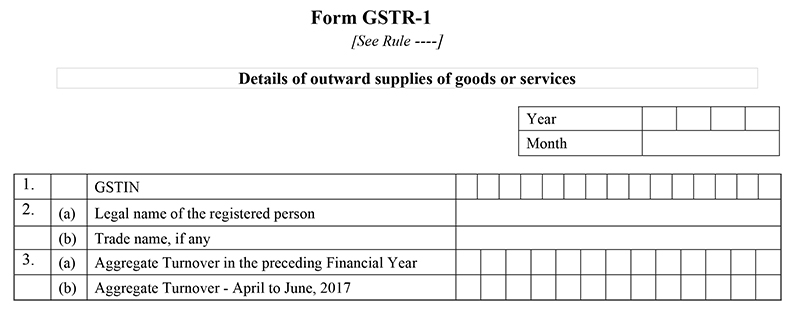

The GSTR 1 form is a return form for regular taxpayers who have to file details of outward supplies on the 11th of next month for those who cross a turnover of more than 1.5 crores annually. The taxpayers who are under the threshold limit of 1.5 crores will have to file quarterly returns. The taxpayer can download the GSTR 1 form in PDF format here.

Here, we are going to study the procedure of filing the GSTR-1 form, as according to the rules and regulations, every registered taxpayer will have to submit the complete details of sales i.e. outward supplies in the GSTR-1 form. The time limit for filing the GSTR-1 form is within 11 days from the end of the succeeding month for regular taxpayers.

- Features of GSTR 1 Form

- Who Should File GSTR 1

- GSTR 1 Due Date

- GSTR 1 IFF Due Date

- Interest on Late Payment and Charges

- GSTR 1 Common Errors

- GSTR 1 Important Terms

- GST Council Meeting Update

- The Procedure for Filing GSTR 1

- GSTR 1 Filing By Gen GST Software

- General Queries on GSTR 1 Form

Latest Updates in Form GSTR-1

- GSTN has introduced essential updates to the reporting process for Table 12, a specific section of the GST returns under GSTR-1 and GSTR-1A. read more

- HSN Codes- A new advisory will be introduced for Phase-III of Table 12 in GSTR-1 and 1A, effective from the return period of February 2025. View More

- GST Dept implementation of mandatory mentioning of HSN codes in GSTR-1 and 1A Forms. read more. | read PDF

- “New Advisory on Reporting of supplies to unregistered dealers in GSTR1/GSTR 5. This functionality is currently under development.” View more

- The CBIC’s new advisory requests taxpayers to add their bank account details before filing GSTR-1/IFF. View more

- 53rd GST Council Meeting Updates:

- “The threshold for reporting of B2C inter-State supplies invoice-wise in Table 5 of FORM GSTR-1 was recommended to be reduced from Rs 2.5 Lakh to Rs 1 Lakh.”

- The GST Council has suggested an optional Form GSTR-1A for taxpayers.

- GSTN has enabled new features for GSTR-1 taxpayers to fetch the HSN summary from GST e-invoices in Table 12. However, in cases where the HSN code is not available, it needs to be added manually. View more

- GST-1 and IIF advisory to grab the modification details of the supplies made via ECO in tables 14A and 15A. View more, Read the PDF

- Advisory for registered taxpayers as to how to provide bank account details under Central Goods and Services Tax Rules, 2017 – Rule 10A. View more

- To ensure the timely filing of GSTR-1 by taxpayers, the government has implemented this restriction. Failure to submit GSTR-1 will render taxpayers unable to file GSTR-3B, leading to the imposition of late fees and penalties. View more

- The CBIC has issued the new advisory for GSTR-1 and GSTR-3B liability and differences (DRC-01B). View more

File GSTR 1 Form by Gen GST Software, Get Demo!

GSTN New Improvements in Form GSTR-1 & IFF

The revision and the upgraded version of GSTR-1/IFF which has been made available on the GST portal to rectify the experience of the assessee. The surge will enable the saving of the GSTR-1 information on the GST portal efficiently and user-friendly.

The other improvements will be executed incrementally in a regular way. In 2 ways, the changes will be executed to ensure that any interruption towards taxpayers gets lower and the effective feedback obtained is accounted for in the next phase. The advisory covers the revisions that are drawn in Phase-1 and the advisory regarding Phase-2 reforms will follow.

Quarterly Filing GSTR 1 Without IFF Filing

From tomorrow onwards, the Central Board of Indirect Taxes and Customs (CBIC) explained the uncertainty regarding the Invoice Furnishing Facility. CBIC specified that Invoice Furnishing Facility (IFF) is a choice to be practised, which relies on the requirements of the supplier and their buyer. Assessee might furnish their GSTR-1 for the quarter excluding the furnishing of IFF.

