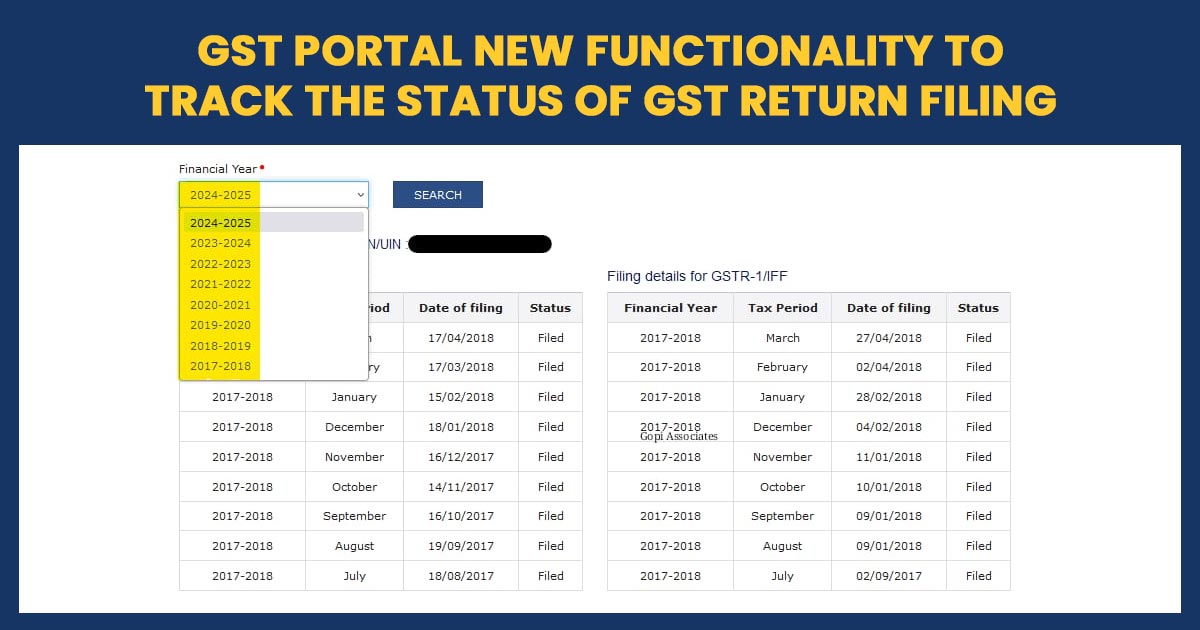

New functionality has been incorporated by the GST portal that permits the users to monitor the status of return filing of the enrolled assessees financial year-wise. The same rise has the motive to furnish effective clarity and simplicity of access to historical information for businesses and tax professionals.

Key Highlight of New Functionality

Track the Status of Your Return Filing Financial Year by Year.: Users are now facilitated to review taxpayers’ GST return filing status from FY 2017-18 to the present date. It eases the procedure to track compliance over several years.

Increases Clarity: The latest functionality permits effective oversight and clarity that ensures the business updates its compliance records.

Ease of Use: The user-friendly interface of the GST portal ensures that even those who have bounded technical knowledge can navigate and use the same new feature.

What is the Method to use the Updated Features?

- GST Portal Login: Access the Goods and Services Tax portal using your credentials.

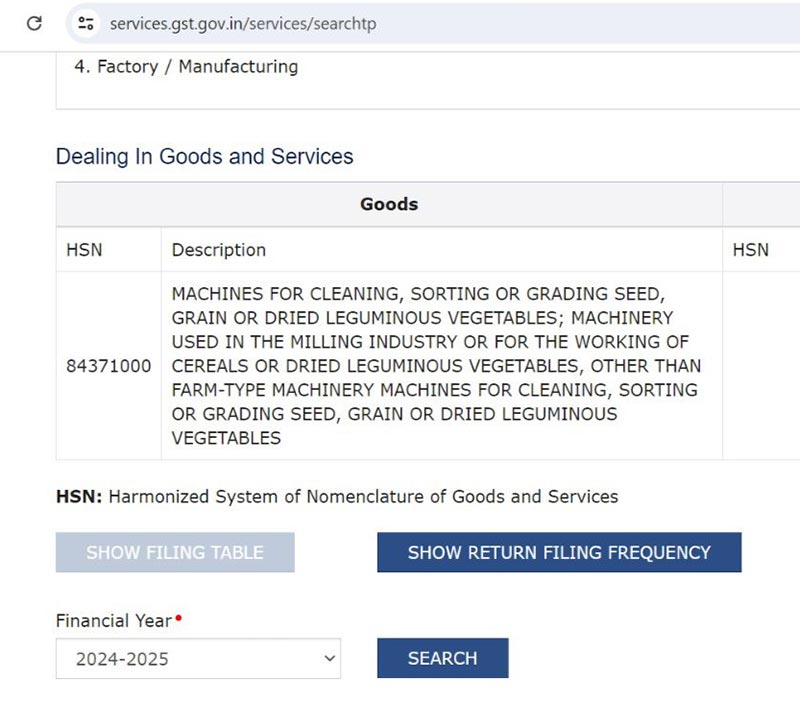

- Select Return Filing Status: Discover the ‘Return Filing Status’ option in the main menu.

- Select Financial Year: Select the financial year you desire to review.

- View Return Filing Status: The portal will show the return filing status for the chosen year, furnishing details like the filing date, status (filed/not filed), and any discrepancies.

Conclusion: It is a crucial step for the start of the fiscal year return filing status monitoring on the GST portal to improve the efficiency and clarity of GST compliance. Both businesses and tax professionals shall discover the same feature invaluable in maintaining precise records and ensuring timely compliance.