-4 SUMMARY (PDF) option.

Q.12 Is the taxpayer allowed to download system computed values of Form GSTR-9A?

Yes, the taxpayer is allowed to download the system computed values for Form GSTR-9A in PDF format. And the same can be used as a reference by the taxpayer while filling Form GSTR-9A.

Q.13 What is the due date to file Form GSTR-9A?

The due date for filing Form GSTR-9A for an F.Y. is 31st December of the subsequent the financial year or as postponed by Government through notification from time to time.

Q.14 What happens once the COMPUTE LIABILITIES button is clicked?

When the computer liabilities button is clicked, operations are initiated on details of various tables on the GST Portal at the back end and Late fee liabilities are also calculated when the computed Form GSTR-9A is filled after the due date.

Q.15 Is it mandatory to add information related to all supplies made during the F.Y.?

Yes, it is mandatory to add information related to all supplies made during the F.Y. and not only the supplies reported in the return.

Q.16 Is the late fee charged in case of late filing of Form GSTR-9A?

Yes, the late fee is charged in case of a filing of Form GSTR-9A after the due date.

Q.17 Is it mandatory to pay the late fee (if applicable) for filling the Form GSTR-9A?

Yes, it is mandatory because the Form GSTR-9A cannot be filed without payment of the late fee for filing the Form GSTR-9A after a specified date.

Q.18 Is there any option available which substitutes the late fee (if applicable) payment in Form GSTR-9A?

Yes, any additional payment can be done through Form GST DRC-3 only and that too in cash. After filing Form GSTR-9A, the link is given to navigate to Form GST DRC-03 to pay tax, if any.

Q.19 What can be done if available cash balance in Electronic Cash Ledger is not sufficient to offset the liabilities?

If available cash balance in Electronic Cash Ledger is not sufficient to offset the liabilities, then additional cash, a taxpayer needs to pay is shown in the “Additional Cash Required” column. A challan may be generated by clicking on the CREATE CHALLAN button for the additional cash.

Q.20 What needs to be done when a warning message is displayed that records are under processing or processed with the error while filing Form GSTR-9A?

When a warning message is displayed that records are processed with the error or are under processing at the back end, then :

- When the records are still under processing, wait for processing to be completed at the back end.

- When the records which are processed with error, go back to Form GSTR-9A and take action on those records.

Q.21 In-form GSTR-9A, can the additional liability be declared if not reported earlier in Form GSTR-4?

Yes, additional liability not reported earlier in Form GSTR-4 can be declared in Form GSTR-9A. & this additional liability declared in Form GSTR-9A is to be paid through Form GST DRC-03.

Q.22 Is any Offline Tool available for filing Form GSTR-9A

No offline tool is available for filling Form GSTR-9A but it will be introduced very soon.

Q.23 Can the Form GSTR-9A return be revised after filing?

No, the Form GSTR-9A return cannot be revised after filing.

Q.24 What consequences take place after Form GSTR-9A is filed?

After Form GSTR-9A is filed:

- Generation of ARN on the successful filing of the return in Form GSTR-9A.

- Delivery of SMS and an email on taxpayer’s registered mobile number and email id.

- Electronic Cash ledger and Electronic Liability Register Part-I will get updated on successful set-off of liabilities (Late fee only).

- Filed form GSTR-9A will be available for view/download in PDF and Excel format.

Q.25 Can Form GSTR-9A be previewed before filing Form GSTR-9A on the GST Portal?

Yes, by clicking on ‘PREVIEW DRAFT GSTR-9A (PDF)’ you can view/download the preview of Form GSTR-9A in PDF and by clicking on ‘PREVIEW DRAFT GSTR-9A (EXCEL)’ button you can view/download the preview of Form GSTR-9A in Excel format, before filing Form GSTR-9A on the GST Portal.

Q.26 Explain the different modes of signing Form GSTR-9A?

Form GSTR-9A can be filed using DSC or EVC.

- Digital Signature Certificate (DSC): A Digital Signature Certificate authenticates the identity electronically while providing a high level of security for online transactions by safeguarding the privacy of the information exchanged using a digital certificate. The GST Portal accepts only PAN-based Class II and III DSC.

- Electronic Verification Code (EVC): The Electronic Verification Code (EVC) authenticates the identity of the user at the GST Portal by generating an OTP (One Time Password) which is sent to the registered mobile phone of Authorized Signatory filled in part A of the Registration Application.

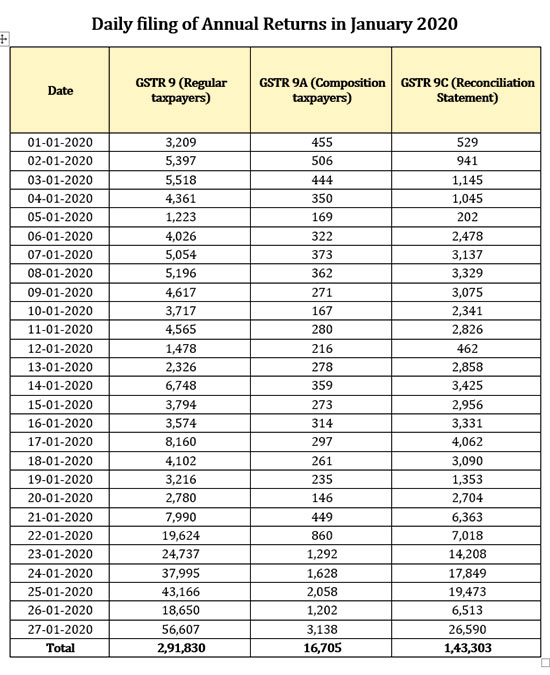

GTSR 9A Annual Return Filing Data January 2020