The Goods and Services Tax constitutional amendment having been declared by the Government of India, the roll-out of the GST Bill will be an aggregate effort of the Central and State Governments, the citizens and the IT platform supplier, i.e. GSTN, CBEC, and State Tax Departments.

Other than these fundamental members, there will be different partners, e.g. Focal and States impose powers, RBI, the Banks, the expense experts (assessment form preparers, Chartered Accountants, Tax Advocates, STPs and so forth.), budgetary administrations giving organisations like ERP organisations and Tax Accounting Software Providers and so forth.

The GST System will have a G2B entry for citizens to get to the GST Systems, in any case, that would not be the main path for connecting with the GST framework as the citizen through his decision of third gathering applications, which will give all UIs and comfort by means of desktop, mobile, different interfaces, will have the capacity to cooperate with the GST framework.

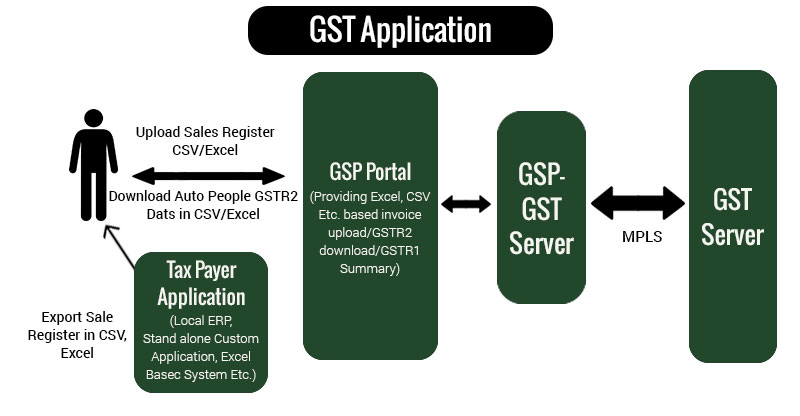

Hereby, under is the mentioned elaboration of the application.

The third-party applications will associate with the GST framework by means of secure GST System APIs. Every such application is required to be produced by third-party specialist organisations that have been given a nonspecific name, GST Suvidha Provider or GSP. The GSPs are conceived to give creative and helpful strategies to citizens and different partners in interfacing with the Systems from enlistment of the element to transferring of receipt points of interest to the filing of GST returns.

Therefore, there will be two arrangements of collaborations, one between the App client and the GSP and the second between the GSP and the GST System. It is visualised that the App supplier and GSP could be a similar substance. Another variant could be where information in the required format straightforwardly goes to the GSP-GST Server.

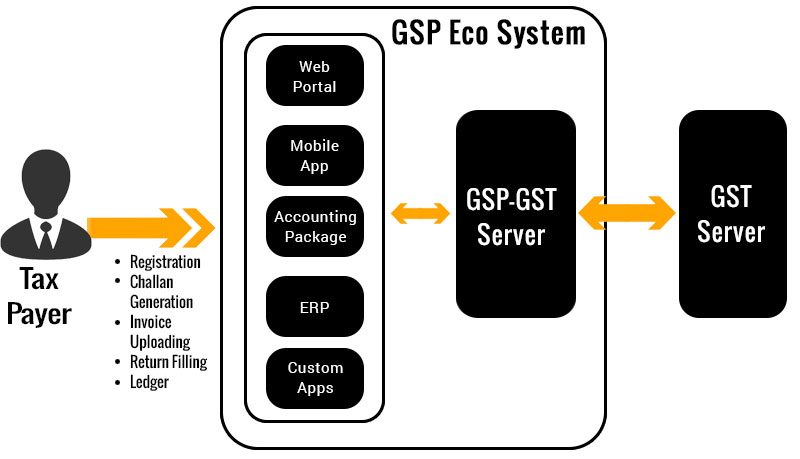

In the advancing environment of the new GST administration, it is imagined that the GST Suvidha Providers (GSP) idea will play an imperative and key role. It is the attempt of GSTN to manufacture the GSP eco framework, guarantee its prosperity by setting up an open, straightforward and participative structure for skilled and persuaded undertakings and business visionaries.

GST Compliance Obligation by the Taxpayer:

The citizen under the GST Regime should give the following information at the general interims:

- Receipt information transfer (B2B and expansive esteem B2C)

- Transfer GSTR-1 (return containing supply information), which will be made in view of the receipt information and some other information given by the citizen.

