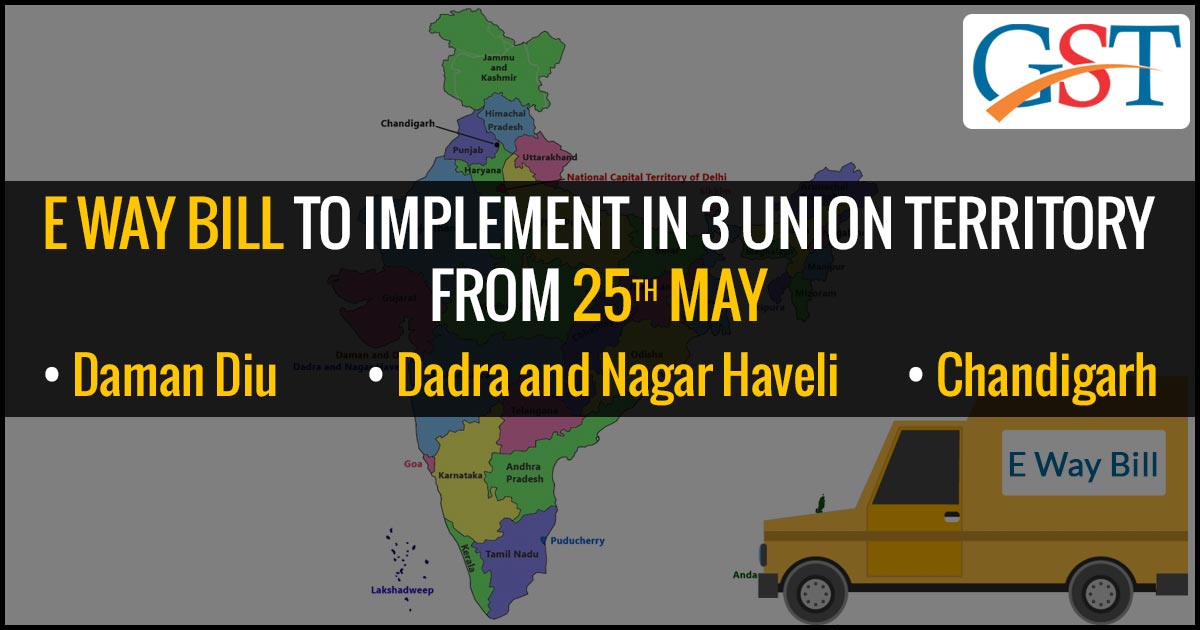

The central government had mandated the GST E Way Bill in 3 union territories including Chandigarh, Dadra and Nagar Haveli, Daman and Diu.

Earlier, the government had directed there will be no e way bill required for the movement of goods in the territory of Chandigarh, Dadra and Nagar Haveli, Daman and Diu and Lakshadweep.

In the latest announcement towards the implementation of GST e waybill, the central government has mandated the Union territory e waybill in 3 UT from 25th May 2018 as described Chandigarh, Dadra and Nagar Haveli, Daman and Diu.

The announcement was made through a notification which discarded the earlier notification which stated that there was no need of an e waybill in the union territories irrespective of the value of the supplies.

The GST e waybill is an electronically generated bill for transportation of goods worth more than 50,000 within or outside the state is known as intrastate and interstate transportation.

Read Also: GST E Way Bill Preparation Guide for Transport Companies & Suppliers

Earlier in the month, GST e-way bill has been applicable in the state of Nagaland from 1st May while it is same on the trial in the state of Punjab.

Rajasthan has applied the intrastate GST E Way Bill from 20th May. Most of the states are still waiting to get their GST E Way Bill applicability which will be soon provided once any technical glitch is sorted out.

Till now in most of the states, there is intrastate GST E Way Bill is applicable but as from 1st June 2018, it will be automatically applied in all the states across India with no further announcement.

Recommended: Why Select Gen GST Software for E Way Bill Queries?