The Goods and Services Tax Network (GSTN) has issued a notice advising the implementation of Two-factor authentication (2FA) on the GST portal nationwide starting December 1st, 2023. According to the advisory:

To enhance the security of the GST portal, GSTN will introduce two-factor authentication (2FA) for taxpayers. The initial rollout of 2FA has been successfully conducted in Haryana and is functioning smoothly. In the first phase, 2FA will be implemented in Punjab, Chandigarh, Uttarakhand, Rajasthan, and Delhi. The second phase will include the remaining states across the nation.

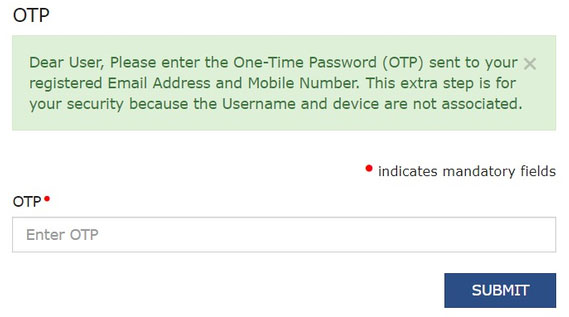

Taxpayers must enter a one-time password (OTP) after providing their credentials. They will receive an OTP to their Primary Authorized Signatory’s mobile number and email address.

Read Also: List of Latest Features on Official GST Portal for Taxpayers

Taxpayers are urged to ensure that their authorized signatory’s email and mobile numbers are up to date on the GST Portal to receive the OTP communication. The OTP will only be requested if the taxpayer changes their system (desktop, laptop, or browser) or location. This solution will be implemented from December 1st, 2023.