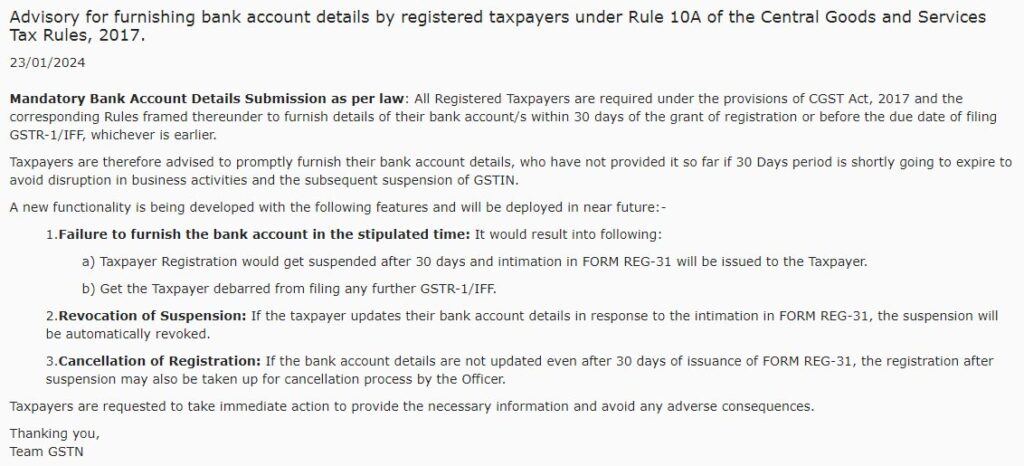

In the official advisory (No. 623) released on January 23, 2024, the Goods and Services Tax Network (GSTN) has underscored the essential obligation for registered taxpayers to provide their bank account information following Rule 10A of the Central Goods and Services Tax Rules (CGST), 2017.

As per the provisions outlined in the CGST Act, 2017, and its corresponding rules, all registered taxpayers are required to furnish their bank account details within 30 days from the registration date or before the due filing date of GSTR-1/IFF, whichever comes first.

To ensure adherence and avoid any interruptions in business operations, taxpayers who have not yet furnished their bank account details are strongly urged to do so promptly, particularly if the 30-day timeframe is approaching expiration. Non-compliance may lead to the suspension of GSTIN and subsequent disqualification from filing GSTR-1/IFF.

To streamline this procedure, a new functionality with tailored features is presently in the process of development and will be rolled out in the upcoming days.

Read Also: List of Latest Features on Official GST Portal for Taxpayers

Major Features

Failure to provide the bank account in the stipulated time- The same shall consequence into-

- Post 30 days the registration of the assessee shall get suspended and the intimation in form REG-31 will be issued to the assessee.

- Get the assessee debarred from filing any more GSTR-1/IF

- Revocation of suspension- Should the taxpayer revise their bank account information upon receiving the notice in form REG-31, the automatic suspension will be revoked.

- Registration cancellation- Failure to update the bank account details within 30 days of receiving form REG-31 may lead the Officer to initiate the cancellation process for the registration that has been suspended.