The Central Board of Indirect Taxes and Customs (CBIC) has recently intimated Central Goods and Services Tax Rules (Fourteenth Amendment), 2020 via Notification No. 94/2020-Central Tax dated December 22, 2020. The said notification notifies Form GST REG-31 for ‘Intimation for suspension & notice for cancellation of registration‘ under Rule 21A of the Central Goods and Services Tax Rules, 2017.

Latest Updates

22nd December 2022

- Kerala High Court quashed proceedings against the petitioner, M/s Pankaj Cottage, preventing GST Registration Cancellation notice Form GST REG-17 from being issued instead of REG-31. Read Order

Corrigendum Related to New GST REG-31 Form Via Central Notification 94/2020

The Central Board of Indirect Taxes and Customs (CBIC) stated the incorrectness for New Form GST REG-31 revealed for ‘Intimation for suspension & notice for cancellation of registration’. The board has given the corrigendum to the notification 94/2020 so as to change Form REG 31 which is about (Intimation for suspension & notice for cancellation of registration) to give 30 days for giving the clarification to the jurisdictional office as stated in Rule 21A.

Here you can find the format for Form GST REG-31 along with the details concerning the filing of the form.

“FORM GST REG – 31

[See rule 21A]

Date: < DD > < MM > < YYYY >

Reference No.

To,

GSTIN:

Name:

Address:

Intimation for suspension and notice for cancellation of registration

In a comparison of the following, namely,

- (i) Returns furnished by you under section 39 of the Central Goods and Services Tax Act, 2017

- (ii) Outwards supplies details furnished by you in form GSTR 1

- (iii) Auto-generated details of your inwards supplies for the period _ to_

- (iv) ………………….. (specify)

And other available information, the following discrepancies/ anomalies have been revealed:

- Observation 1

- Observation 2

- Observation 3

(Details to be filled based on the criteria relevant for the taxpayer).

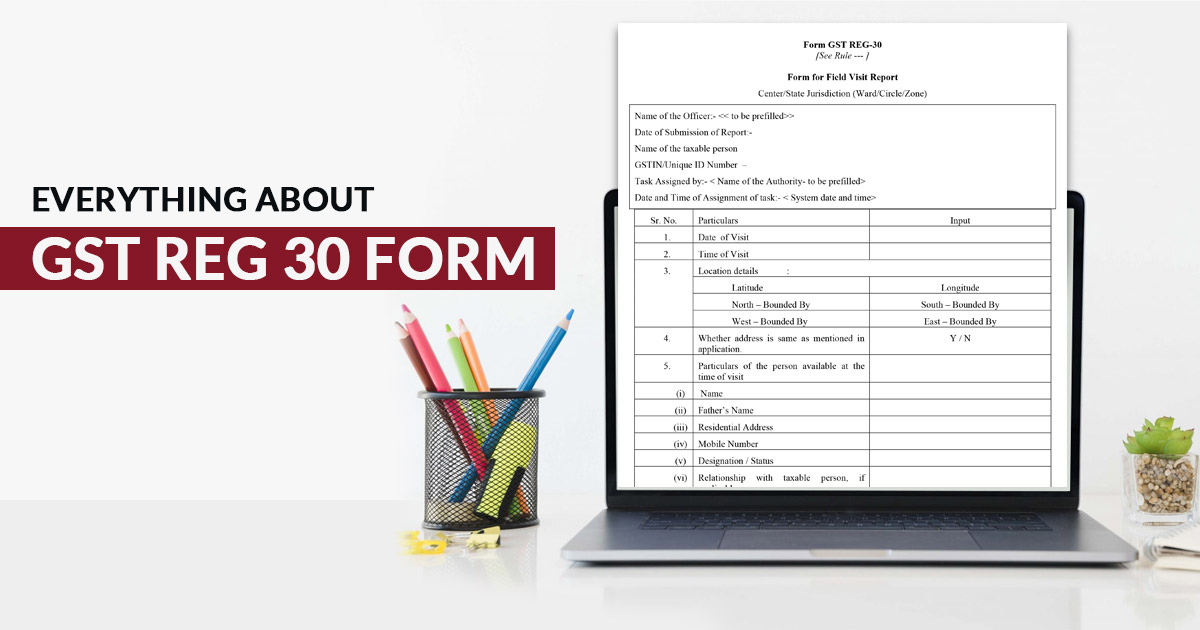

Read Also: GST REG-30 Form for Physical Verification Report by Officer

- These discrepancies/anomalies prima facie indicate contravention of the provisions of the Central Goods and Services Tax Act, 2017 and the rules made thereunder, such that if not explained satisfactorily, shall make your registration liable to be cancelled.

- Considering that the above discrepancies/anomalies are grave and pose a serious threat to the interest of revenue, as an immediate measure, your registration stands suspended, with effect from the date of this communication, in terms of sub-rule (2A) of rule 21 A.

- You are requested to submit a reply to the jurisdictional tax officer within seven working days from the receipt of this notice, providing an explanation for the above-stated discrepancy/ anomaly. Any possible misuse of your credentials on the GST common portal

- The suspension of registration shall be lifted on the satisfaction of the jurisdictional officer with the reply along with documents furnished by you, and any further verification as the jurisdictional officer considers necessary.

You may please note that your registration may be cancelled in case you fail to furnish a reply within the prescribed period or do not furnish a satisfactory reply.

Name:

Designation:

NB: This is a system-generated notice and does not require a signature by the issuing authority.”