Recently Commissioner made amendments in the principal notifications No.s – 76/2019, 77/2019 and 78/2019 – Central Tax, which were published in the Gazette of India, Extraordinary vide number G.S.R. 452(E), G.S.R.767(E), and G.S.R. 769(E).

According to the latest amendments by the commissioner, the due dates for filing different returns extend for the GST registered individuals whose principal place of business is in Assam, Manipur or Tripura.

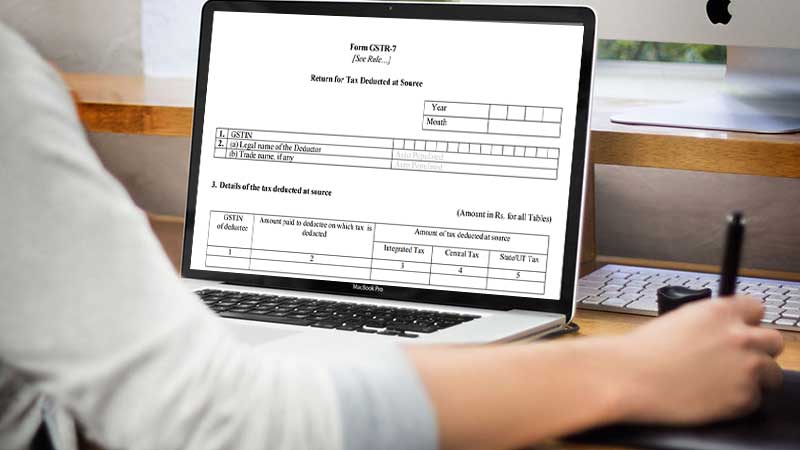

The due dates have been extended for the returns to be filed the month of November 2019. The due date for filing form GSTR 7

A proviso is added in the first paragraph, after the third proviso of the notification No.26/2019, declared by the Government of India in the Ministry of Finance (Department of Revenue) on 28th June 2019, under the powers provided by sub-section (6) of section 39 read with section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017).

The new proviso to be inserted, reads, “Provided also that the return by a registered person, required to deduct tax at source under the provisions of section 51 of the said Act in form GSTR 7 of the Central Goods and Services Tax Rules, 2017 under sub-section (3) of section 39 of the said Act read with rule 66 of the Central Goods and Services Tax Rules, 2017, for the month of November 2019, whose principal place of business is in the State of Assam, Manipur or Tripura, shall be furnished electronically through the common portal, on or before the 25th December 2019.”

According to the latest proviso, businesses registered under GST need to deduct TDS under the provisions of section 51 of GST Act and report the same in form GSTR 7 and the due dates for the filing the same for the month of November 2019 is 25th December 2019 for the businesses with principal place of business is in the State of Assam, Manipur or Tripura.

Additional amendments were made by the Commissioner on the recommendations of the GST Council. The change is made in the government’s notification No. 44/2019 – Central Tax dated the 09th October 2019, which specifies that the return form GSTR 3B

A proviso shall be inserted in the first paragraph of the said notification, after the second proviso. This new proviso, reads, “Provided also that the return in form GSTR 3B of the said rules for the month of November 2019 for registered persons whose principal place of business is in the State of Assam, Manipur, Meghalaya or Tripura, shall be furnished electronically through the common portal, on or before the 31st December 2019.”

This amendment extends the deadlines for filing the GST return in form GSTR-3B

Another amendment was made in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.46/2019 – Central Tax, dated the 9th October 2019. In this notification as well, a new proviso is inserted in the first paragraph, after the proviso. The new proviso reflect the due dates of 31 December 2019, for furnishing the details of outward supplies in form GSTR 1

The notification reads, “Provided that for registered persons whose principal place of business is in the State of Assam, Manipur or Tripura, the time limit for furnishing the details of outward supplies in form GSTR 1 of Central Goods and Services Tax Rules, 2017, by such class of registered persons having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or current financial year, for the month of November 2019 till 31st December 2019.”