As per the recent update, The central government is planning to do changes in the slabs of Goods and Service Taxes (GSTs) soon. As per the rumors, the Good and Service Tax council can increase the GST from 5% to 6% on many essential goods.

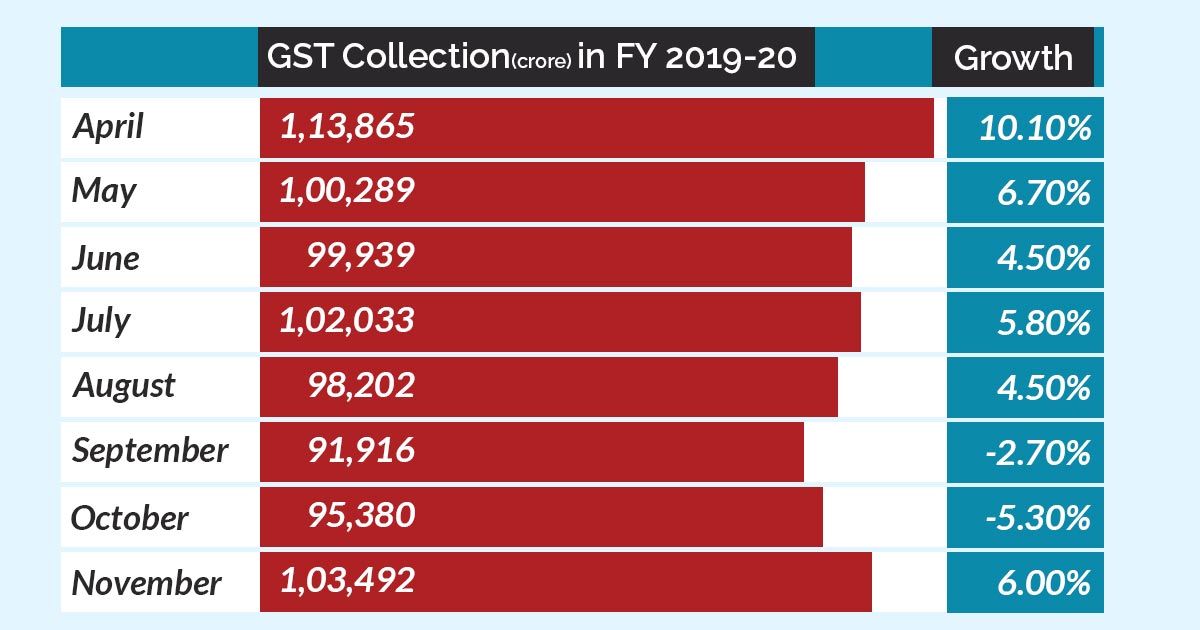

This plan is being considered to increase the revenue from GST, as per expectation this step will help the government to get additional revenue of Rs 1,000 crore. The Government’s monthly GST collection target is around Rs. 1.18 lakh crore.

At the present time, there are 4 slabs under GST Grab the information of revised GST slab rates on consumer products in India, Although the GST council finalized the slab rates like 5%, 12%, 18% and 28%. Read More i.e 5% slab, 12% slab, 18% slab and 28% slab. The 5% Slab is for essential items, like food, clothes, and shoes, the slab is generating 5% of the entire tax.

Read Also: 6% Rise in GST Collection in November Shows Signs of Economic Recovery

If GST is raised from 5% to 6% then it means that the Central Government will levy 3% GST and the State Governments will be 3%. The governments of some states say that this increase will increase the tax rate by 20 percent.

According to some media reports, chairperson of GST council (Finance Minister of the country) and Finance Minister of other states which are included in the 38th GST Council