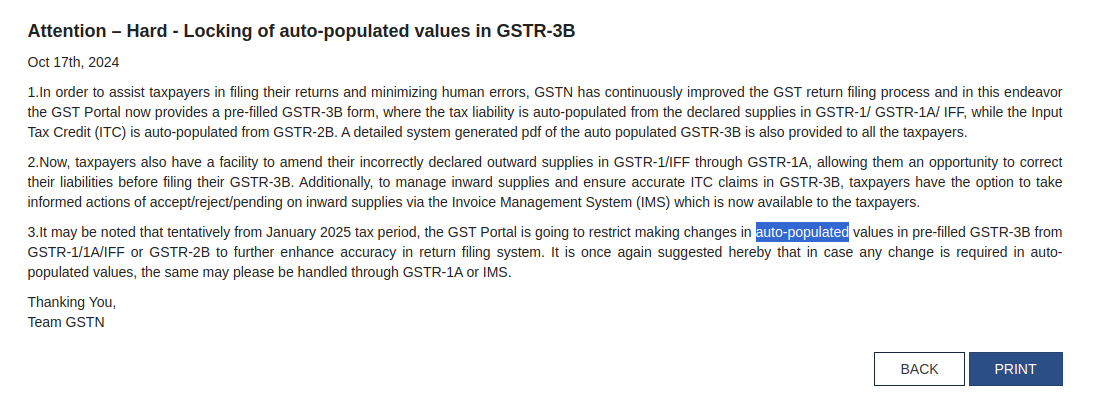

A pre-filled GSTR-3B form has been introduced due to simplified GST filing, which simplifies the process and assists assessees in filing their GST returns precisely.

GST Portal Pre-filled GSTR-3B

The GST Portal auto-fills the GSTR-3B form:

- Input Tax Credit (ITC) from GSTR-2B.

- Tax obligation from GSTR-1, GSTR-1A, or IFF (Invoice Furnishing Facility).

- Taxpayers can download a detailed system-generated PDF of the pre-filled GSTR-3B.

Main Objective to Pre-filled GSTR-3B Form

The objective is to facilitate the return filing process for the assessees via auto-populating the tax liability and Input tax credit and lessening the manual entry errors.

In What Way Does GSTR-1A Assist in Correcting Outward Supplies?

GSTR-1A permits the assessees to make corrections if any wrong outward supplies are declared in the GSTR-1 return or IFF before finalizing GSTR-3B.

- The assessees can rectify the mistakes in outward supplies.

- The same assures the precise tax liabilities reporting.

Handling the Inward Supplies

The assessees can handle the inward supplies and adjust ITC claims by accepting, rejecting, or marking them as pending through an Invoice Management System (IMS).

GSTN Portal Upcoming Changes Jan 2025

The GST Portal from January 2025, will restrict changes in auto-populated values in GSTR-3B:

No manual changes will be allowed to values auto-populated from GSTR-1, GSTR-1A, IFF, or GSTR-2B.

If there are any revisions needed must be incurred through the use of GSTR-1A for outward supplies or IMS for inward supplies before filing the return.

Main Difference B/W GSTR 1 and GSTR 1A

| Form GSTR 1 | Form GSTR 1A |

|---|---|

| GSTR-1 is been used to report the sales transactions and fetches all the sales data incurred through the registered assessee. | The assessees are permitted by the GSTR-1A to rectify the mistakes that are declared in GSTR-1. |

| The same comprises original information of outward supplies, which includes invoices, credit/debit notes, documents issued, and exports. | The same comprises of the amendments incurred before the information provided in GSTR-1 earlier. |

| On the grounds of the turnover of the taxpayer GSTR-1 is been filed on a monthly or quarterly basis. | Any time GSTR-1A could be used post GSTR-1 filing if there is any mistake that required to be rectified. |

Most Important Frequently Asked Questions (FAQs)

Q.1 – In what way is tax liability auto-populated in the GSTR-3B form?

Based on the supplies declared in GSTR-1, GSTR-1A, or IFF the tax obligation in GSTR-3B is auto-populated.

Q.2 – By which form ITC auto-populated into GSTR-3B?

From GSTR-2B ITC shall get auto-populated.

Q.3 – What would be the measures needed to be opted via the assessee on inward supplies using the IMS

The stated measures can be taken by the taxpayers on the inward supplies in IMS- accept, reject, or mark invoices as pending for further review.