The Goods and Services Tax (GST) portal has activated Form DRC-03A which allows the taxpayers to adjust or set off the voluntary payments against the order of demand.

The same new form is been introduced Under Notification 12/2024, which is an addition to the GST compliance process.

The DRC-03A form acts as a continuation of the initial DRC-03 form, facilitating a more efficient method for offsetting liabilities listed in the Electronic Liability Ledger.

Form DRC-03 has already been used by the Taxpayers that are needed to file DRC-03A to finalize their payment adjustments.

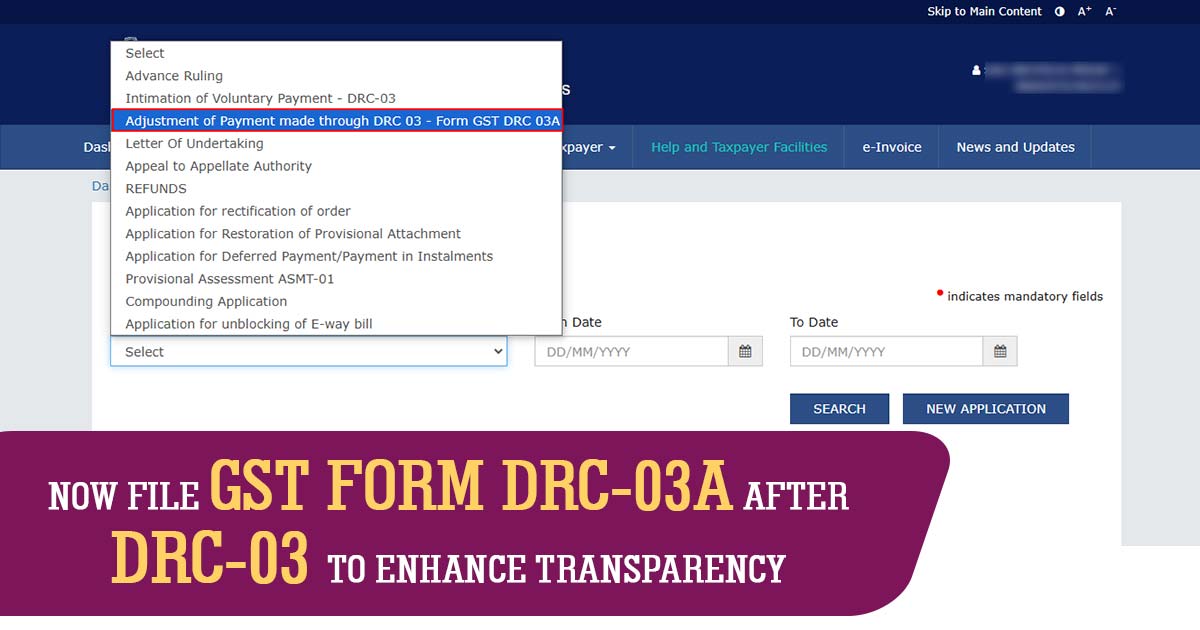

Taxpayers can navigate to the GST portal to access Form DRC-03A, by following these steps:

- Go to User Services

- Select My Application

- Choose Form GST DRC-03A

The activation of this form on the GST portal is intended to boost transparency and streamline the voluntary payment process for taxpayers, in line with the government’s initiatives to enhance GST compliance and administrative effectiveness.

Center Tax Notification No. 12/2024

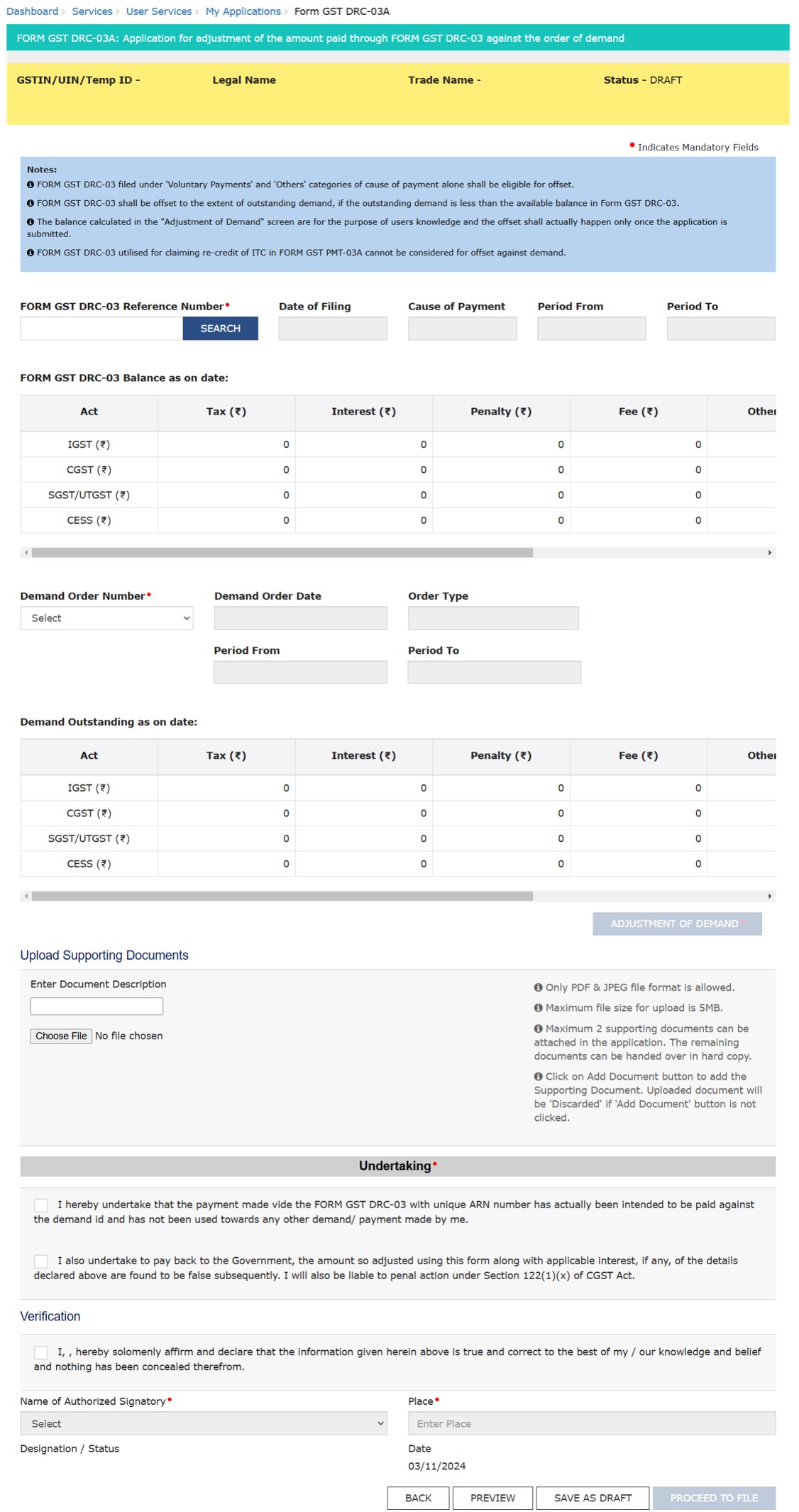

GST DRC-03A Form Format