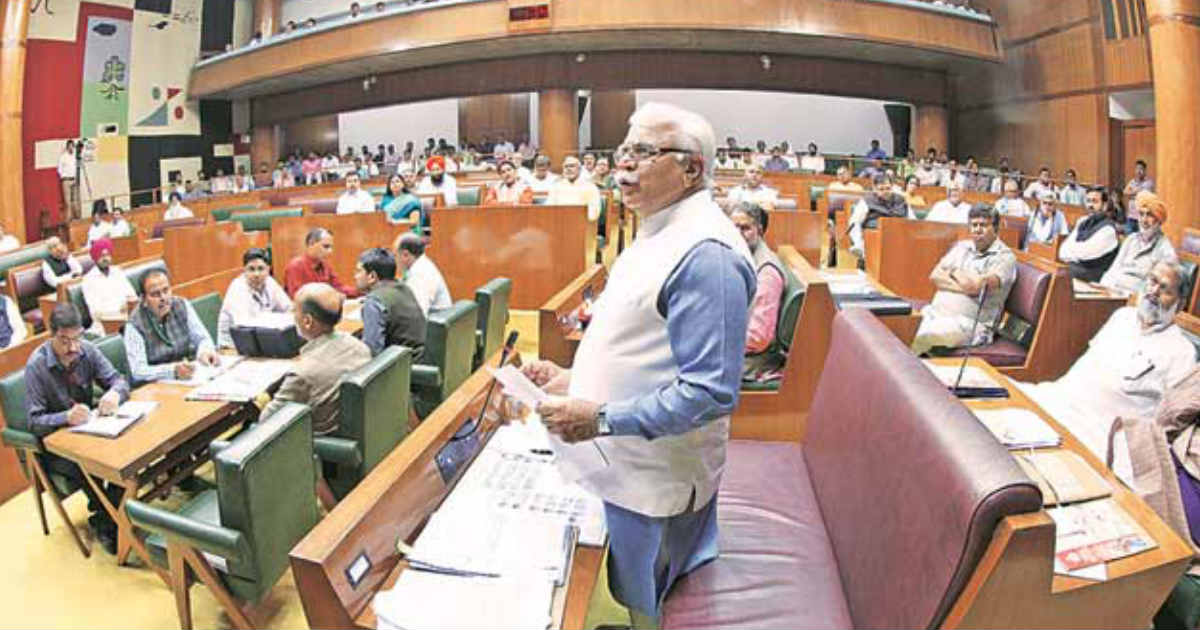

GST has again seen a positive response from the Haryana state as the state assembly passed the reformative Goods and services tax bill in the significant one-day session of the house and also in a turning point, gave the legislators a hike of salary and allowances with a rise from 50 thousand to 60 thousand per month of the ministers.

In this regard, Haryana Excise and Taxation Minister Abhimanyu was there to speak about GST and said that, “GST is a path-breaking reform in taxation history which will knit the entire country into a single market by ironing out distortions, putting an end to skewed and dissimilar tax practices and make the going for trade and industry a lot easier.”

“The new tax would subsume 17 different types of indirect taxes of the Centre and States and do away with the multiplicity of taxes, The GST will take the feature of the Value Added Tax (VAT) from State boundaries to the national level. The GST is a destination-based tax. The threshold limit for the GST has been fixed at ?20 lakh, which is currently ?5 lakh in Haryana.” he added

The Haryana Excise and Taxation Minister Abhimanyu was very much hopeful and assured that GST is a very compatible and synchronized to the best possible way in order to maximize the benefits of the tax system to the people and the government equivalent.

Capt. Abhimanyu also said that “Traders under composition scheme would be required to pay tax at the rate of half per cent under the State GST and a half per cent under the CGST. The manufacturers will have to pay at the rate of 1% and taxpayers serving foods will be paying at the rate of 2.5% under the composition scheme of GST.”

The minister also informed that after the introduction of this new taxation regime, the taxpayers will only have to deal with the only single point of the tax authority. He also mentioned that “The principle of a single interface for the taxpayers constitutes the cornerstone of GST implementation. Therefore, the State authorities and central authorities have been cross-empowered to perform various statutory functions under the Central and States laws to provide a single interface to the taxpayers.”