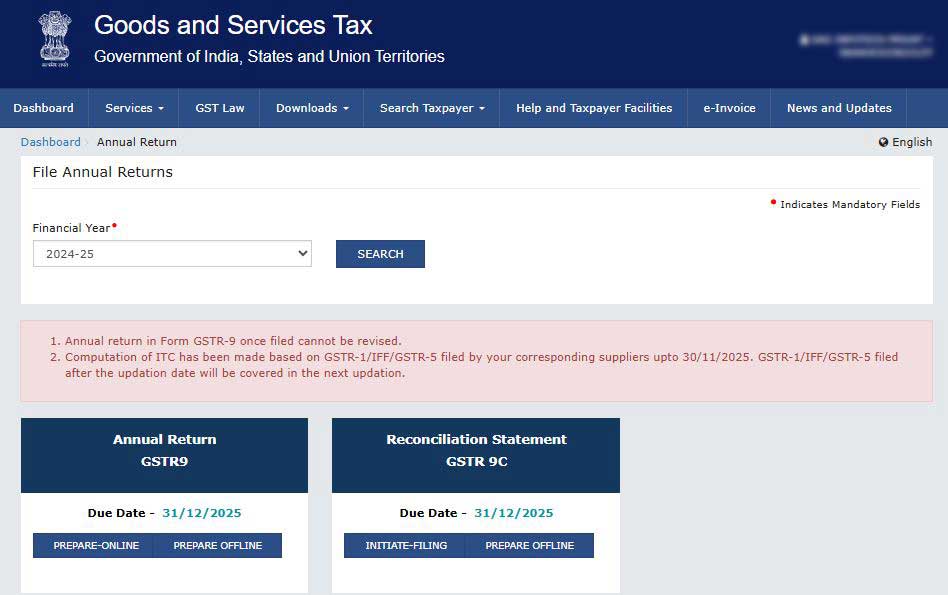

The GST portal has been updated to enable online filing of Goods and Services Tax (GST) annual return using form GSTR-9. The reconciliation statement using the GSTR-9C form has been enabled for filing. Significantly, the GSTR-9 annual return filing due date is December 31, 2025, for FY 2024-25, implying there can be less time this year for filing the annual return.

Tax expert cited that Taxpayers can access the filing options, including “PREPARE-ONLINE” and “PREPARE OFFLINE” for GSTR-9, and “INITIATE-FILING” and “PREPARE OFFLINE” for GSTR-9C, directly on the GST portal.

Tax expert added that GSTR-9 and 9C for Annual Return have been enabled on the portal now of October 12, 2025. The official time available to taxpayers is 9 months, i.e., from April 2025 to December 2025. As annual return and reconciliation statement forms have been released late, the actual time available is less than 3 months.

As per a tax expert, the Last Date to file GSTR 9 and GSTR 9C is December 31, 2025; therefore, taxpayers and professionals were waiting for the filing to open. GSTR 9 Filing is obligatory if your turnover surpasses Rs 2 crore, and GSTR 9C Filing is obligatory if your turnover exceeds Rs 5 crore.

Also Read: All About GSTR 9 Online Filing with Due Dates and Penalty

GSTR 9 and GSTR 9C Filing is not an easy task as the whole Financial Year’s data needs to be compiled, so its availability will enable Filers to start filing. GSTR 9C is a reconciliation statement that can be filed only after filing GSTR 9, which is the Annual Returns.