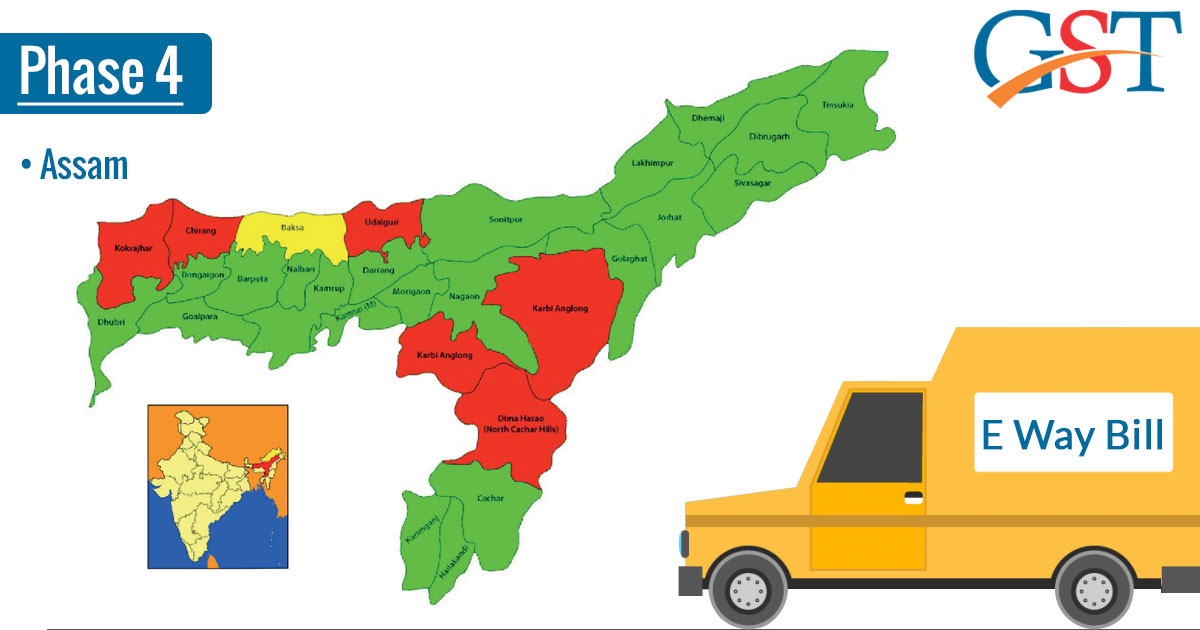

Recently Assam government issued the notifications regarding GST E Way Bill for intrastate movement of goods and has confirmed the implementation from 16th May 2018.

The notification states all the rules and provisions regarding the intrastate supplies of goods done within the state and relevant provisions for the bill to be applied properly.

The GST E Way bill is slated to bring uniformity for the movement of goods across the nation with thorough check and accountability. Under the newly implemented GST E Way Bill, it is mandatory to register online for the movement of goods more than the value of INR 50,000.

Also, there will be an exemption of some items from the registration under GST E Way Bill, including, LPG cylinders, vegetables, food grain and jewellery etc. The goods transported on the non-motorised conveyance such as bullock cart or any other human operative carts are also exempted from the registration under GST E Way Bill.

While in the 2nd Phase of GST intrastate E Way Bill implementation there were 6 states in which the bill was implemented namely, Jharkhand, Bihar, Haryana, Tripura, Uttarakhand, Himachal Pradesh. The bill was implemented from 20th April 2018 across these 6 states in a timely manner.

Under the 3rd phase of GST E Way Bill for the intrastate transportation of goods, the states like Arunachal Pradesh, Madhya Pradesh, Meghalaya, Sikkim, and Puducherry were called for inclusion in the bill from 25th April 2018.