- Download information on internal supplies (receipts or buy) as Draft GSTR-2 from the GST Portal, made by the Portal in view of GSTR-1 documented by comparing providers.

- Make adjustments to the values made and downloaded from the GST gateway. Conclude the same in light of his own purchases (internal supply information) and transfer GSTR-2

- Document GSTR-3 made by the GST Portal in view of GSTR-1 and 2, and other data and duty paid.

- Likewise, there are different returns for different classifications of citizens, like an easygoing citizen or a synthesis citizen.

GST Suvidha Provider Design

It is normal that the GSPs should furnish the citizens with all administrations specified above, notwithstanding keeping up their individual business ledgers (deals record and buy record) and other value-added services around the same.

Here, we mention the GSP ecosystem via this infographic presentation.

Another imperative administration anticipated from GSPs is the programmed compromise of procurement made and entered in the buy register and information downloaded as GSTR-2 from the GST entry. In extra, there will be area-specific or exchange-specific needs which the GSPs are required to satisfy.

While the GST System will have a G2B gateway for citizens to get to the GST System there will be a wide assortment of citizens (SME, Large Enterprise, Small retail merchant and so forth.) who will require distinctive sort of offices like changing over their buy/deals register information in GST consistent format, incorporation of their Accounting Packages/ERP with GST System. Also, the particular needs of an industry or exchange could be met by GSP. To put it plainly, the GSP can help the citizens in GST consistency through its imaginative arrangements.

Representation and Implementation Structure

Citizens’ accommodation will be key to the achievement of GST administration. The citizen ought to make a decision to utilise third-party applications which can give changed interfaces on desktops, portable workstations, and mobiles and can associate with the GST System. The GSP-created applications will associate with the GST framework by means of secure GST framework APIs.

The Larger part of the GST framework functionalities identified with citizens’ GST compliance requirements might be accessible to the GSP through APIs. GSPs may utilise GST APIs and enhance and upgrade the citizens’ involvement. (The APIs of the GST System are RESTful, JSON-based and stateless). The GST System won’t be accessible over the Internet for security reasons.

The generation API end focuses must be expanded by means of MPLS lines. All APIs will be accessed over HTTPS protocol. The advantages of API based reconciliation are:

- Utilisation crosswise over advancements and platforms (mobile, tablets, desktops, and so forth) in light of the individual necessities

- Robotised transfer and download of information

- Capacity to adjust to changing tax collection and different business guidelines and end client use models.

- Coordination with client software (ERP, Accounting frameworks) that citizens and others are currently utilising for their everyday exercises

- Determination and Onboarding of GSPs

- Any forthcoming candidate for GSP should meet the pre-capability criteria for GSPs

- GSPs who meet the pre-capability criteria will sign an agreement with GSTN to end up distinctly an approved GSP

- On marking of the agreement, GSPs will get an exceptional permit key for getting to the GST framework. GSPs will be validated utilizing this permit key (Client id + Client Secret) gave by GSTN. GSP will have the arrangement to create different License keys according to its need

Who Can be Converted into GSP?

The associations and substances that are expected to join as GSPs are envisioned to be as under:

- Registered organisations in India in the IT/ITES/BFSI space

The Most Productive Approach to Become a GSP

GSPs should join an agreement with GSTN. This draft contract has the accompanying substance:

- Definitions, duties of GSPs and their legitimate commitments and in addition, liabilities

- Specialised structural system in the matter of how GSPs should coordinate with the GST System

- Business terms and conditions alongside SLAs to be met

- Pre – capability criteria for GSPs

Goods and service tax network authoritative figure combined up to a productive tool as an offline mode to include all the tax-paying entities for the invoice uploading and return of taxes. The GST Suvidha providers are in the league of creating utility apps for the general public against the competitive market of Application service providers who are engaged in cut-throat competition. The tool will be helpful for low-connectivity internet areas and will serve as a mediator to convert the invoice data into a compatible format for the GST structure.

Know How to Maintain Secure Financial Data Under GST

Now the traders can upload invoice of all their sales and purchases from 24th July, as told by the chairperson, Naveen Kumar of GSTN. The GSTN portal released an offline Excel sheet for filling in all the invoice details to be uploaded to the GSTN portal. The sheet can be uploaded in less than a minute and can be fed with data totalling up to 19000 invoices within it. The portal will also be carrying a video demo on how to upload the invoices.