The GST Council in its 42nd meeting on 5 October 2020 suggested that the scheme of quarterly return filing and the monthly payment of taxes (QRMP scheme) for taxpayers having an average turnover of up to Rs.5 crores. For example, an enrolled individual who has an intention to claim the policy for the quarter from July to September can use this option from the 1st of May to the 31st of July. Although an enrolled individual is not needed to practice the option for every quarter.

The invoice furnishing facility (IFF) is for the quarterly GSTR-1 filers that can opt to upload their invoices for each month. A quarterly GSTR-1 filer is a small assessee with a turnover of Rs 1.5 cr. According to the policy, the supplier who opts for the policy shall have to furnish the GSTR-1 on a quarterly grounds. In the 1st two months of the quarter, the supplier can choose to upload his selective B2B invoices to a newly commenced platform on the GST server or invoice Furnishing Facility.

Also, the information that has already been filed in the above facility in the 1st two months is not urged to be filed again in Form GSTR-1. Rs 50 lakhs are the average limit which will not be surpassed for the invoices uploaded on the monthly grounds to IFF. January 2021 is the date when the scheme will commence.

Liability Statement According to GSTR 1 Via Email

GSTR 1 is required to be filed by an assessee on the 11th of the next month for which he is filing and GSTR 3B is the summary of the seller’s transactions which is required to be submitted by the 20th-24th of the succeeding month. The government is working on a system that can provide a statement of liability for the assessee according to the GSTR1 (GST return form) filed by him. The statement will match the transactions recorded under GSTR 1 and GSTR 3B. This will help in quick and easy returns for the assessee and will help the government in curbing tax evasion. The purpose of the system is to find those who are gaming with the system and the second is to formulate better policy.

CBIC Department Offers NIL Statement Filing of GSTR 1

The CBIC department has finally given great relief to all the taxpayers by providing the facility of filing GSTR 1 form NIL statement by means of SMS starting from the July 1st week of 2020.

Salient Features of GSTR-1 Return Form

- The Form GSTR-1 is filed by all the registered taxpayers to fill outward supply details of business, irrespective of whether the transaction was done or not in a month

- It should be filled by the 11th of the next month which the return has to be filed

- The invoice details need to be filled in the prescribed fields

- The outward supplies include supplies to an unregistered person, registered person, exempted and exports, received advances and non-GST supplies

Who Should File GSTR-1

All the registered taxpayers need to file the return, except:

- Input Service Distributors

- Composition Dealers

- Non-resident Taxable Person

- Taxpayers liable to collect TCS

- Taxpayers are liable to deduct TDS

- Suppliers of OIDAR (Online Information and Database Access or Retrieval)

Deadlines for Return Filing of GSTR 1

Details of GSTR 1 due date for both traders, turnover up to 1.5 crores and turnover more than 1.5 crores.

Turnover Up To 1.5 Crore (Quarterly)

| Period | Last Date of Filing |

|---|---|

| October-December 2025 | 13th January 2026 |

| July – September 2025 | 13th October 2025 |

| April – June 2025 | 13th July 2025 |

| January – March 2025 | 13th April 2025 |

| October-December 2024 | 15th January 2025 |

Note:

- “For taxpayers having nil tax liability in GSTR-3B or nil outward supplies in GSTR-1, the late fee is to be capped at Rs 500 (Rs 250 CGST + Rs 250 SGST).”

- “Extension of the due date of filing GSTR-1/ IFF for the month of May 2021 by 15 days.”

- “GST Council recommended amendments in certain provisions of the Act so as to make the present system of GSTR-1/3B return filing as the default return filing system in GST.” Read more

Turnover of More Than 1.5 Crore (Monthly)

| Period | Last Date of Filing |

|---|---|

| January 2026 | 11th February 2026 |

| December 2025 | 11th January 2026 |

| November 2025 | 11th December 2025 |

| October 2025 | 11th November 2025 |

| September 2025 | 11th October 2025 |

| August 2025 | 11th September 2025 |

| July 2025 | 11th August 2025 |

| June 2025 | 11th July 2025 |

| May 2025 | 11th June 2025 |

| April 2025 | 11th May 2025 |

| March 2025 | 11th April 2025 |

| February 2025 | 11th March 2025 |

| January 2025 | 11th February 2025 |

| December 2024 | 13th January 2025 |

Note:

- “For taxpayers having nil tax liability in GSTR-3B or nil outward supplies in GSTR-1, the late fee is to be capped at Rs 500 (Rs 250 CGST + Rs 250 SGST).”

- “Extension of the due date of filing GSTR-1/ IFF for the month of May 2021 by 15 days.”

