In a bid to ease the Goods and Services Tax (GST) registration procedure the GST Network (GSTN) has launched numerous enhancements to address the pertinent fields. Such updates are made to rectify the preciseness and efficiency of the process of registration which provides an advantage to the taxpayer in India.

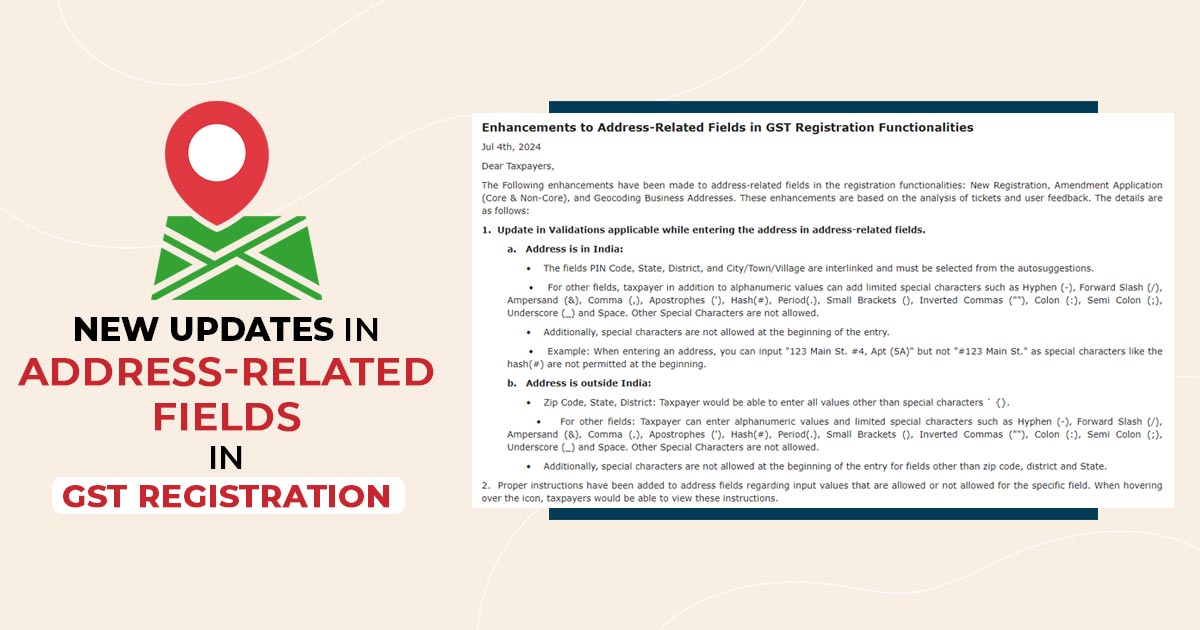

Below are the enhancements that have been made to address related fields in the registration functionalities: New GST Registration, Amendment Application (Core & Non-Core), and Geocoding Business Addresses. These enhancements are based on the analysis of tickets and user feedback. The particulars are as follows:

1. Validations update applicable while entering the address in address-related fields.

- A. Address is in India:

- The fields PIN Code, State, District, and City/Town/Village are interlinked and should be selected from the autosuggestions.

- For other fields, the taxpayer in addition to alphanumeric values can add limited special characters such as Hyphen (-), Forward Slash (/), Ampersand (&), Comma (,), Apostrophes (‘), Hash(#), Period(.), Small Brackets (), Inverted Commas (“”), Colon (:), Semi-Colon (;), Underscore (_) and Space. Other Special Characters are not allowed.

- At the start of the entry special characters are not permitted

- Example: When entering an address, you can input “123 Main St. #4, Apt (5A)” but not “#123 Main St.” as special characters like the hash(#) are not permitted at the beginning.

- B. Address is outside India:

- Zip Code, State, District: Taxpayer will be enabled to enter all values other than special characters ` {}.

- For other fields: Taxpayer can enter alphanumeric values and limited special characters such as Hyphen (-), Forward Slash (/), Ampersand (&), Comma (,), Apostrophes (‘), Hash(#), Period(.), Small Brackets (), Inverted Commas (“”), Colon (:), Semi-Colon (;), Underscore (_) and Space. Other Special Characters are not allowed.

- Special characters are not permitted at the start of the entry for fields other than zip code, district, and State.

- For the input values that are permitted or not permitted for the specific field, accurate instructions have been added to address fields. Taxpayers will be able to view these instructions when hovering over the icon.

- The above-mentioned amendments shall not impact the information that has been saved already in the system even when it includes the special characters that are no more permissible. When an assessee is filing an amendment application and is editing the tab that includes the address information then the system will validate the address on the grounds of the aforesaid logic.

- The mentioned amendments are on the grounds of the tickets raised wherein the users were not known with the characters permitted and are not permitted in address fields or which fields can be modified and which fields are to be selected from a drop-down menu exclusively. One of the cases was when the assessee was inserting a hash (#) at the start of the Building Number field. In these cases, the help desk or support team reported the assessee to remove the hash (#) character and submit the application again.

- The aforesaid amendments are applied for the Normal Taxpayers – Regular, SEZ Unit, SEZ Developer, Composition, Input Service Distributor, and Casual Taxpayers.

- The field of locality/sub-locality is not compulsory

- i. If the Locality/Sub-locality field is left blank or is mapped to another Pin Code, the system displays the following warning messages: “Locality/Sub-locality does not match the Pin Code. Do you like to save the details?” or “You have not filled in Locality/Sub-locality. Do you like to save the particulars and move further?”

- ii. Example: If you enter Pin Code 123456 but leave the Locality/Sub-locality field blank, you will see the message: “You have not filled in Locality/Sub-locality. Do you want to save the details and proceed further?”

- iii. For the case to continue with the registration, tap “YES” to proceed, and the system will permit you to move forward.

Similar: GST Composition Scheme: Key Features, Eligibility and Registration Process