High Alert for New GST Registrants

Key and Useful Update for New GST Registrants. The Goods and Services Tax Network (GSTN) has made it legally mandatory for the new GST Registrants

According to Rule 10A, it is legally mandatory for GST taxpayers

- To provide the bank account details within the 45 days of the time limit from the date of the grant of the registration or

- The date on which return shall be required (as per section 39) to be furnished whichever is earlier

“Kindly update your Bank Account details within 45 days. GSTIN Registration may be canceled if such details are not updated within the timeline, the GSTN said.”

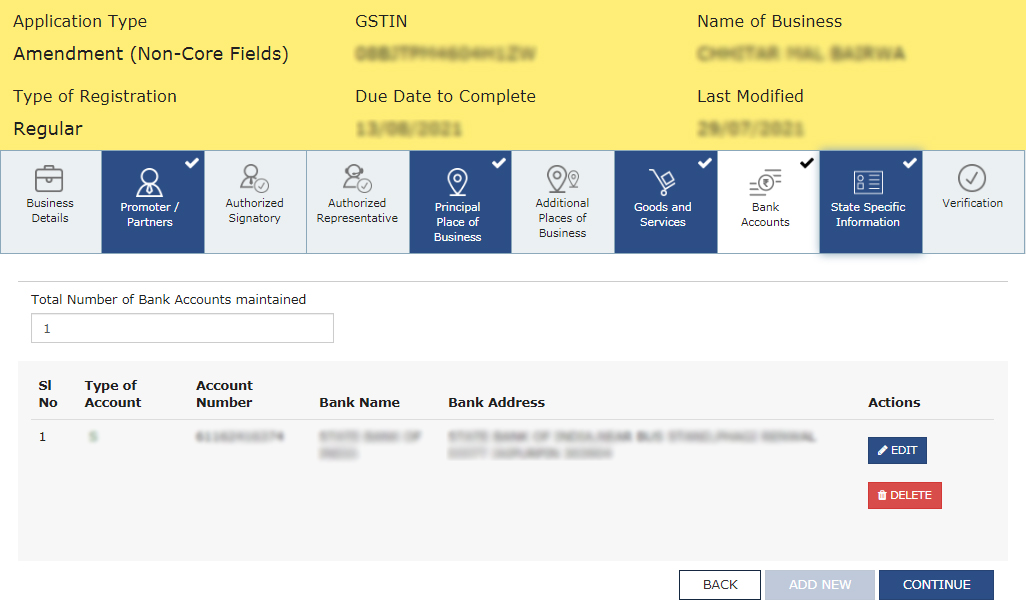

Steps to Update Bank Account Details on GST Portal

- Login to the taxpayer portal

- Go to Services

- Click on Registration

- Click on the tab Amendment of Registration Non-Core Fields

- Select tab Bank Accounts

- Add details of Bank Account (Account No., IFSC, Address, Bank Account type)

- Click on the verification tab, select authorized signatory, enter a place

- Sign application using DSC, E-sign or EVC

When the Notification was Issued

Through notification bearing number 31/2019 — Central Tax that is dated June 28, 2019, the Central Board of Indirect Taxes and Customs has notified the Central Goods and Services Tax (Fourth Amendments) Rules, 2019.

Consequently, a new rule 10A has been inserted in the Central Goods and Services Tax Rules, 2017.

Applicable to Whom

The provisions of rule 10A are applicable to a newly registered taxpayer who has recently received a certificate of registration in the Form GST REG-06

Persons Who are Exempted from this Rule (10 A)

The aforesaid rule 10A is not applicable to the below-mentioned categories of persons:

- The persons who have been registered as per rule 16 of GST rules, 2017

- The persons who have been registered as per rule 12 of the Central Goods and Services Tax Rules, 2017

Repercussions of Non-Compliance of Rule 10A

If the aforesaid taxpayer does not furnish bank details within the mentioned time limit, then finally the registration of such taxpayer shall be cancelled.