- “GST Council recommended amendments in certain provisions of the Act so as to make the present system of GSTR-1/3B return filing as the default return filing system in GST.” Read more

- “GSTR-1 due date for April’21 extended to 26th May and IFF due date extended to 28th May.” Read more

Due Date of GSTR 1 IFF Under QRMP Scheme

| Period | Due Date |

|---|---|

| January 2026 | 13th February 2026 |

| December 2025 | 13th January 2026 |

| November 2025 | 13th December 2025 |

| October 2025 | 13th November 2025 |

| September 2025 | 13th October 2025 |

| August 2025 | 13th September 2025 |

| July 2025 | 13th August 2025 |

| June 2025 | 13th July 2025 |

| May 2025 | 13th June 2025 |

| April 2025 | 13th May 2025 |

| March 2025 | 13th April 2025 |

| February 2025 | 13th March 2025 |

| January 2025 | 13th February 2025 |

| December 2024 | 15th January 2025 |

Interest on Late Payment of GST Tax & Missing GST Return Due Date Penalty

As the GST council rules and regulations state, every continuous late payment of taxes will attract 18 per cent per annum interest on the GST tax applicable just after the commencement of the due date till the taxes are to be payable to the government.

According to the provision, If certain taxpayers drop in any of the deadlines for the GST tax payment, then there will be interest calculations from the due date i.e. 1000*18/100*1/365= Rs. 0.49 per day approximately.

(Rs. 1000 is the assumed tax payment) (18% per annum is the interest rate) (1-day delay from the taxpayer)

In various situations, where a taxpayer does not file their return within specified due dates mentioned by the government authorities, he is obliged to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

Avoid Common Errors While Filing GSTR-1

- JSON Errors

- Expected errors regarding the composition scheme:

- Registered under the Composition Scheme in August month? You are not subject to file the GSTR-1 form for July Month

- Registering under the Composition scheme in an account of 1st October? You are required not to furnish the GSTR-1 form for July month

- Have you stuck with invoice-related data?

- Date format: The date should be in the correct format- dd-mm-yyyy (i.e. 01-06-2017)

- Invoice Number: Invoice number accepts only two special characters- hyphen and forward slash (/)

- Invoice Data: This field should be furnished to a maximum of 2 decimal digits

Important Terms to Know in GSTR-1

- GSTIN: Goods and Services Taxpayer Identification Number

- UIN: Unique Identification Number

- UQC: Unit Quantity Code

- B2B: One registered Taxpayer to another registered taxpayer

- B2C: One registered to another unregistered person

- POS: Place of Supply of Goods and Services

- SAC: Services accounting code (Services Accounting code is filled in case of the supply of services)

HSN: Harmonised System of Nomenclature (HSN code is filled in case of the supply of Goods)

- A taxpayer has to mention the aggregate turnover of the previous year in the first return filed by the assessee. This data will be auto-populated from the next returns

- A person with less than 1.5 crores aggregate turnover need not provide HSN and SAC

- For B2B supplies, all details of invoices have to be uploaded and for B2CL supplies, only invoices more than 2.5 lakhs in inter-state have to be uploaded

Let’s understand the Procedure of Filing GSTR 1 in a Detailed Format

The return form GSTR-1 includes a total of 13 sections, but all these sections are not necessary to be filled and will be prefilled. Some of the details of sections in the GSTR 1 form are:

Part 1 to Part 3 – Outward Supplies Table Details

- GSTIN – As allotted by the government, the GST Identification Number is based on PAN and is 15 digit long goods and services taxpayer identification number. It is to be noted that the GSTIN is auto-filled in every return filing of the taxpayer

- Name of the taxpayer – The taxpayer’s name will also be auto-filled while the time of return filing at the common GST portal

- The gross turnover of the taxpayer in the earlier Financial year: – The details will have to fill up for the first time of filing, after that the details will be auto-populated in the financial statement next year

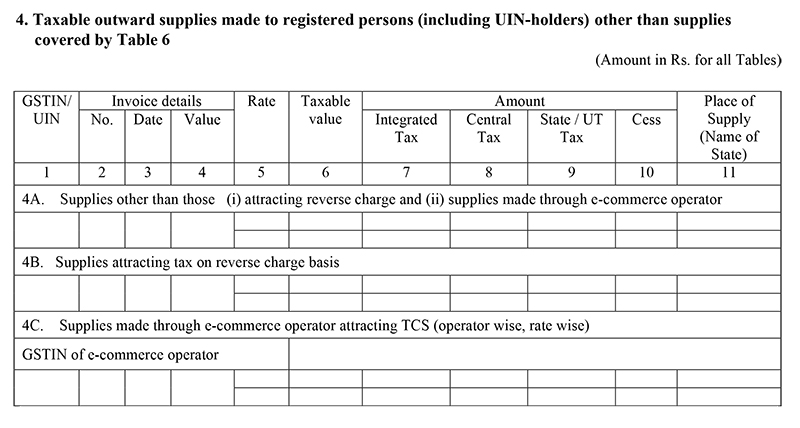

Part 4 – Taxable Outward Supplies Made to Registered Persons Other than Supplies

The details of all the taxable supplies done by the organization to the registered taxable person. The details will be included regarding normal taxable supplies, all the supplies under the reverse charge mechanism and supplies done by e-commerce operators

