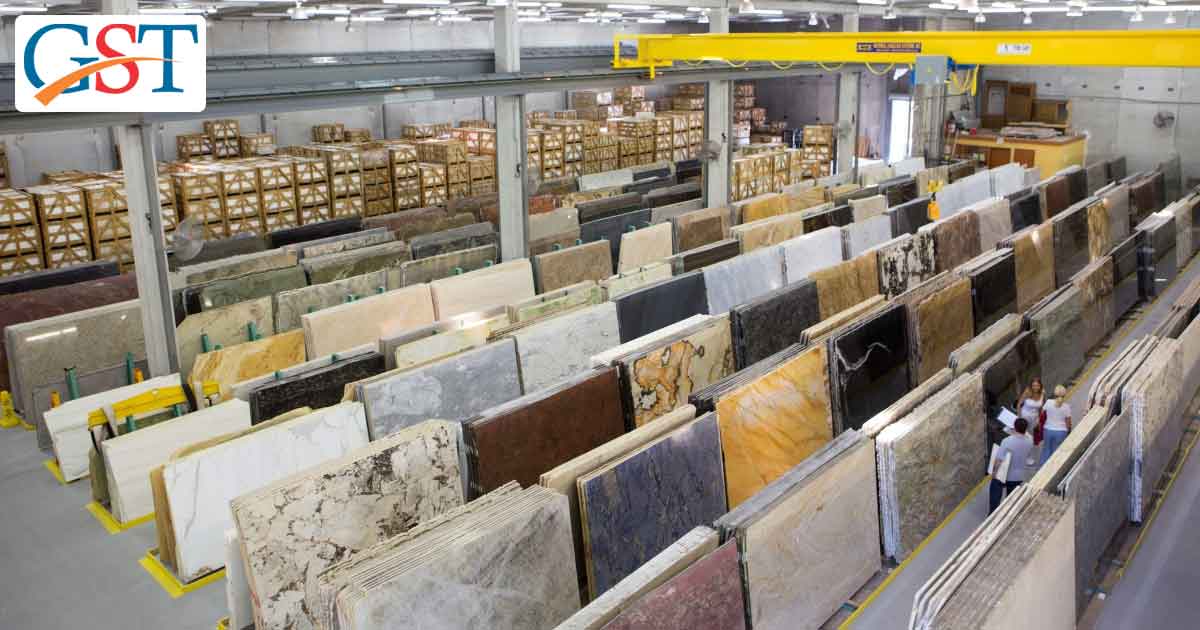

After the reduction of GST rates on marble stones and tiles, the prices of stones have declined and there is a rise in the sale of both marble stones and tiles. Those traders who were facing downturn since the implementation of July are expecting good results now. Since the price of tiles also declined along with marble stones, the industry is expecting a good demand in the near future due to the increase in the manufacturing.

Since 1st July 2017, when new indirect tax system was implemented throughout the country, cement, marble stones and tiles were placed in the category of 28 percent under GST. Due to 28 percent tax on marble along with tiles, Merchants of Marble in Rajasthan had undergone strike almost for a month. Even after that, no measure was taken by the government due to which the sale of the marbles got adversely affected. Since no appropriate action was taken by the government the traders had to withdraw the strike without any decision.

The decline in the sale of marble and tiles from 5th July to November compelled the traders to demand changes in slab rates under GST. In the GST Council Meeting which was held in November, the slab rate was reduced from 28 percent to 18 percent directly. Due to the decline in GST rates, the prices of marble stone and tiles have reduced from 5 to 10 rupees per feet. Due to high prices and GST, customers who were not purchasing the marble stone earlier, have now changed their decision.

The biggest drop could be seen in the prices of white marble stone which have reduced from Rs 55 to 45 rupees per feet. Additionally, granite prices also fell down by Rs 70 per- feet. Currently, marble is selling at Rs 40 per feet and the prices of tiles were also reduced.

After the reduction of GST rates on the marble stone, several traders have received a sign of relief and the demand for marble have started increasing. Several varieties of marble have declined from Rs 5 to Rs 10 per feet, it is anticipated that the demand for marble stone might increase in the near future.

Recommended: Impact of GST on Real Estate Sector in India

30% Employee Cut Off in Marble Industry

After the implementation of goods and services tax, there were tremors in the business world and its shocks were also felt in the marble industry as well. The marble industry is going through some of the very bad phases and had to lay off several employees to get rid of debts.

According to the reports of the state department of mines and geology, there is a huge 30% shortening of workers from the past years, while the productions also got hit by 12% straight after the implementation of GST.

The stone and marble industry is said to be hit by the impact of the implementation of GST, demonetisation and RERA. There is but one market which can give a revival to the industry and that is US market which has shown some interest in the industry in spite of other government obligations.

A total of 2555 crores of exports was done in the year 2017-18 in front of 2016-17 having 2302 crores, due to the shifting of focus on foreign markets. It is yet to see the final impact on the industry.