Upon GST portal, every assessee who is enrolled requires one electronic register known as the Electronic liability register and two electronic ledgers namely Electronic Cash Ledger and Electronic Credit Ledger. The amount needed to pay as a tax is shown by these registers and ledgers, the amount available to furnish out the tax liability online, and input credit balance.

Towards the two segments, the electronic liability register is divided out of which the initial section undergoes the liabilities and the other section undergoes the liabilities excluding the returns.

The return concerning the liabilities accumulated will be shown in the electronic liability register. The payments that are performed via electronic cash ledger and credit are used to issue the liabilities, Liabilities pertaining to GST CMP-03, GST, ITC-03, and GST REG-16.

This can be obtained inside the post-login mode utilizing the path Services > Ledgers > Electronic Liability Register

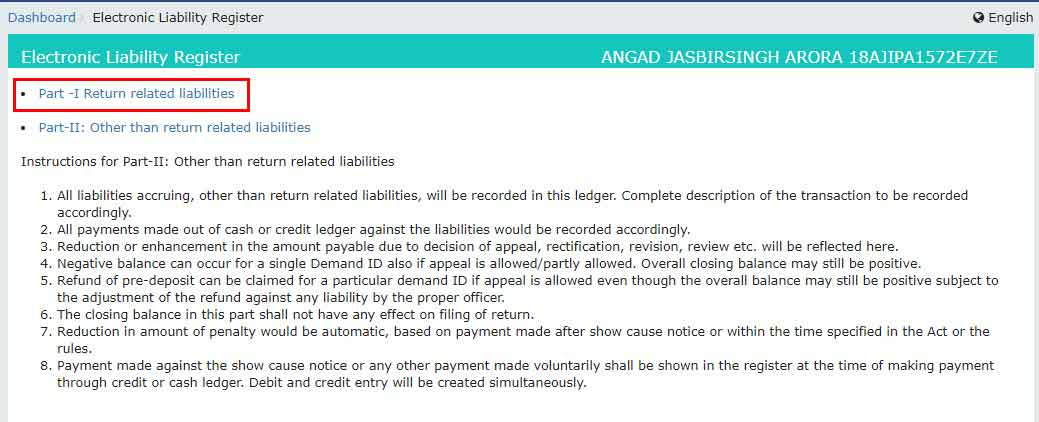