- 4(A) regarding normal taxable supplies except included in 4(B) & 4(C)

- 4(B) All the supplies under the reverse charge mechanism should be included rate-wise here

- 4(C) supplies done by e-commerce operators regarding the collection of tax at source should be furnished operator-wise and rate-wise

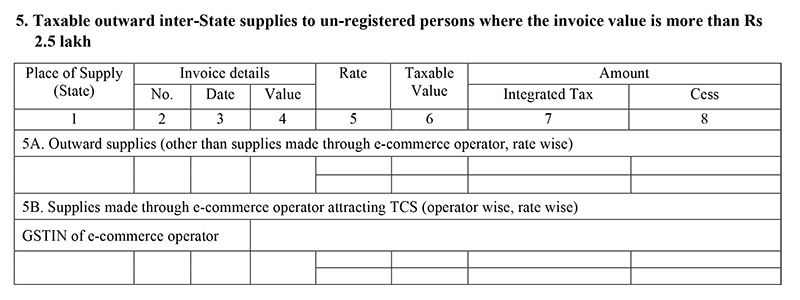

Part 5 – All the Details Regarding Outward Inter-state Supplies to the Unregistered Individuals in which the Invoice Value Exceeds INR 2.5 lakh

The section will cover all the taxable supplies done with an unregistered individual in the other state, while the details need to be furnished when the value exceeds INR 2.5 lakh.

- 5A, all the interstate supplies attracting more than Rs. 2.5 lakh should be included invoice-wise and rate-wise here

- 5B, all the supplies by the e-commerce operator to an unregistered person attracting the collection of tax at source should be uploaded rate-wise and invoice-wise

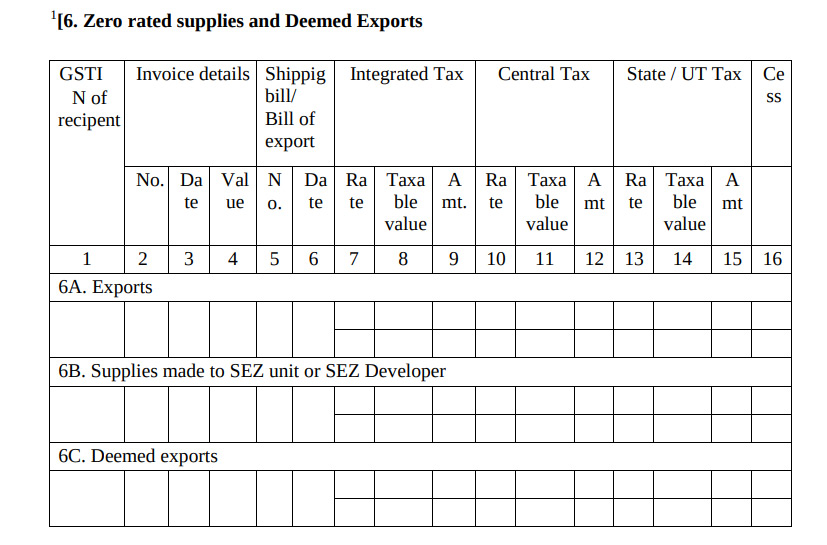

Part 6 – All the Zero-Rated Supplies and All Deemed Exports:

The section will assume all the zero-rated supplies, deemed exports (supply has been done to the SEZ, EOUs), and exports. The table will be furnished with all the details of supplies invoice-wise and rate-wise to corresponding out-of-India exports in 6A, outward supplies to SEZ developer, and supplies attracting deemed exports in 6C

The important points to be noticed down before furnishing the details in this table:

The details of the shipping bill number and date should be furnished and in case of unavailability of the receipt and details, the same can be updated in next month’s return filing details in Table 9 for the same and claim the refund in that return form

- The supplies made by SEZ to the domestic tariff area without the bill entry should be furnished in GSTR-1 by SEZ

- The supplies made by SEZ to DTA with the bill cover should be mentioned in imports in GSTR-2 by the DTA unit

- GSTIN number should be left blank under ‘Exports’ heading

- The tax amount will be ‘0’ in 6A & 6B heads, in case of IGST, CGST, SGST and Cess(under the bond/ letter of undertaking) is not paid

Table-6A details need to be furnished by the exporters for claiming the GST refunds concerning export data for a particular time-period. According to GSTN, after filing the export-related data in table-6A, the exporters can upload and save the form.

What is table 6A of Form GSTR 1?

Table 6A of Form GSTR 1 is a table of GSTR 1 – outwards supplies a statement of the supplier, which an exporter desiring refund of taxes paid on exports or ITC related to exports is required to furnish on the GST portal. The taxpayer has to declare the details of export invoices in this table.

Who needs to file table 6A of Form GSTR 1?

