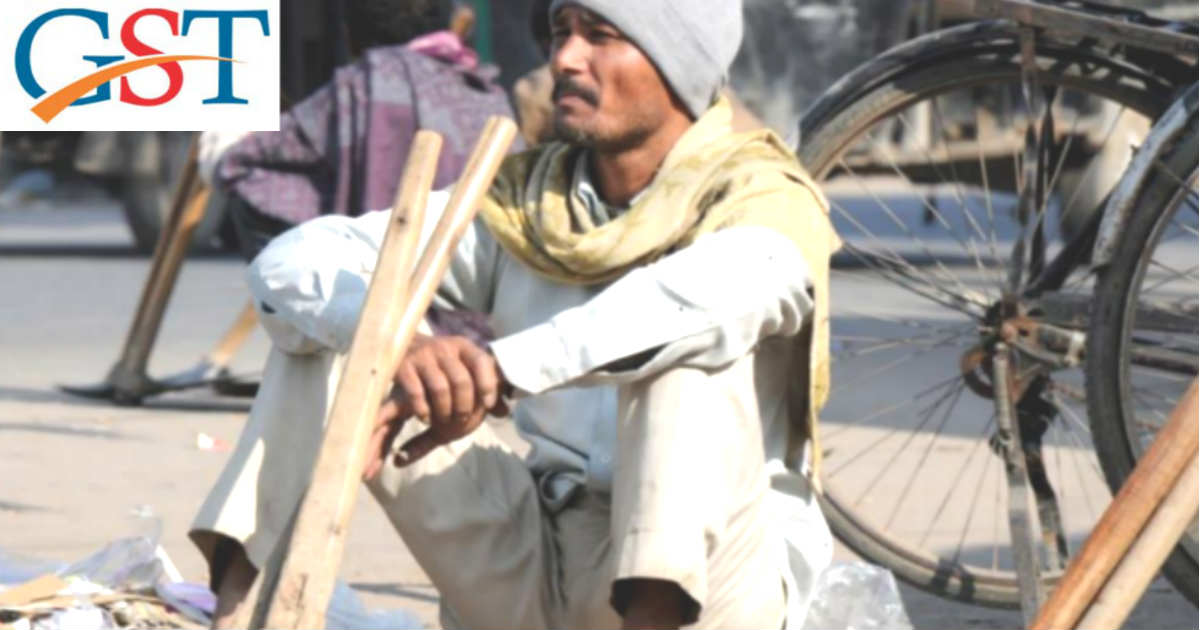

A total of 9 days passed since daily wage labourers from the sandstone industry of Rajasthan to get a employment for a day in the dry land of Bhilwara by lifting sandstone slabs.

The labourers never mind the weight of these stone slabs as they have to feed their family but due to the GST, they have to calculate all the aftermath of the new taxation policy in spite of being totally illiterate.

The Rajasthan has seen a big hit after the implementation of goods and services tax as there is a dip of around 20 percent in the production of sandstone.

There are many complex situations in ascertaining the actual impact of GST on the economy but the latest one is coming to press upon the most difficult of all i.e. impact on jobs in India.

Also to raise the problem further the economic survey related to the demonstration and wage has not been done since 2016. This particular inadequacy has left the experts with less chance to know the actual health of the economy.

A known professor from the IIT Delhi said that, “Demonetisation and GST coerced some firms which had the capacity to turn formal to become so, through the use of bank accounts for payments, and this may show up in an increase in some formal employment, for instance in the payroll data of the Employee Provident Fund Organisation.”

Production capacity also went half as the Rajasthan state has lowered the input of stones due to the applicability of GST even on the smaller stones and scraps.

Sandstone manufacturing in the state of Rajasthan has slowed sharply as in 2016-17 while giving an eye over the data from Rajasthan’s Department of Mines and Geology stated a production increased from 19.6 lakh tonnes in 2014-15 to the 21 lakh tonnes in 2015-16, and then it made a sudden decline by 50 percent to 11.5 lakh tonnes in 2016-17.

Read Also: Goods and Services Tax Impact on Common Man in India

Overall the state of daily wage workers are not in an easy condition and there is a lot to do in terms of compliance and tax structure in a bid to secure some employment for these extremely poor class of people.

Source: https://www.huffingtonpost.in/