Electronic Liability Register Has Two Parts

Part-1: GST Return Related Liabilities

Select the Part – 1 Return related liabilities link

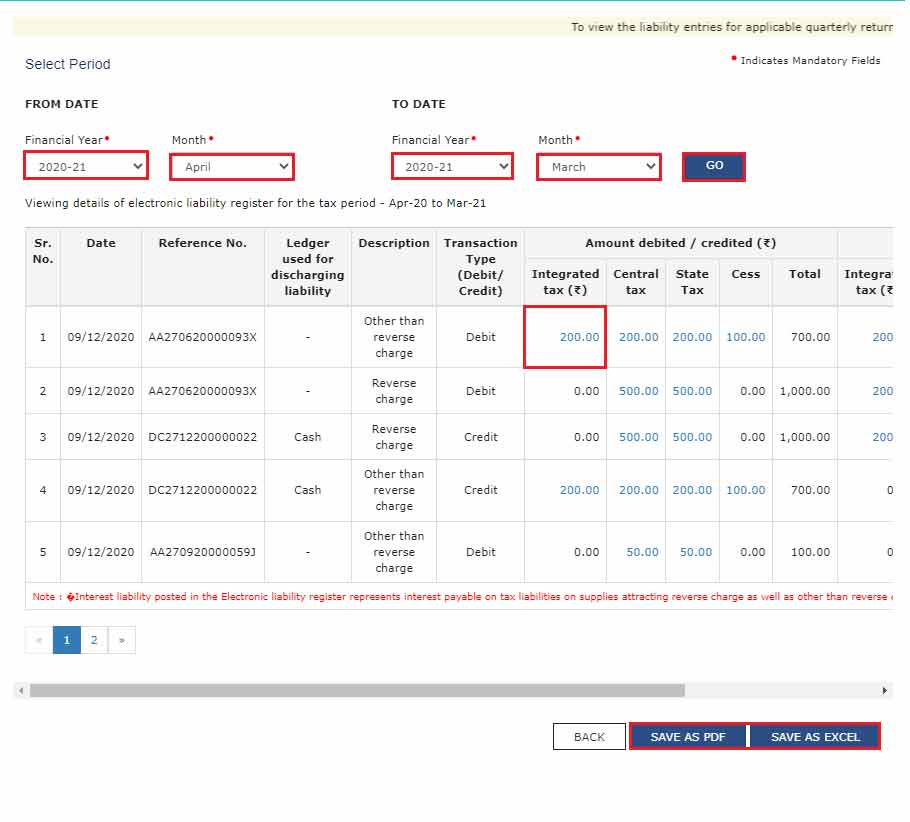

The Register of Electronic Liability is displayed on the GST portal page. From the FY & Month scroll bar and choose the month & financial year for which you want to see the register of electronic liability.

Now push the go button. And register of electronic liability information are displayed.

Note: Click the SAVE AS PDF and SAVE AS EXCEL button to save the Electronic Liability register in the pdf and excel format.

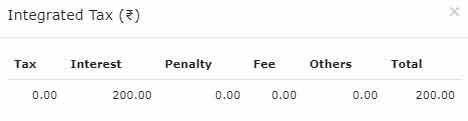

You can click the link under Integrated Tax, Central Tax, State Tax and Cess to view further details.

Note: The Minor Heads include: Tax, Interest, Penalty, Fee, Others and Total. The Minor Head wise balance is displayed for the selected Major Head.

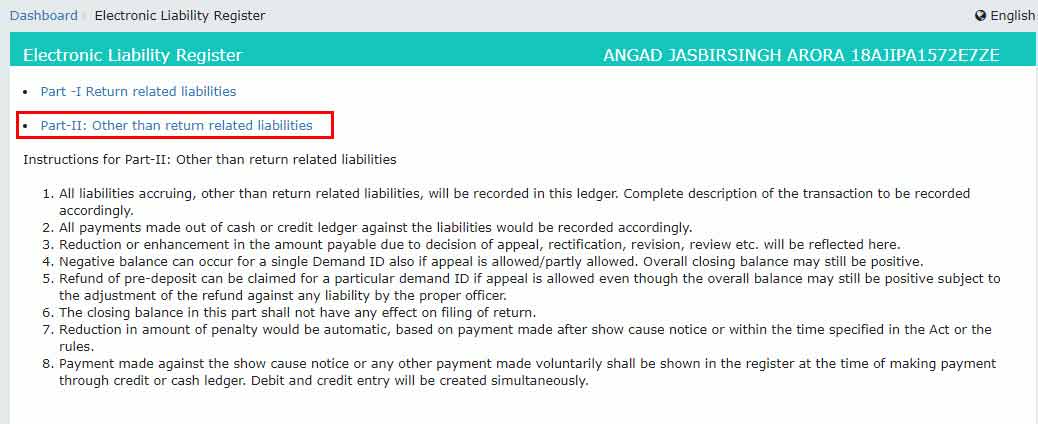

Part – II: Other than Return Related Liabilities

Select the Part – II: Other than return related liabilities link.