Every registered taxable person, other than an input service distributor/compounding taxpayer/TDS deductor/TCS collector, who wants to claim the refund on taxes paid on exports can file Table 6A of Form GSTR 1 electronically on GST portal.

Where can I file Table 6A of Form GSTR 1?

Table 6A of GSTR can be filed from the returns section of the GST portal. In the post-login mode, you can access it by going to services > Returns > Returns dashboard. After selecting the financial year and tax period, Table 6A of Form GSTR 1 in the given period of time which will be displayed.

When the exporters will sign it digitally, it will reach to the customs department and customs department will do matching with GSTR-3B form and shipping bill and will be approved by the department.

At the end of the procedure, the exporter will get the refund in the respective bank account or will get a check.

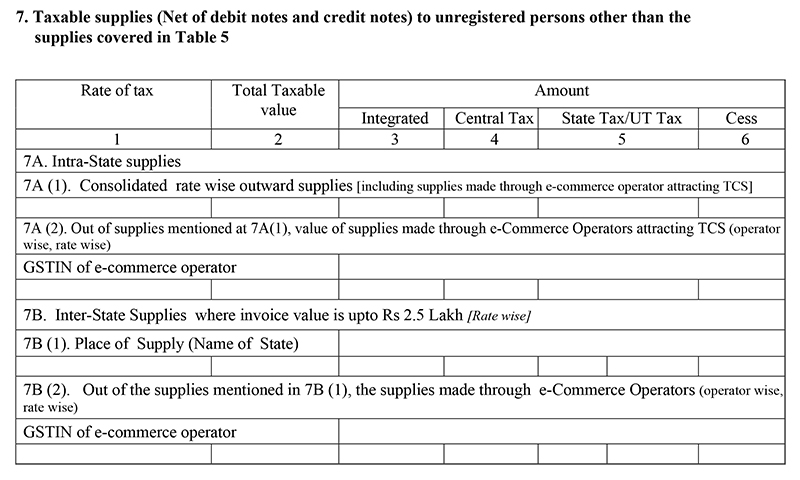

Part 7 – Taxable Supplies to Unregistered Person (Net of Debit and Credit Note)

All the items in taxable supply accountability sold to an unregistered dealer will be coming into this section.

The section will be covering:

- 7A, the taxable intra-state supplies to the unregistered dealer

- 7A(1), the rate-wise details of intra-state supplies made to the unregistered person and through e-commerce operator

- 7A(2), the operator-wise and rate-wise details of supplies made in 7A (1) through e-commerce operator attracting the collection of tax at source

- 7B supplies below INR 2.5 lakh as inter-state sales to the unregistered person

- 7B(1), the state-wise and rate-wise details of inter-state supplies below Rs. 2.5 lakh

- 7B(2), the operator-wise and rate-wise details of supplies mentioned in 7B(1) through e-commerce operator for collection of tax at source

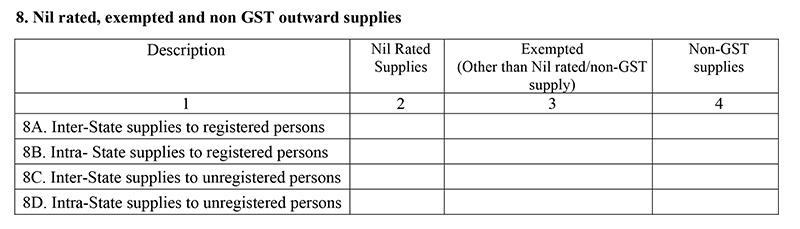

Part 8 – All the NIL Rated, Exempted and Non-GST Outward Supplies

- Supplies whether exempted, nil rated or non-GST items which are not included in the sections above will be detailed here in this section. This includes the separate details of inter-state supplies/intra-state supplies to a registered/unregistered person.

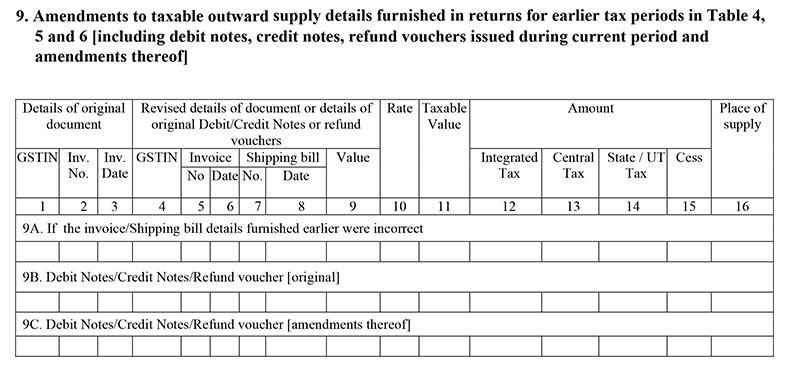

Part 9 – All the Amendments to the Taxable Outward Supplies to an Unregistered Individual (For Current Tax Period)

All the amendments to outward taxable supplies details and the returns furnished for the previous tax intervals. Details of every other amendment in outward supply from earlier tax period have to be reported under this section while any amendment in debit or credit note also requires being included in this section. Any changes in table 3, table 4, and table 6 from previous returns should be included here. The table should be furnished as:

- 9A, if the earlier filled details in table 6 were incorrect or non-available at the time of filing the returns, it should be added here with corresponding shipping number and date

- 9B, the details of debit notes, credit notes, and refund voucher should be furnished here

- 9C, the amendments during the previous tax period to the debit notes/credit notes/refund vouchers should be furnished here

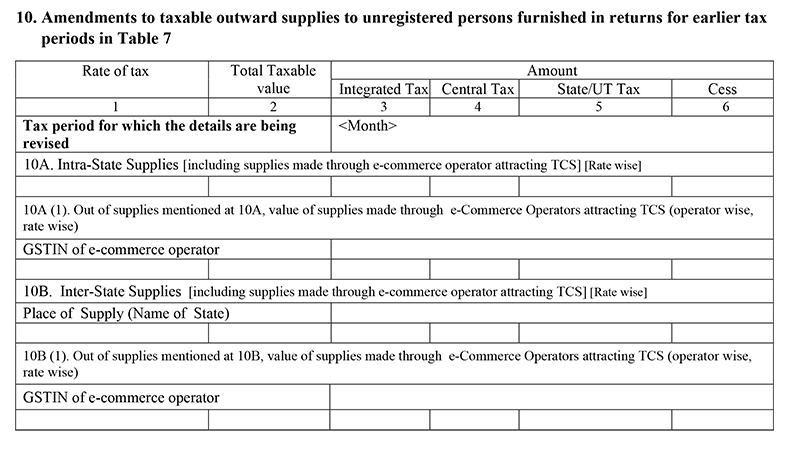

Part 10 – All the Amendments to the Taxable Outward Supplies to an Unregistered Individual Furnished (Previous Tax Period):

The details of amendment of any taxable outward supplies done to an unregistered individual from an earlier tax period need to be included in this section.

This is how to fill the details:

- 10A, here you need to fill the rate-wise details of debit notes/credit notes issued to an unregistered person for intra-state supplies

- 10A(1), the separate details of supplies from 10A made through e-commerce operator

- 10B, the rate-wise details of interstate supplies made to an unregistered person with amount value more than 2.5 lakh Rs.

- 10B(1), the details of interstate supplies from 10B made through the e-commerce portal

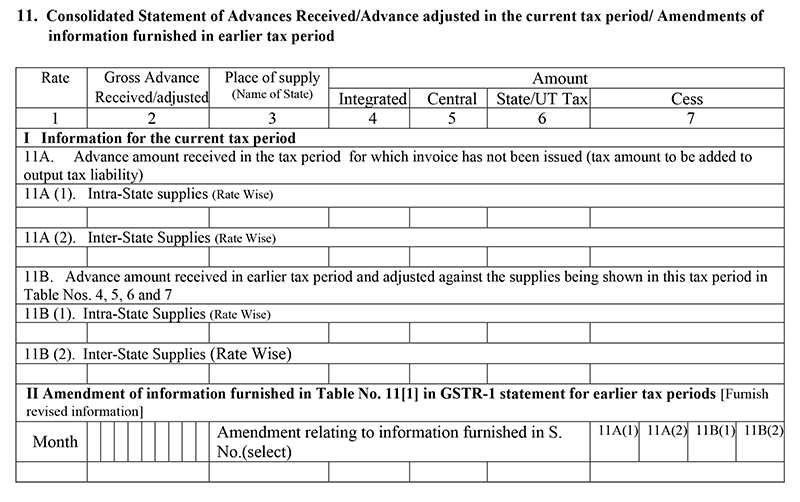

Part 11 – Consolidated Statement of Advance Received:

Under this section, all the details of advance received and adjusted in the current time period will be included. The result will increase/decrease of GST liability while any kind of amendment in advance payment from the previous tax period is recorded here. The table includes the following information to be included:

- 11A, the details of the advance amount received without the invoice issued. This kind of amount must be added to output tax liability

- 11A(1), rate-wise intra-state supplies regarding 11A

- 11A(2), rate -wise inter-state supplies regarding 11A

- 11B, the details of the advanced amount received earlier and adjusted this time in table no. 4,5,6 and 7

- 11B(1), rate-wise intra-state supplies regarding 11B

- 11B(2), rate-wise inter-state supplies regarding 11B

- Part 2 of table 11, amendments to the previous tax period in table 11A and 11B

Part 12 – Outwards Supplies HSN Wise Summary:

- The taxpaying individual will have to consolidate all the taxable supplies through the HSN codes. A significant amount of information is added in this section on the supplies of IGST, CGST and SGST collected. The person making an annual turnover of more than 2.5 crores has an option to fill or not the HSN code here although the description of those goods is necessary for this head. UQC is the unit quantity code and only accepts a unit of measure which is prescribed by the portal.