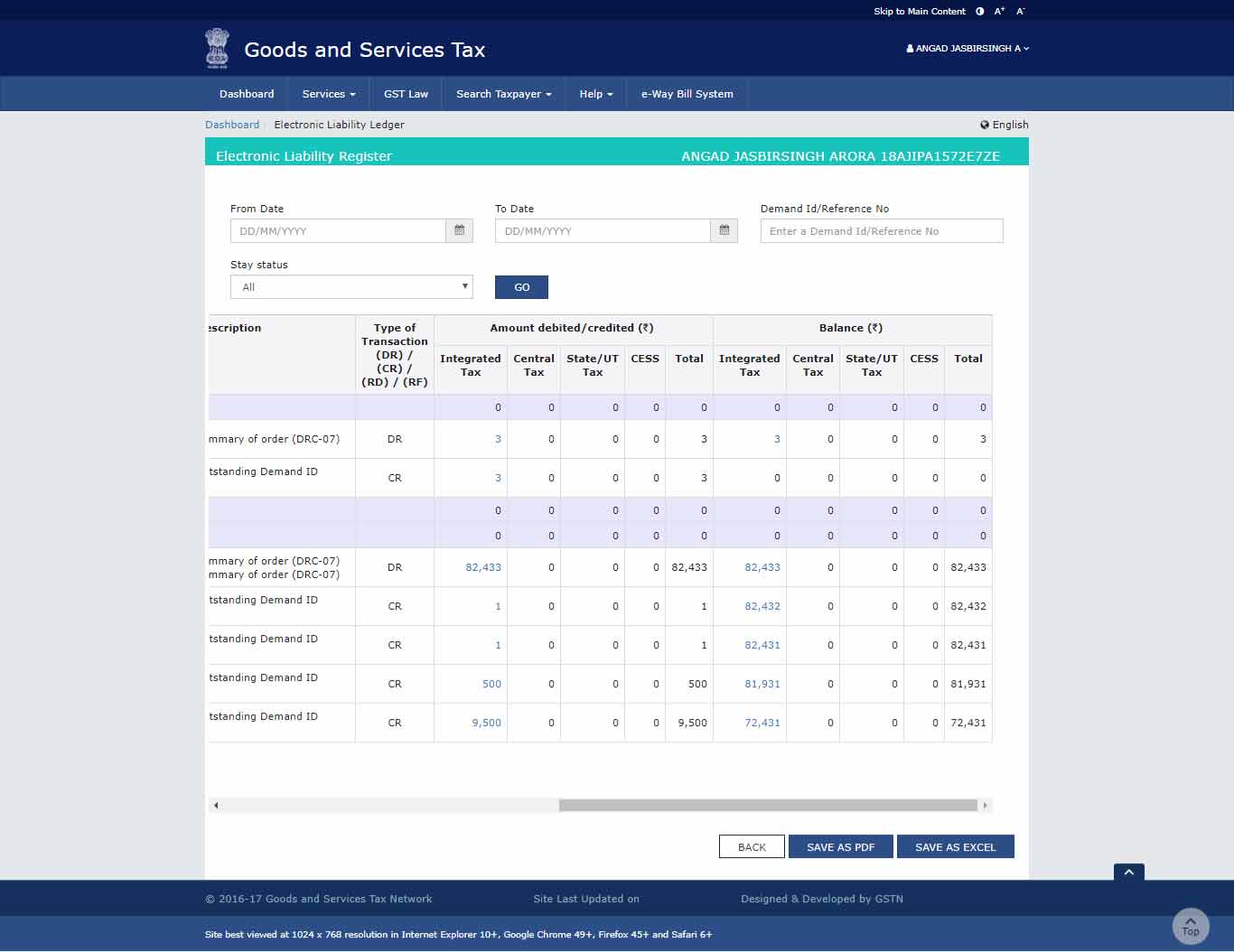

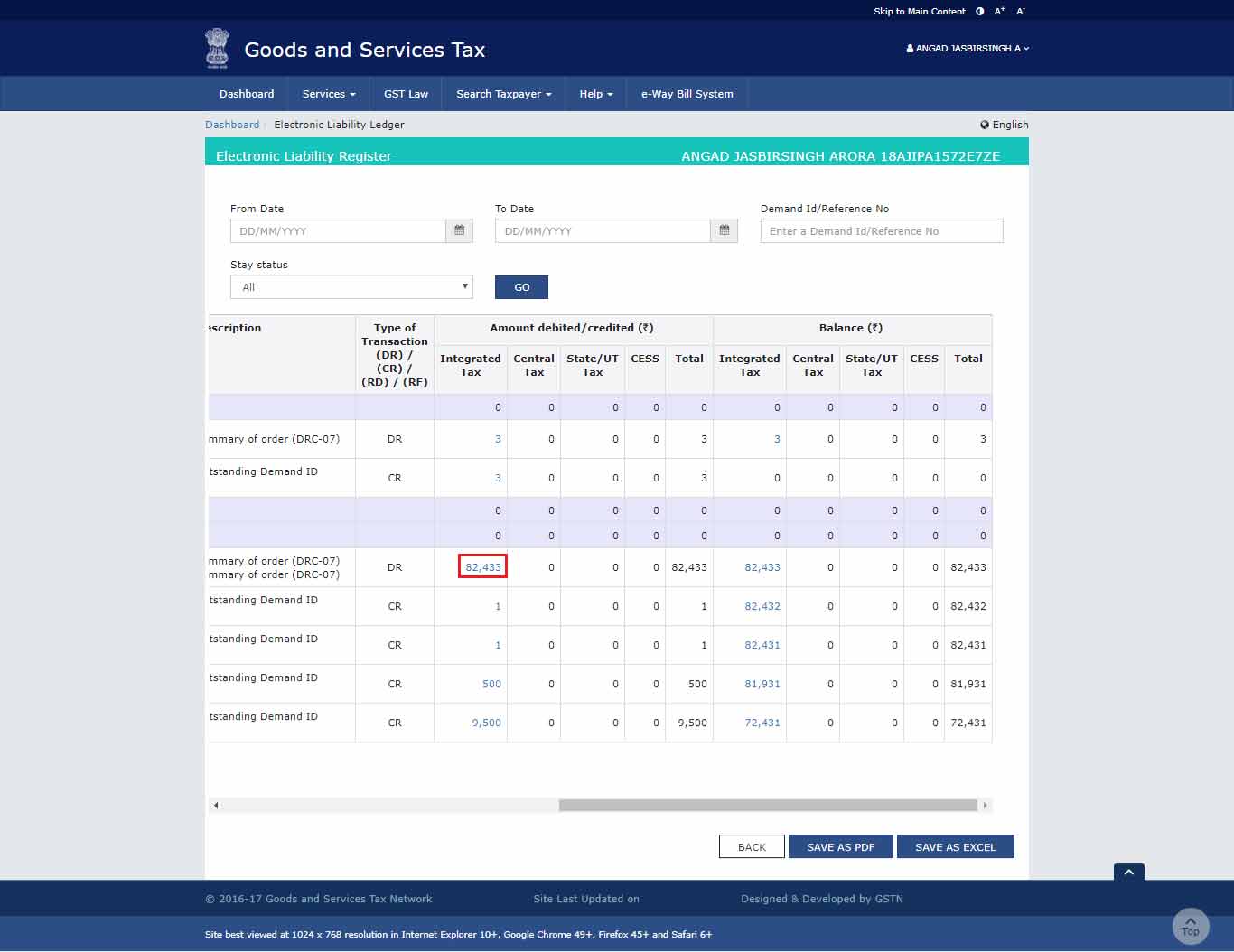

The Electronic Liability Register page is displayed.

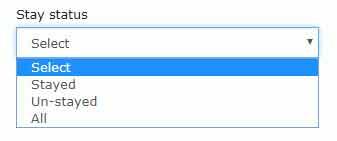

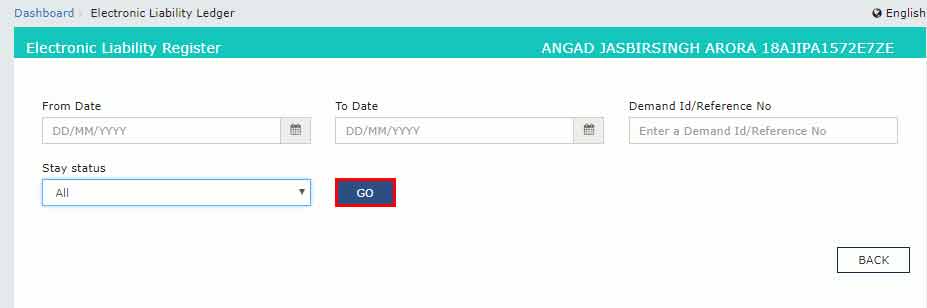

Select the search criteria from the choices available. You can select the Stay Status from the drop-down list.

Click the GO button.