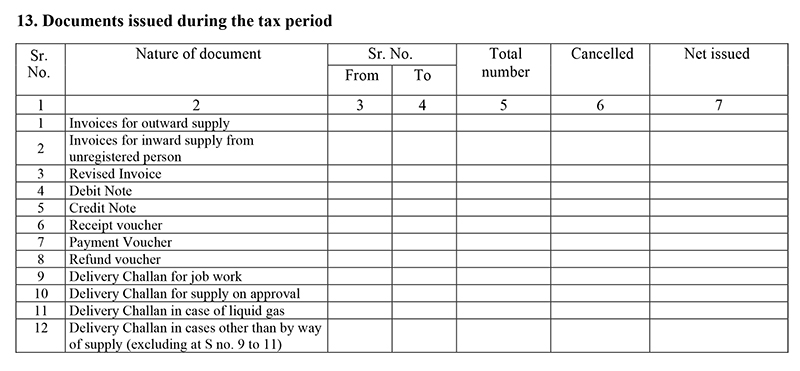

Part 13 – Documents Released in the Tax Period:

- The sections require all the details of the invoice and its relevant issues in the tax period, revised invoices, credit notes and debit notes.

General Queries on GSTR 1 Form

Q.1 – Is there any possibility to correct any errors in GSTR-1?

It is not possible to correct GSTR- 1, once filed. If any mistakes occurred while filing returns, it will be corrected in the next month returns. For example, if a mistake occurs in August GSTR- 1, the correction for the same will be modified in September GSTR- 1

Q.2 – What is B2C in GSTR 1?

B2C Small Invoices (5A,5B) abruptly means Business to Small Customer Invoice. Sales refer to Unregistered person amounting up to INR 250000

Q.3 – What is GSTR 3B and GSTR 1?

The GSTR-3B is a summarised return form whereas, the GSTR-1 is a report for all output invoices and taxes on them. Originally it has been foreseen that the GSTR-3B and the information and taxes furnished as per Forms GSTR-1,2,3 would be reconciled with the help of a system based reconciliation

Q.4 – Can GSTR 1 be revised?

It has been known that there is no provision till now following which, a return once filed cannot be revised. In case of any mistake done while return filing, rectification could be done in the next periods (month/quarter) return. Explaining through an example, If a mistake is made in September GSTR-1, then rectification for the same could be made in October’s GSTR-1

Q.5 – Should the GSTR-1 be filed in the case of zero sales in a month?

Yes, The GSTR 1 form is mandatory to be filed. On the other side, If the total sales for a year are less than Rs 1.5 crore, then the return should be filed on a quarterly basis.

Q.6 – Can the invoice be uploaded only once while filing the return?

The invoice could be upload anytime. It is better to upload invoices at regular intervals during the month so as to avoid bulk uploading at the time of return filing. The bulk upload is time-consuming.

Q.7 – Can an uploaded bill on the GST portal be altered?

After the bills are uploaded, changes could be made in them multiple times. No restriction has been attached on changing invoices’ details after uploading them. But, the invoices could be changed only before submitting a return. But once submitted, the numbers are frozen

Q.8 – Should a GSTR-1 form be filed even after filing GSTR-3B?

The GSTR-3B is a simple return form aided to be filed by traders on a monthly basis only till March 2018. Still, we need to file the return through the GSTR-1 form on a monthly or a quarterly basis.

Q.9 – Does a person opting a composition scheme should file the GSTR-1 form?

A person opting composition scheme should not file the GSTR-1 form. For this, there is a GSTR-4 form which is required to be filed and submitted on a quarterly basis by the taxpayer opting for composition scheme

Q.10 – Can the GST payment be made after filing GSTR-1?

In the GSTR-1 return, details of sales are filed with the government. After filing of this return, no tax has to be paid. The tax is supposed to be paid at the time of filing GSTR-3B (notified for months until March 2019).

Q.11 – If a Businessman files the GSTR-1 form for July 2017 and his annual sales are below Rs. 1.5 lakh, should he file a quarterly or monthly return?

In such a case the businessman needs to file a quarterly return. Also, as the return for July is already filed he should omit July sales from his return.

Q.12 – Is there any provision for amendment in the details already filed in GSTR-1? If yes, then what will be the filing period to make such amendments?

Yes, the amendment could be done to an already filed GSTR-1 for a particular tax period, by the declaration of the amended details in the return

- For example: If Mr X of Kerala sold some goods to Mr Y of Karnataka for INR 1,00,000 on 30th August 2017 and declared the details on GSTR-1 of August 2017.

- Later he realized that he made a mistake on the date of the invoice. Now, this could be rectified by filing an amended invoice with correct invoice date i.e. 16th August 2017

- But the amended details would reflect in the GSTR 1 of September 2017

Q.13 – What should be the ‘Revised date’ in the amended invoice in this case?

The ‘Revised date’ reflecting in the amended invoice must not be later than the last date of the original invoice tax period

- For example, If an original invoice dated 12/07/2017 undergoes amendment in August then the revised invoice date should not be later than 31/07/2017

Q.14 – What all details amendments are not admissible or not allowed?

The below-mentioned details cannot be amended at Invoice level:

- The Customer GSTIN

- Changing a tax invoice into the bill of supply

- The following details with respect to Export Invoices cannot be amended:

- a) Shipping Bill Date/Bill of Export Date

- b) Type of Export- With/Without payment

- The below mentioned, with respect to Credit Debit Notes cannot be amended:

- a) Receiver/Customer GSTIN | Note: However, you may amend & link any other invoice for the same GSTIN

- b) Place of Supply

- Reverse charge mechanism applicability

- Reason: All the above-jotted details are based on the original Invoice hence, these details must match with the details of the linked Invoice.

- If the person receiving goods has taken action on the invoices i.e. accepted it or modified it and relatively, the supplier accepts such modifications in GSTR-1A, then he is not supposed to make any amendment in those invoices as those amended invoices would automatically get reflected in the GSTR-1 of the supplier in the month of such acceptance under the relevant amendments tabled. Following details cannot be amended at the summary level.

- Nil Rated

- HSN summary of Outward supplies

- Cannot add a new place of supply

Note: The existing place of supply could be replaced with another place of supply following some limitations. Refer to the examples given below:

Q.15 – What are the acceptable amendments in context to the Place of supply?

In the GSTR-1 return, details of sales are filed with the government. After filing of this return, no tax has to be paid. The tax is supposed to be paid at the time of filing GSTR-3B (notified for months until March 2019)

With respect to Place of Supply, note the following:

- The original place of supply could be amended for a transaction

- One is not allowed to add any new place of supply to a transaction

Let us understand the above with the following scenarios:

| Nature | Place of supply | Rate of Tax | Taxable Value | Amendment |

|---|---|---|---|---|

| Original | Kerala | 18% | INR 10000 | Allowed |

| Amended To | Karnataka | 18% | INR 10000 | |

| Original | Kerala | 28% | INR 50000 | Allowed |

| Amended To | Karnataka | 18% | INR 50000 | |

| Original | Karnataka | 5% | INR 10000 | Allowed |

| – | – | 12% | INR 20000 | |

| Amended To | Karnataka | 18% | INR 30000 | |

| Original | Kerala | 18% | INR 60000 | Allowed |

| Amended To | Karnataka | 28% | INR 20000 | |

| Amended To | Karnataka | 12% | INR 40000 | |

| Original | Kerala | 18% | INR 60000 | Not Allowed |

| – | – | 12% | INR 40000 | |

| Amended To | Karnataka | 28% | INR 50000 | |

| Amended To | Kerala | 12% | INR 50000 | |

In all the cases above, where the original place of supply was amended from Kerala to Karnataka (whether or not there was a change in tax rates or invoicing), the amendment is allowed.

Q.16 – Where would the amended invoices reflect in GSTR-1?

The amended invoices or details are declared in the tax period in which the amendment takes place as follows:

| S. no. | Type of Amendment | Explanation |

|---|---|---|

| 1 | B2B Amendments (9A) | Any amendment made in the invoices which have been already issued must be reported here. These are the invoices for taxable supplies made to registered taxpayers. This includes supplies made to SEZ/ SEZ Developers with or without payment of taxes and deemed exports. |

| 2 | B2C Large Amendments (9A) | Any Amendment done in the original invoices already issued must be mentioned here. They reflect the original invoices issued for taxable outward supplies made to unregistered taxpayers where:

|

| 3 | Credit/Debit Notes (Registered) Amendments (9C) | In case of any Credit or debit note amendment against already issued Credit or debit note reported under B2B (i.e where supply is made to the registered taxpayer), will be reported here. |

| 4 | Credit Debit Note (Unregistered) Amendments (9C) | Amended Credit or debit note issued against original Credit or debit note is reported under B2C Large and Export Invoices section |

| 5 | Export Invoices Amendments (9A) | Amended invoices issued against already issued original invoices must be reported here. Export invoices include

|

| 6 | B2C Others Amendments (10) | Amendments made in such invoices which have been already issued earlier must be reported here.

These are all those invoices not covered under:

|

| 7 | Advances Received (Tax Liability) Amendments (11(2)) | In case of any amendment made to the advances received in previous tax, periods need to be declared here. |

| 8 | Adjustment of Advances Amendments (11(2)) | Any amendment made to the advances and adjusted in previous tax periods has to be declared here. |