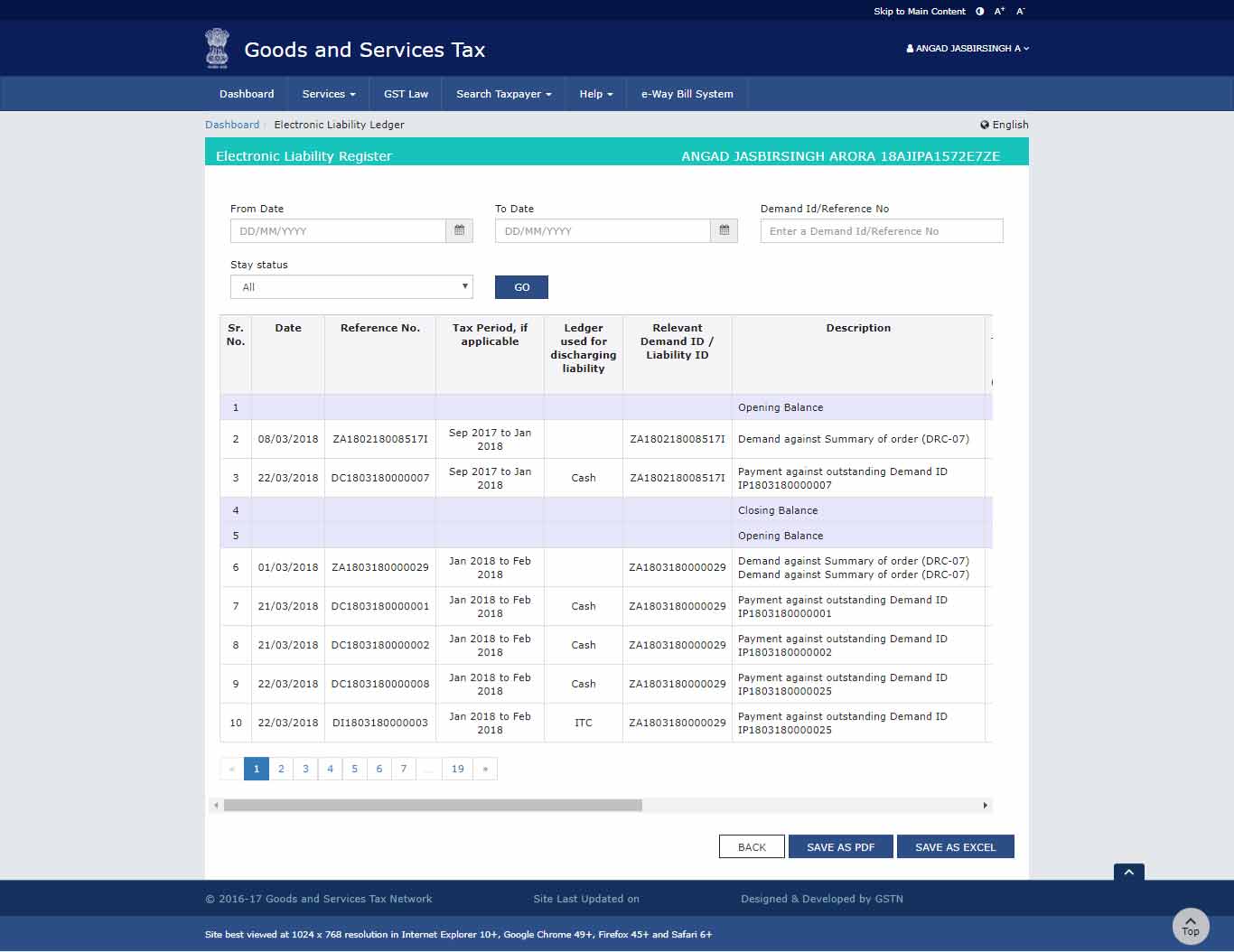

The Electronic Liability register details are displayed.

Note: Click the SAVE AS PDF and SAVE AS EXCEL button to save the Electronic Liability Ledger in the pdf and excel format.

Use the scroll bar to view more details.

You can click the link under Amount debited/ credited and Balance to view further details.

Details will appear as below:

The electronic liability register shall get managed through the GST platform and is seeing the intention towards the highest of 12 months.

The assessee-approved GST practitioner and his jurisdictional officer can see the tax liability register.